The payback period is calculated as follows. Payback period: formula

This is usually measured in terms of the years it takes to return an investment based on future cash flows.

Investors consider the payback period to assess the risk of loss of capital and the liquidity of the project. The shorter the payback period, the lower the risk, since expenses are recovered faster.

Methods for calculating payback period

Calculation of the payback period of investments depends on whether the annual income is received in equal or unequal amounts. Therefore, there are two ways to measure this indicator.The first method is to calculate the payback period with equal revenues. If the annual income comes in equal amounts, The formula used is:

Payback period = Initial investment / Annual net cash flowA deposit of 100 thousand rubles, which generates an income of 25 thousand per year, has a return period of four years.

The second method is to calculate the payback period for unequal revenues. If an investment generates different annual amounts of income, you need to calculate the cumulative cash flow on a cumulative basis and then apply the formula:

Payback period = (A-1) + ((Initial investment - Total cash flow(A-1) ) / Net cash flow A )Where:

A - year of full return of investment;

A-1 - the year preceding year A.

A contribution of 200 thousand rubles will bring 20 thousand income in one year, 60 thousand in two years, 80 thousand in three years, 100 thousand in four years, and 70 thousand in five years. It will be reimbursed in the fourth year, in which income exceeds expenses. The exact period is calculated using the formula: 3 + (200-160) / 100 = 3 + (40 / 100) = 3 + 0.4 = 3.5 years (or three years and 146 days).

Limitations of the method

The payback period is intended solely to calculate the period of return of the invested funds. It does not provide complete information about the performance of deposits due to limitations. This method does not take into account:- the time value of money, i.e. the change in the purchasing power of cash over time due to inflationary processes. Money is brought to its current value by discounting payments;

- income after covering initial expenses, i.e. does not reflect the overall return on investment. This may lead to the selection of less profitable investments in terms of profit.

Discounted payback period

A decrease in the real value of money over time increases the period of return on investments, therefore, to obtain an accurate interval, a discounted payback period is calculated. This method accounts for the time value of money by discounting the cash inflows from the project using a discount rate ® . The discounted flow is calculated by dividing the actual flow by the present value factor:Income / (1 + r)nwhere n is the period to which the cash flow relates.

Constant or variable (different for individual periods) discount rates are established.

The algorithm for calculating the discounted payback period corresponds to the method of calculating the period for unequal income, except that ordinary income is replaced by discounted income:

Discounted payback period = (A-1) + ((Initial investment - Cumulative discounted cash flow(A-1) ) / Net discounted cash flow A ).

When you start a business or a new project within an existing business, it is extremely important for you to understand one thing: when will your project pay off.

The moment your project pays off, you will prove to yourself and the world that it was worth investing in. Moreover, you will prove to yourself that you are an entrepreneur!

The initial investment has already been returned and now you can make a profit with peace of mind!

Before you start calculating the payback of the project

Before we begin calculating the project's payback, let's ask ourselves: how is payback measured?

The question is, of course, stupid. It is clear that not in meters or decibels.

The payback of a project is ALWAYS measured in time: days, months, quarters, years.

For projects with initial investments of up to 1 million rubles, it makes sense to measure the payback in months. For larger projects – in years.

Having conducted hundreds of trainings with aspiring entrepreneurs, I realized one simple thing: all complex formulas and calculations do not work in real life. Moreover, they do not work in small businesses.

Therefore, I will try to discard complex economic terminology and explain it in extremely understandable language.

“Ingredients” for calculating the return on investment of a project

Project payback is an integral indicator. This means that in order to calculate it, you need to know a number of other indicators - these are the amounts income, expenses, profit, starting investments.

Income– this is the money that you receive (or plan to receive) from your clients after the launch of the project. Clients will pay you this money for goods sold or services provided.

Expenses- this is, on the contrary, the money that you pay to your suppliers of goods and services. These include expenses for raw materials, supplies, work performed, and rental payments. Also taxes, wages, insurance premiums - all this relates to the concept of expenses

Profit = income – expenses

It's that simple. Therefore, to calculate profit for the month, you need to:

- add up the entire cash flow - income;

- add up all cash expenditures - expenses;

- calculate the difference between the first and second

If we talk about a project, we mean future income, expenses and profit. It is advisable to plan monthly.

How do expenses differ from starting investments when calculating the return on investment of a project?

In addition to the concepts of income, expenses and profit, another indicator appears in the calculation of the project’s payback - initial investment amount or investment amount.

Starting investment is the amount of money that needs to be invested in order to start earning and receiving income from the project.

What is usually required to start a project:

- buy equipment;

- renovate the premises;

- buy furniture and office equipment;

- buy an initial supply of goods in a sufficient range;

- undergo state registration;

- obtain a license;

- obtain permission for the type of activity from supervisory authorities

All this must be done to launch a business and start making money. Let me emphasize that these investments must be made before you start making money from the project.

Difficulties always begin when it becomes necessary to divide expenses and start-up investments.

A simple example: rental payments for premises (rent or starting investments?)

You have rented a room and now need to make repairs. It will take about two months before you launch your business and start selling. Where should rent payments for the first two months be attributed: to start-up investments or expenses?

There is one simple rule: all expenses relate to initial investments until the moment you launch the project and start receiving income from it.

Starting a business and receiving your first income is a kind of watershed.

All that was before this was the initial investment. Everything after that is an expense.

Therefore, in our example, rental payments for the first two months must be classified as starting investments. It was necessary to rent the premises in order to start earning income in two months.

After the first income is received, rental payments become expenses. You pay them monthly.

So, you need to remember a simple rule: all expenses that you will pay before receiving the first income from the project must be classified as starting investments. All expenses after this point can be classified as current expenses.

Formula for calculating project payback

To calculate the payback, it is necessary to compare all the profit received from the beginning of the project with the amount of starting investments.

At the moment when the amount of profit accumulated since the beginning of the project exceeds the amount of the starting investments, the project will pay off.

The payback of a project of 6 months means that the profit received in 6 months is greater than the amount of the initial investment. But the profit received in 5 months does not yet exceed it.

To calculate the payback you can:

Option 1. Calculate profit monthly, and then cumulatively for each month, comparing the amount of accumulated profit with the amount of starting investments.

An example of calculating the payback of a project

For example, let's take a simple life situation: you want to buy an apartment and rent it out. In principle, this is also a business project. The goal of this project is to make money.

1) We evaluate the starting investments

Starting investment in this case = cost of the apartment + cost of repairs + cost of furniture = 5,000,000 rubles

2) We estimate the average monthly profit

Income = amount of monthly rent = 50,000 rubles per month

Expenses = amount of utility bills + amount of current apartment repairs (based on an average month) = 10,000 rubles

Average monthly profit = income – expenses = 40,000 rubles per month

3) We calculate the payback of the project

This is such a long-paying project. Therefore, no one buys real estate in order to make money. Real estate serves primarily for the purpose of saving money.

How to calculate the payback of your project?

Let's move on to the most important question - how to calculate the payback of your project. In order to solve this problem, you can use several methods:

Method 1. Take a piece of paper and calculate. This method is the fastest and easiest. It is suitable for very simple projects like the one we just calculated (the apartment purchase project).

Method 2. Calculate everything in excel. This method is longer and less simple. This method is suitable for those who know how to use Excel, write formulas, and set up tables. I used this method often in the past.

Method 3. Take advantage. Much easier than setting up formulas in Excel. It can calculate projects of almost any complexity. Now I only use this method.

Calculation of project payback

The payback period of a project is one of the key indicators of investment efficiency, by which one can determine their feasibility and choose between several investment objects. Read what formulas it is calculated by, how to evaluate it using the investment modeling method, and also see calculation examples.

What is this article about?:

What is the payback period of the project

Payback period is one of the most common and understandable indicators when assessing the effectiveness of investment projects . We often talk about the return on investment in hardware, software, land and information resources to justify decisions about purchasing a resource or implementing a project. This is understandable. Everyone wants to make the most of their investment.

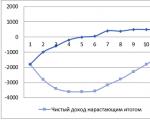

The payback period of an investment project is the period of time during which the net income on an accrual basis becomes equal to zero. The designation PBP from English is often used. Pay Back Period. In other words, this indicator serves as the tipping point between negative and positive net income. The positive net income zone is the profit zone for which the investment project was started. Let us visualize the payback period indicator on the cash flow graph (see Fig. 1).

Picture 1. Payback period of investments on a cash flow chart

In the figure, the payback period of the project is approximately 13.5 investment steps. These can be different periods - a month, a quarter, a year, based on the results of which an interim summing up of the costs incurred and the income received is carried out.

Download and use it:

How it will help: The document contains the principles and methods of investment planning. It sets out uniform rules for managing investment projects and the procedure for their initiation, as well as methods for assessing their effectiveness. This will help avoid unnecessary expenses and increase the efficiency of using capital investments.

Payback point for an investment project

Transition from negative net cash flow to positive is called the payback point of the investment project.

The advantages of calculating the payback period of investments are as follows:

- Ease of calculation if alternative projects are ranked ceteris paribus.

- The calculation can be done quickly “on the knee” without taking into account the factor of changes in money over time (discounting).

- The rate of return is set by the company, which gives a minimum of error and inaccuracy in calculations when discounting.

Formula for calculating the payback period of a project

Basic formula (1) for calculating the payback period PP:

where: I – the amount of investment in the project,

CF – discounted cash receipts from the investment project.

How to accurately calculate the payback period of an investment project using Excel

To quickly and accurately determine the payback period of an investment in Excel, you need to:

Understand what initial data and in what form will be required for calculations;

- develop a special form in Excel.

Interpretation of payback period values

The payback period is quite difficult to interpret. There is a rule: the project with the shorter payback period is the one that is more effective. However, the criterion does not reveal what will happen to financial results and income after the established period. Therefore, additional analysis of other significant criteria for the effectiveness of an investment project is required.

It should be remembered that serious strategic projects have long payback periods, so this indicator is a good auxiliary, but not the only criterion. However, operational analysis must begin with the question of return on investment.

Note that to calculate the payback period, it is necessary to know the exact quantitative values of investments and generated cash flows for each reporting period, given to the current date. In practice, it often turns out that the conditions of a company’s financial activities have changed, the economic situation does not correspond to planned realities, and cash receipts from a new product have deviated more or less than the permissible 5% deviations. As a result, the payback period increases significantly.

How it will help: develop a comprehensive methodology for regular assessment and analysis of investment projects.

How it will help: establish procedures for monitoring the effectiveness and risks of investment projects.

Video. Procedure for calculating the payback period

A simple payback period (payback period = PBP) is the minimum integer number of years (periods) during which the accumulated cash flows steadily reach a value not less than the initial investment. Discounted payback period (DPP) – used to account for money over time. That is, 500 rubles in a year is not the same as the same 500 rubles today. Benedikt Wagner, CEO of Wagner & Experts, explains in the video how to count them. More information about all investment evaluation methods can be found in . Dedicated to this topic .

How to take into account the factor of environmental variability

Carry out an accurate analysis of all revenues and costs throughout the implementation of the project, ensure the reliability of the sources of cash flow of the investment project. This option involves maintaining an aggressive financial policy, time and labor costs for analyzing each business transaction for compliance with the budget. In addition, the company is not immune to the impact of inflation on changes in the value of money over time.

You can use the environmental simulation method to estimate the payback period of the project. This method is more flexible in terms of exact cash receipts, since we set a certain range of values and consider random market processes of changes in the business and macro environment.

Simulation modeling method for analyzing the payback period of investments

“It is impossible to predict the future, but this is our job” - these words very accurately describe the simulation modeling method. Simulation modeling is a convenient tool for analyzing the payback period - it is visual, easy to understand and test. Its use in work serves as a kind of lifesaver for top management.

5 Key Benefits of Simulation for Estimating ROI

- Wide variety of future development scenarios.

- Fast calculations using MS Excel.

- High assessment of the predicted result.

- Independence of decision makers in the company.

- Graphic representation of the result.

The essence of the method is that the initial static model is supplemented with a range of variable data - this is how we automatically model the market and possible financial conditions. For this approach, investments and cash flows should be assessed in terms of minimum and maximum values. The more scenarios are developed and calculated, the more accurate the financial result will be - in our case, the payback period for investments.

To make it clearer, let’s look at an example of estimating the payback period of a project using the simulation method.

How it will help: will tell you how to check the input data of the financial model to ensure that the calculations and forecasts are realistic.

How it will help: when planning an investment project, it is important to correctly assess the competitiveness of new products and their market prospects. This decision will help take into account the forecast of the market situation and possible risks in the sales plan.

An example of calculating the payback period of a project

According to the financial department, investments in expensive equipment range from 1,300 to 2,000 million rubles, depending on the dollar exchange rate and the results of procurement tenders. The company's management expects that with full capacity utilization the following cash flows will be generated (see Table 1).

Table 1. Forecast studies for equipment procurement

|

Index |

Meaning |

|

|---|---|---|

|

Internal rate of return, % |

||

|

Investment costs for the project year 0 (million rubles) |

||

Let's estimate the payback period of investments in the purchase of equipment. The risk indicator in this case for the company’s management is the payback time of the equipment over 5 years.

Let's calculate the payback period using methods that allow you to find the interval of values of the indicator of interest based on the intervals of values of the incoming data.

We randomly select the cash flow value using a random number generator in MS Excel. MS Excel provides the RAND() function for this. It returns an arbitrary value from the interval we specify. We obtain one of the scenarios for the development of the market environment for each year of the project.

Let me remind you that the intervals for changing cash flow values are provided by the financial and economic unit of the company.

Repeating these steps, we conduct several hundred experiments in Excel using the same RAND() function. We obtain many values of the indicator we are interested in (the payback period of the project).

Having generalized the theory, we will build a table of results (Table 2).

For example, under scenario 1, the payback period will be:

We find that the criterion for project implementation (more than 5 years) in this scenario does not suit the company’s management. We move on to consider the next scenario and so on. Let's create 10 thousand rows.

table 2. Calculation by simulation method

|

Scenario no. |

Investment costs (million rubles) |

Cash flow for the project year 1 (RUB million) |

Cash flow for the project year 2 (million rubles) |

Cash flow for the project year 3 (million rubles) |

Cash flow for the project year 4 (RUB million) |

Payback period at a given rate of return |

Exceeds the payback period established by management? |

|---|---|---|---|---|---|---|---|

|

±10% (deviation from interval) |

from 1300 to 2000 |

from 350 to 500 |

from 450 to 480 |

from 550 to 650 |

from 150 to 600 |

more than 5 years |

|

Let's present the results graphically (Figure 2).

Figure 2. Analysis of the obtained payback periods under various scenarios

Based on the modeling results, we can predict: approximately 12% of the risk comes from the equipment purchase project; in this situation, the payback period of the project is more than 5.5 years. In addition, there is a 4% chance of a rapid return on investment, less than 3.5 years.

There is about an 80% chance that the payback period will be from 3.5 to 5.5 years. This is a high assessment of the success of implementing the project on time for the company's management. Thus, we managed to recoup the investment in equipment in 5 years.

Thanks to a new approach to assessing the payback period of investments, an analysis of the investment project was carried out using the simulation method, the probabilistic value of the payback period of the project was obtained and the risk of its implementation was assessed.

How to choose a bank to implement an investment project

To implement the investment project, the company will need a partner bank. You should be very meticulous in choosing it. After all, the well-being of clients largely depends on the condition of the servicing bank and the level of its current liquidity. It is necessary not only to carefully select a bank, but also then to monitor its financial condition in the process of work, taking into account the range of services provided and their cost, the bank’s rating, specialized focus, successful experience and competence in implementing similar projects.

conclusions

It is better to start analyzing the project with the simplest thing - with the timing of the return of funds. The main advantages of payback period analysis are the simplicity and speed of calculation. And in combination with simulation modeling, it is possible to assess the risk of the rate of return on investment, which is important for large projects that require high investment costs. The main disadvantage is the limited information about how cash flows and financial results will behave outside the project implementation period. Therefore, the project should be assessed comprehensively, taking into account other financial ratios.

Payback period of capital investmentsis calculated taking into account net profit, and in some cases is considered in the context of additional investments. Let us consider the features of calculation, as well as the application of this financial indicator.

What is capital investment?

Capital investments are understood as fundamental investments in a business aimed at forming the organization’s fixed assets. This formation can be carried out through construction, procurement, reconstruction, re-equipment, application of the results of design and survey activities (Article 1 of the Law “On investment activity in the form of capital investments” dated February 25, 1999 No. 39-FZ).

Subjects of investment carried out in the form of investments under consideration can be investors, project customers, contractors, as well as users of fixed assets formed as part of capital investments (Article 4 of Law No. 39-FZ). Each of them may be interested in the fastest return on investment. Let's study how its terms are calculated, as well as the purposes for which the corresponding indicator can be used.

Formula for payback period of capital investments

In the general case, the formula for calculating the indicator under consideration takes into account:

- The amount of investment made during a given period—for example, a year of business activity.

- Net profit during the relevant period, which is obtained through the use of acquired fixed assets.

CO = KV / PE,

СО - payback period in years;

KV - capital investments;

PE - annual net profit.

In turn, net profit (NP) is determined by the formula

(OC - SP) × OP,

OTs - selling price per unit of production;

SP - unit cost of production;

OP - volume of production.

Formula for payback period of additional capital investments

The indicator under consideration is determined if the enterprise has the task of calculating how quickly the investment, which is the difference between:

- basic investments;

- supplemented investments - increased due to additional ones, for which the payback period is calculated.

In this case, the main investments can be real, and additional ones can be calculated (assumed, used for the purpose of modeling the return on investment). As part of the corresponding calculations, as a rule, the same volume of output of the same goods and other economic results of activity are taken into account - for example, the area of built houses. But at the same time, in many cases, different indicators of cost and selling price per unit of goods are taken into account.

The payback period for additional investments is calculated using the formula

SOD = (DV - KV) / (PDV - PKV),

KV - basic capital investments;

DV - supplemented capital investments (basic, increased by additional);

PKV - the company's net profit with basic investments;

PDV is net profit with additional investments.

If the indicator under consideration (as, in fact, the previous one) is less than the normative one, then the management of the enterprise may decide to reduce the selling price of the product in order to increase the competitiveness of the company in the market. If the payback period for investments is longer than the normative one, then the company, on the contrary, will have to increase selling prices.

The company determines the standard indicator for the payback period of investments (additional investments) independently - based on the specifics of the business model, recommendations of auditors, opinions of investors, and in many cases - taking into account industry averages.

Results

The payback period of capital investments is calculated as the ratio of the volume of corresponding investments to the amount of net profit of the enterprise. In some cases, the payback period for investments that supplement the main investments may be determined. Both indicators may be important in terms of determining the optimal selling price of a product.

You can learn more about the nuances of investing in certain assets of an enterprise in the articles:

Before making an investment, money holders should get an idea of when the money will help generate profits. For this purpose, a special formula for the payback period has been developed; it allows you to calculate the financial ratio.

There are different concepts of payback periods, they depend on the goals of the investment. Let's get to know them better.

For investment

The payback period is the time interval after which the amount of invested funds becomes equal to the income received. The coefficient allows you to find out the time after which it will be possible to return the invested funds and begin to take profits. To determine it, the formula for the payback period of the project is used.

Typically, an investor is faced with the need to determine the optimal project for investment. In this case, it is necessary to compare the coefficients of each of them; most often, preference is given to the one with a lower discounted payback period. This kind of business will allow you to start earning money faster.

For equipment

The payback period for purchased equipment serves to calculate the period during which the invested funds can be returned thanks to the profit that can be additionally received.

For capital investments

The indicator is used to calculate the efficiency of reconstruction and production renewal. It allows you to find out the time during which cost reductions and additional profits can exceed the investments made. Calculations will help assess the feasibility of investing in the company's capital.

Calculation methods

When determining the coefficient, two methods are used: simple and discounted payback period. In the second case, it is determined not just the time of return of the spent funds, but taking into account the devaluation of the currency.

The formula for calculating the payback period of the simple method is traditional. Thanks to it, you can determine the time period during which the invested funds will be returned. This indicator can be informative in the following conditions:

- investments are made once, at the very beginning of the project;

- if there are a number of alternative projects, their lifespan should be the same;

- the profitability of the project should have approximately equal parts.

This methodology is popular due to its simplicity and clarity. It is perfect if you need to assess risks. However, the simple method does not take into account such important criteria:

This methodology is popular due to its simplicity and clarity. It is perfect if you need to assess risks. However, the simple method does not take into account such important criteria:

- over time, the value of money decreases;

- When the project is paid off, it can make a profit.

The dynamic indicator has no such disadvantages. It allows you to determine the moment at which the net present value will cease to be negative and will remain so in the future. The dynamic payback period of a project is always longer than a simple one. This is due to the devaluation of any currency.

Formula for a simple project payback period

Let's look at it with an example. Let some project require investments in the amount of 160 thousand rubles. It is predicted that every year it will make a profit of 60 thousand rubles. In this case, the payback is calculated as follows:

RR = 160000/60000 = 4 years

As a result, the investor understands that after 4 years he will have to return the money invested. However, at this time, additional funds may be attracted to the project, and their outflow is also possible. In this case, a slightly modified formula for the simple payback period applies:

PP = K0 / PChsg

In it, PChsg represents the net profit that will be received on average during the year. The indicator is determined by subtracting costs from income.

Formula for determining the dynamic payback period of a project

The peculiarity of this technique is that it takes into account the price of funds over time. In this case, an indicator such as the discount rate is introduced.

The formula is presented as follows:

In comparison with the previous example, we will introduce an annual discount rate of 2%. In this case, the annual discounted income will be:

40000 / (1 + 0.02) = 39215 rubles

40000 / (1 + 0.02)² = 38447 rubles

40000 / (1 + 0.02)³ = 37693 rubles

40000 / (1 + 0.02) 4 = 36953 rubles

As a result, over four years the income is not 160 thousand rubles, but 152,308 rubles. As you can see, the project will be paid off not in 4 years, but in a slightly longer period, but less than 5 years.

Payback period is a key financial indicator. Thanks to him in a certain project. We hope the information provided will help assess the attractiveness of this or that and the feasibility of investing money in it.