Variable cost formula. Dependence of cost type on cost object

6.1. Theoretical introduction

As part of ensuring the financial stability of the enterprise, much attention is paid to cost management. According to the type of dependence of the item of expenditure on the volume of production, costs can be divided into two categories - permanent And variables. Variable costs ( VC) depend on the volume of production (for example, raw materials, piecework wages, fuel and electricity for production machines). As a rule, variable costs increase in proportion to the growth in production volumes, i.e. the value of variable costs per unit of output (v) remains constant

where VC is the sum of variable costs,

Q is the volume of production.

fixed costs ( FC) do not depend on the volume of production (for example, staff salaries, depreciation, etc.). The same category includes fixed costs, which, with a significant increase in production volumes, change in steps, i.e. expenses that can be classified as conditionally fixed (for example, if output increases above a certain level, a new warehouse is needed). Fixed unit costs (f) decrease as production increases

Depending on the attribution of the item of expenditure to a specific type of product, the costs are divided into direct (associated with the production of a certain type of product) and indirect (not associated with the production of a specific product). The division of costs into direct and indirect is used when studying the impact of the release (or refusal to release) of a particular type of product on the value and structure of costs. Practice shows that for most enterprises, direct and variable costs are the same to a first approximation. The accuracy of matching direct and variable costs in many cases is at least 5%. As part of a preliminary analysis that highlights the main cost components, this accuracy is sufficient.

The classification of costs into variable and fixed is necessary to calculate the break-even point, profitability threshold and financial safety margin.

Break even characterizes the critical volume of production in physical terms, and profitability threshold- in value terms. Calculation of parameters is based on the calculation of gross income

where GI is gross income;

S - implementation in value terms;

P is the price of the product.

The break-even point (Q without) is the volume of output at which gross income is zero. From equation (6.3)

. (6.4)

The threshold of profitability (S r) is the amount of sales revenue that reimburses production costs, but the profit is zero. Profitability threshold is calculated by the formula

The difference between sales in terms of value and variable costs determines the contribution margin (MS)

![]() . (6.6)

. (6.6)

Marginal income per unit of production With is equal to the additional gross income that the company will receive as a result of the sale of an additional unit of production

![]() . (6.7)

. (6.7)

As can be seen from (6.6) and (6.7), marginal income does not depend on the level of semi-fixed costs, but increases with the reduction of variables.

The difference between the sales revenue and the profitability threshold is margin of financial strength(ZFP). ZFP is the amount by which the volume of production and sales deviates from the critical volume. FFP can be characterized by relative and absolute index.

In absolute terms, the FFP is equal to

![]() , (6.8)

, (6.8)

In relative terms, the FFP is equal to

![]() (6.9)

(6.9)

Where Q is the current output.

ZFP shows how many percent you can change the volume of sales and at the same time not fall into the loss zone. The greater the margin of financial safety, the less entrepreneurial risk.

A key characteristic in the cost management process is the level of incremental expense associated with itemized cost reductions. Cost management comes down to identifying controllable items (for which adjustments are possible as a result of certain activities), determining the amount of cost reduction (in %) and one-time costs for relevant activities. Acceptable are those activities whose performance indicator (e) is the maximum .

![]() ,

(6.10)

,

(6.10)

where ΔGI is the relative change in gross income as a result of

cost reduction;

GI 0 - the level of gross income before cost reduction;

GI 1 - the level of gross income of cost reduction;

Z - one-time costs for measures to reduce

The relationship between the change in profits and expenses:

![]() ,

(6.11)

,

(6.11)

Where Cx- some item of expenditure,

Ref- all other expenses.

The following formula shows by what percentage the gross income will change with a change in expenses for Cx by 1%:

![]() .

(6.12)

.

(6.12)

Formula (6.12) is valid for a situation where the amount of revenue and the amount of other expenses are fixed.

Task 1. The company produces a carbonated drink "Baikal". Variable costs per unit of production - 10 rubles, fixed costs - 15,000 rubles. Selling price 15 rubles. How much of the drink must be sold to generate a gross income of 20,000 rubles.

Solution.

1. Determine the marginal income (rubles) using the formula (6.7):

2. Using (6.3), we determine the quantity of products (units) that must be sold to obtain a GI in the amount of 20,000 rubles.

Task 2. The price of products is 4 rubles. at the level variable costs- 1 rub. The volume of fixed costs is 14 rubles. Issue volume - 50 units. Determine the break-even point, the threshold of profitability and the margin of financial safety.

Solution.

1. Determine the volume of production at the break-even point:

![]() (unit).

(unit).

2. According to the formula (4.5), the profitability threshold (rubles) is equal to:

![]()

3. The absolute value of the financial safety margin:

4. Relative value of the financial safety margin:

The company can change the volume of sales by 90% and at the same time will not suffer losses.

6.3. Tasks for independent work

Task 1. Variable costs for the release of a unit of product are 5 rubles. Fixed monthly costs 1,000 rubles. Determine the break-even point and marginal profit at the break-even point if the product price on the market is 7 rubles. Determine the margin of financial safety with a volume of 700 units.

Task 2. Sales proceeds - 75,000 rubles, variable costs - 50,000 rubles. for the entire volume of production, fixed costs amounted to 15,000 rubles, gross income - 10,000 rubles. The volume of manufactured products is 5,000 units. The price of a unit of production is 15 rubles. Find the break-even point and the threshold of profitability.

Task 3. The company sells products with a given demand curve. The unit cost of production is 3 rubles.

|

Price, rub. |

|||||||

|

Demand, pcs. |

What will be the price and marginal profit, provided that the goal of the firm is to maximize profit from sales.

Task 4. The company produces two types of products. Determine the profit and marginal income from the main and additional orders. Fixed costs - 600 rubles.

|

Indicators |

Product 1 |

Product 2 |

Add. order |

|

Price per unit, rub. |

|||

|

Variable costs, rub. |

|||

|

Issue, pcs. |

Task 5. The break-even point at the aircraft factory is 9 aircraft per year. The price of each aircraft is 80 million rubles. Marginal profit at the break-even point is 360 million rubles. Determine how much the aircraft factory spends per month on expenses not directly related to production?

Task 6. The skate salesman conducts market research. The population of the city is 50 thousand people, distribution by age:

30% of schoolchildren's parents are ready to buy skates. The firm makes decisions to enter the market if the resulting marginal profit is sufficient to cover expenses in the amount of 45,000 rubles. with variable costs of 60 rubles. What should be the price to maximize marginal profit?

Task 7. The company expects to sell 1,300 sets of furniture. The cost of 1 set is 10,500 rubles, including variable costs of 9,000 rubles. The selling price is 14,500 rubles. How much needs to be sold to reach the breakeven level of production? What is the volume that ensures the profitability of production of 35%. What will be the profit with a 17% increase in sales? What should be the price of the kit in order to make a profit of 1 million rubles by selling 500 products?

Task 8. The work of the enterprise is characterized by the following indicators: sales revenue 340 thousand rubles, variable costs 190 thousand rubles, gross income 50 thousand rubles. The company is looking for ways to increase gross income. There are options to reduce variable costs by 1% (the cost of the event is 4 thousand rubles), or alternative measures to increase sales by 1% (one-time costs of 5 thousand rubles). Which activities should be funded first? Make a conclusion on the basis of the measure of the effectiveness of the measures.

Task 9. As a result of the implementation integrated program the company has changed its cost structure, namely:

The value of variable costs increased by 20%, while maintaining the value of fixed costs at the same level;

15% of fixed costs were transferred to the category of variables, keeping the total cost at the same level;

Decreased total costs by 23%, including at the expense of variables by 7%.

How did the changes affect the break-even point and ZFP if the price is 18 rubles? The volume of production and costs are given in the table.

|

Indicators |

Months |

|||

|

Volume of production, pcs. |

||||

|

Production costs, rub. |

||||

Task 10. The results of the analysis of the cost structure and opportunities to reduce costs are shown in the table.

Determine the final cost reduction (in %) and choose from the proposed cost items the one that you should pay attention to in the first place.

| Previous |

Consider the variable costs of an enterprise, what they include, how they are calculated and determined in practice, consider methods for analyzing the variable costs of an enterprise, the effect of changing variable costs with different production volumes and their economic meaning. In order to understand all this simply, at the end, an example of variable cost analysis based on the break-even point model is analyzed.

Variable costs of the enterprise. Definition and their economic meaning

Enterprise variable costs (Englishvariablecost,VC) are the costs of the enterprise/company, which vary depending on the volume of production/sales. All costs of the enterprise can be divided into two types: variable and fixed. Their main difference lies in the fact that some change with an increase in production, while others do not. If the production activity of the company stops, then variable costs disappear and become equal to zero.

Variable costs include:

- The cost of raw materials, materials, fuel, electricity and other resources involved in production activities.

- The cost of manufactured products.

- Wages of working personnel (part of the salary depending on the fulfilled norms).

- Percentage of sales to sales managers and other bonuses. Interest paid to outsourcing companies.

- Taxes that have a tax base of the size of sales and sales: excises, VAT, UST from premiums, tax on the simplified tax system.

What is the purpose of calculating enterprise variable costs?

For any economic indicator, coefficient and concept, one should see their economic meaning and the purpose of their use. If we talk about the economic goals of any enterprise / company, then there are only two of them: either an increase in income or a decrease in costs. If we generalize these two goals into one indicator, we get - the profitability / profitability of the enterprise. The higher the profitability / profitability of the enterprise, the greater its financial reliability, the greater the opportunity to attract additional borrowed capital, expand its production and technical capacities, increase intellectual capital, increase its market value and investment attractiveness.

The classification of enterprise costs into fixed and variable is used for management accounting, and not for accounting. As a result, there is no such stock as "variable costs" in the balance sheet.

Determining the amount of variable costs in overall structure of all costs of the enterprise allows you to analyze and consider various management strategies to increase the profitability of the enterprise.

Amendments to the definition of variable costs

When we introduced the definition of variable costs / costs, we were based on a model of linear dependence of variable costs and production volume. In practice, often variable costs do not always depend on the size of sales and output, therefore they are called conditionally variable (for example, the introduction of automation of a part of production functions and, as a result, a decrease in wages for the production rate of production personnel).

The situation is similar with fixed costs, in reality they are also conditionally fixed, and can change with the growth of production (an increase in rent for production premises, a change in the number of personnel and a consequence of the volume of wages. You can read more about fixed costs in more detail in my article: "".

Classification of enterprise variable costs

In order to better understand how to understand what variable costs are, consider the classification of variable costs according to various criteria:

Depending on the size of sales and production:

- proportionate costs. Elasticity coefficient =1. Variable costs increase in direct proportion to the increase in output. For example, the volume of production increased by 30% and the amount of costs also increased by 30%.

- Progressive costs (similar to progressive variable costs). Elasticity coefficient >1. Variable costs are highly sensitive to changes depending on the size of output. That is, variable costs increase relatively more with output. For example, the volume of production increased by 30%, and the amount of costs by 50%.

- Degressive costs (similar to regressive variable costs). Elasticity coefficient< 1. При увеличении роста производства переменные издержки предприятия уменьшаются. Данный эффект получил название – «эффект масштаба» или «эффект массового производства». Так, например, объем производства вырос на 30%, а при этом размер переменных издержек увеличился только на 15%.

The table shows an example of changing the volume of production and the size of variable costs for their various types.

According to the statistical indicator, there are:

- General variable costs ( EnglishTotalvariablecost,TVC) - will include the totality of all variable costs of the enterprise for the entire range of products.

- Average variable costs (English AVC, Averagevariablecost) - average variable costs per unit of production or group of goods.

According to the method of financial accounting and attribution to the cost of manufactured products:

- Variable direct costs are costs that can be attributed to the cost of production. Everything is simple here, these are the costs of materials, fuel, energy, wages, etc.

- Variable indirect costs are costs that depend on the volume of production and it is difficult to assess their contribution to the cost of production. For example, during the production separation of milk into skimmed milk and cream. It is problematic to determine the amount of costs in the cost of skimmed milk and cream.

In relation to the production process:

- Production variable costs - the cost of raw materials, materials, fuel, energy, wages of workers, etc.

- Non-manufacturing variable costs - costs not directly related to production: selling and management costs, for example: transportation costs, commission to an intermediary / agent.

Variable Cost/Cost Formula

As a result, you can write a formula for calculating variable costs:

Variable costs = Cost of raw materials + Materials + Electricity + Fuel + Bonus part of Salary + Percentage of sales to agents;

variable costs\u003d Marginal (gross) profit - Fixed costs;

The totality of variable and fixed costs and constants make up the total costs of the enterprise.

General costs= Fixed costs + Variable costs.

The figure shows a graphical relationship between the costs of the enterprise.

How to reduce variable costs?

One strategy to reduce variable costs is to use economies of scale. With an increase in the volume of production and the transition from serial to mass production, economies of scale appear.

scale effect graph shows that with an increase in production, a turning point is reached, when the relationship between the size of costs and the volume of production becomes non-linear.

At the same time, the rate of change of variable costs is lower than the growth of production/sales. Consider the causes of the "scale effect of production":

- Reducing the cost of management personnel.

- The use of R&D in the production of products. The increase in output and sales leads to the possibility of costly research research work to improve production technology.

- Narrow product specialization. Focusing the entire production complex on a number of tasks can improve their quality and reduce the amount of scrap.

- Release of products similar in the technological chain, additional capacity utilization.

Variable costs and the break-even point. Calculation example in Excel

Consider the break-even point model and the role of variable costs. The figure below shows the relationship between changes in production volume and the size of variable, fixed and total costs. Variable costs are included in total costs and directly determine the break-even point. More

When the enterprise reaches a certain volume of production, an equilibrium point occurs at which the amount of profit and loss is the same, net profit is zero, and marginal profit is equal to fixed costs. This point is called breakeven point, and it shows the minimum critical level of production at which the enterprise is profitable. In the figure and the calculation table below, it is achieved by producing and selling 8 units. products.

The task of the enterprise is to create security zone and ensure that the level of sales and production that would ensure the maximum distance from the break-even point. The further the company is from the break-even point, the higher the level of its financial stability, competitiveness and profitability.

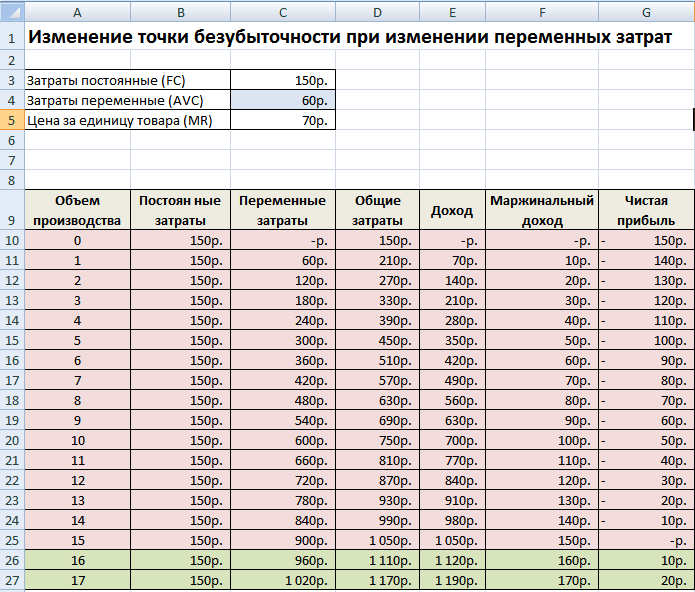

Consider an example of what happens to the break-even point as variable costs increase. The table below shows an example of a change in all indicators of income and expenses of the enterprise.

As variable costs increase, the break-even point shifts. The figure below shows a schedule for reaching the break-even point in a situation where the variable costs for the production of one unit of the product became not 50 rubles, but 60 rubles. As we can see, the break-even point began to equal 16 units of sales / sales, or 960 rubles. income.

This model, as a rule, operates with linear dependencies between the volume of production and income/costs. In real practice, dependencies are often non-linear. This arises due to the fact that the volume of production / sales is affected by: technology, seasonality of demand, the influence of competitors, macroeconomic indicators, taxes, subsidies, economies of scale, etc. To ensure the accuracy of the model, it should be used in the short term for products with stable demand (consumption).

Summary

In this article, we reviewed various aspects variable costs / costs of the enterprise, what forms them, what types of them exist, how changes in variable costs and changes in the break-even point are related. Variable costs are the most important indicator of the enterprise in management accounting, for creating planned targets for departments and managers to find ways to reduce their weight in total costs. To reduce variable costs, you can increase the specialization of production; expand the range of products using the same production facilities; increase the share of research and production developments to improve the efficiency and quality of output.

Lecture Search

Semi-fixed costs(English) total fixed costs

In simple words, these are expenses that remain relatively unchanged during the budget period, regardless of changes in sales volumes. Examples are: management expenses, expenses for rent and maintenance of buildings, depreciation of fixed assets, expenses for their repair, time wages, on-farm deductions, etc. In reality, these expenses are not permanent in the literal sense of the word. They increase with the increase in the scale of economic activity (for example, with the emergence of new products, businesses, branches) more than slowly than growth in sales, or grow in leaps and bounds.

What does variable cost (formula) include?

Therefore, they are called conditionally constant.

- Interest bankruptcy

- leasing

- depreciation

- Payment guards, watchmen checkpoints

- Payment rent

- Salary management personnel layoffs

(English) variable costs

Examples of Variable Costs

Examples direct variables costs are:

- Energy and fuel costs;

Examples indirect variables

Break even (BEP — break even point

BEP=* Sales proceeds

Or what is the same BEP= = *P

VER = or VER =

=

or VER =

=

Additionally:

BEP (break even point) - break even,

TFC (total fixed costs

VC(unit variable cost

P (unit sale price

C(unit contribution margin

CVP

overhead costs

Indirect costs

Depreciation deductions

©2015-2018 poisk-ru.ru

Variable costs: what is it, how to find and calculate them

Marginal Cost Formula

The concept of marginal cost

The marginal cost formula is calculated by the increment ratio total costs to an increase in the quantity of goods. Also, the marginal cost formula is determined by the ratio of the increase in variable costs (the change in the sum of total costs is equal to the change in the variable costs of each additional unit) to the increase in the quantity of goods.

Types of costs

Each enterprise, in its desire to maximize profits, bears the cost of acquiring production factors, while striving to achieve the level of production of a given volume of output at the lowest cost.

The enterprise cannot influence the price of resources, but knowing the dependence of the volume of production on the number of variable costs, the costs are calculated.

In accordance with the organization, expenses are classified into groups:

- Individual expenses for a specific company,

- Public spending is the cost of producing a certain type of product, which is borne by the entire economy,

- opportunity cost,

- Production costs, etc.

Also, costs are classified into 2 groups:

- Fixed costs include the investment of funds in order to ensure stable production. This type of cost is constant and does not depend on the production volume;

- Variable costs include costs that are subject to easy adjustment, without causing damage to the activities of the enterprise (they change in accordance with production volumes).

Marginal Cost Formula

Marginal cost is the change in the total cost of the enterprise in the process of producing each additional unit of goods.

The formula for marginal cost is as follows:

MS = TC / Q

Here, TC is the increase (change) in total costs;

Q - increase (change) in the volume of output of goods.

To calculate the increase in total costs, the following formula is used:

TC = TC2 TC1

To calculate the change in output, the following equation is used:

Q = Q2 Q1

Substituting these equalities into the marginal cost formula, we obtain the following formula:

MS = (TC2 TC1) / (Q2 Q1)

Here Q1, T1 are the initial amount of output and the corresponding amount of costs,

Q2 and TC2 are the new quantity of output and the corresponding cost.

The meaning of marginal cost

The calculation of the marginal cost makes it possible to determine the degree of benefit of producing each additional unit of goods.

Marginal costs are an important economic tool that determines the strategy of production development. The level of marginal cost makes it possible to show the volume of production at which the company needs to stop to get the maximum amount of profit.

In the case of an increase in production and sales, the costs of the enterprise change as follows:

- Uniform change says that marginal cost is constant, equal to variable cost per unit of output;

- The accelerated change reflects an increase in marginal cost with an increase in output;

- Slow change shows a decrease in the firm's marginal cost if its costs of purchased raw materials decrease with an increase in output.

Examples of problem solving

Lecture Search

Examples of Variable Costs

Conditionally fixed and conditionally variable costs

In general, all types of costs can be divided into two main categories: fixed (conditionally fixed) and variable (conditionally variable). According to the legislation of the Russian Federation, the concept of fixed and variable costs is present in paragraph 1 of Article 318 of the Tax Code of the Russian Federation.

Semi-fixed costs(English)

Examples of Variable Costs

total fixed costs) - an element of the break-even point model, which is the costs that do not depend on the size of the volume of output, as opposed to variable costs, which add up to total costs.

This type of cost largely overlaps with overhead, or indirect costs associated with the main production, but not directly related to it.

Detailed examples of semi-fixed costs:

- Interest obligations during the normal operation of the enterprise and maintaining the volume of borrowed funds, a certain amount must be paid for their use, regardless of the volume of production, however, if the volume of production is so low that the enterprise is preparing for bankruptcy , these costs can be neglected and interest payments can be stopped

- Enterprise property taxes , since its value is quite stable, are also mostly fixed costs, however, you can sell property to another company and rent it from it (form leasing ), thereby reducing property tax payments

- depreciation deductions with a linear method of accrual (evenly for the entire period of use of the property) according to the chosen accounting policy, which, however, can be changed

- Payment guards, watchmen , despite the fact that it can be reduced with a decrease in the number of employees and a decrease in the load on checkpoints , remains even when the company is idle, if it wants to keep its property

- Payment rent depending on the type of production, the duration of the contract and the possibility of concluding a sublease agreement, it can act as a variable cost

- Salary management personnel in the conditions of the normal functioning of the enterprise is independent of the volume of production, however, with the accompanying restructuring of the enterprise layoffs ineffective managers can also be reduced.

Variable (conditionally variable) costs(English) variable costs) are expenses that change in direct proportion in accordance with an increase or decrease in the total turnover (sales proceeds). These costs are associated with the operations of the enterprise for the purchase and delivery of products to consumers. This includes: the cost of purchased goods, raw materials, components, some processing costs (for example, electricity), transportation costs, piecework wages, interest on loans and borrowings, etc. They are called conditional variables because the direct proportional dependence on sales volume actually exists only in a certain period. The share of these expenses may change in some period (suppliers will raise prices, the rate of inflation of selling prices may not coincide with the rate of inflation of these costs, etc.).

The main sign by which you can determine whether costs are variable is their disappearance when production is stopped.

Examples of Variable Costs

In accordance with IFRS standards, there are two groups of variable costs: production variable direct costs and production variable indirect costs.

Production variable direct costs- these are expenses that can be attributed directly to the cost of specific products on the basis of primary accounting data.

Production variable indirect costs- these are expenses that are directly dependent or almost directly dependent on changes in the volume of activities, however, due to the technological features of production, they cannot or are not economically feasible to be directly attributed to manufactured products.

Examples direct variables costs are:

- The cost of raw materials and basic materials;

- Energy and fuel costs;

- The wages of workers engaged in the production of products, with accruals on it.

Examples indirect variables costs are the costs of raw materials in complex production. For example, when processing raw materials - coal - coke, gas, benzene, coal tar, ammonia are produced. When milk is separated, skimmed milk and cream are obtained. In these examples, it is possible to divide the costs of raw materials by types of products only indirectly.

Break even (BEP — break even point) - the minimum volume of production and sales of products at which costs will be offset by income, and in the production and sale of each subsequent unit of production, the enterprise begins to make a profit. The break-even point can be determined in units of production, in monetary terms, or taking into account the expected profit margin.

Break-even point in monetary terms- such a minimum amount of income at which all costs are fully paid off (the profit is equal to zero).

BEP=* Sales proceeds

Or what is the same BEP= = *P (see below for a breakdown of the values)

Revenue and expenses must refer to the same time period (month, quarter, six months, year). The break-even point will characterize the minimum allowable sales volume for the same period.

Let's look at the example of a company. Cost analysis will help you visualize the BEP:

Break-even sales volume - 800 / (2600-1560) * 2600 \u003d 2000 rubles. per month. The actual sales volume is 2600 rubles/month. exceeds the breakeven point, good result for this company.

The break-even point is almost the only indicator about which you can say: “The lower the better. The less you need to sell to start making a profit, the less likely you are to go bankrupt.

Break-even point in units of production- such a minimum quantity of products at which the income from the sale of this product completely covers all the costs of its production.

Those. it is important to know not only the minimum allowable revenue from sales in general, but also the necessary contribution that each product should bring to the total profit box - that is, the minimum required number of sales of each type of product. To do this, the break-even point is calculated in physical terms:

VER = or VER =

=

or VER =

=

The formula works flawlessly if the company produces only one type of product. In reality, such enterprises are rare. For companies with a large range of production, the problem arises of allocating the total value of fixed costs to certain types products.

Fig.1. Classic CVP Analysis of Cost, Profit and Sales Behavior

Additionally:

BEP (break even point) - break even,

TFC (total fixed costs) - the value of fixed costs,

VC(unit variable cost) - the value of variable costs per unit of output,

P (unit sale price) - the cost of a unit of production (realization),

C(unit contribution margin) - profit per unit of production without taking into account the share of fixed costs (the difference between the cost of production (P) and variable costs per unit of production (VC)).

CVP-analysis (from the English costs, volume, profit - expenses, volume, profit) - analysis according to the "costs-volume-profit" scheme, an element of managing the financial result through the break-even point.

overhead costs- the costs of doing business that cannot be directly related to the production of a particular product and therefore are distributed in a certain way among the costs of all manufactured goods

Indirect costs- costs that, unlike direct ones, cannot be directly attributed to the manufacture of products. These include, for example, administrative and management costs, staff development costs, costs in the production infrastructure, costs in social sphere; they are distributed among various products in proportion to a reasonable base: wages production workers, the cost of materials used, the volume of work performed.

Depreciation deductions- an objective economic process of transferring the value of fixed assets as they wear out to a product or service produced with their help.

©2015-2018 poisk-ru.ru

All rights belong to their authors. This site does not claim authorship, but provides free use.

Copyright Violation and Personal Data Violation

Estimating the behavior of production costs

The dependence of production costs on the level of business activity of the enterprise characterizes the behavior of costs. Business activity the enterprise is determined by the level of use of its production capacity, labor productivity, the introduction of new technologies. To evaluate cost behavior highest value has the production capacity of the enterprise. The production capacity is the volume of products that the company produces or will be able to produce in the reporting or future periods.

There are three types of production capacities: theoretical, practical and normal.

theoretical production capacity is the maximum output that a company can achieve if all machines and equipment operate optimally without downtime. In practice, this indicator is used only in analytical calculations to assess the level of use of production capacity.

Practical production capacity is the theoretical capacity minus machine downtime, work interruptions and other reasonable downtime.

Normal capacity is the average annual volume of output required to meet the needs of the implementation. When evaluating the behavior of costs, the normal capacity of the enterprise is used.

To assess the behavior of costs, they are classified into:

- permanent;

- variables;

- conditionally constant.

In addition, it is calculated cost response ratio:

Where y - the growth rate of costs for a certain period;

X - growth rate of business activity of the enterprise.

It is believed that fixed costs remain unchanged over a short period of time. If K r. h.= 0, then the costs are fixed.

variable costs vary depending on the volume of production. They are divided into proportional, progressive and digressive.

Proportional costs- costs that vary in direct proportion to the volume of production. If K r. h.= 1, then the costs are proportional.

Progressive costs - costs that rise faster than the growth in output. If K r. h.

>1, then the costs are considered progressive.

Digressive- these are costs, the growth rate of which is lower than the growth rate of output. If 0<K r. h.<1, то это дигрессивные затраты.

Each type of cost corresponds to a specific cost behavior schedule:

1.proportional 2.progressive 3.digressive

In real life, there are rarely exclusively fixed or variable costs. In most cases, the costs are conditionally permanent (conditional variables). These costs contain both variable and fixed components. Such costs include entertainment expenses, advertising costs, compensation for the use of personal transport, certain types of taxes, etc. Therefore, semi-fixed costs can be presented in the form of a formula:

y = a + b*X,

Where at- the total amount of conditionally fixed costs;

A- a fixed part of the costs;

V— cost response factor;

X - production volume (indicator of business activity).

If there is no fixed part in this formula, then this type of cost is variable. If the cost response coefficient for this item takes on a zero value, then these costs are permanent.

Related information:

Site search:

Lecture Search

Examples of Variable Costs

Conditionally fixed and conditionally variable costs

In general, all types of costs can be divided into two main categories: fixed (conditionally fixed) and variable (conditionally variable). According to the legislation of the Russian Federation, the concept of fixed and variable costs is present in paragraph 1 of Article 318 of the Tax Code of the Russian Federation.

Semi-fixed costs(English) total fixed costs) - an element of the break-even point model, which is the costs that do not depend on the size of the volume of output, as opposed to variable costs, which add up to total costs.

In simple words, these are expenses that remain relatively unchanged during the budget period, regardless of changes in sales volumes. Examples are: management expenses, expenses for rent and maintenance of buildings, depreciation of fixed assets, expenses for their repair, time wages, on-farm deductions, etc. In reality, these expenses are not permanent in the literal sense of the word. They increase with an increase in the scale of economic activity (for example, with the emergence of new products, businesses, branches) at a slower pace than the growth in sales volumes, or grow in leaps and bounds. Therefore, they are called conditionally constant.

This type of cost largely overlaps with overhead, or indirect costs associated with the main production, but not directly related to it.

Detailed examples of semi-fixed costs:

- Interest obligations during the normal operation of the enterprise and maintaining the volume of borrowed funds, a certain amount must be paid for their use, regardless of the volume of production, however, if the volume of production is so low that the enterprise is preparing for bankruptcy , these costs can be neglected and interest payments can be stopped

- Enterprise property taxes , since its value is quite stable, are also mostly fixed costs, however, you can sell property to another company and rent it from it (form leasing ), thereby reducing property tax payments

- depreciation deductions with a linear method of accrual (evenly for the entire period of use of the property) according to the chosen accounting policy, which, however, can be changed

- Payment guards, watchmen , despite the fact that it can be reduced with a decrease in the number of employees and a decrease in the load on checkpoints , remains even when the company is idle, if it wants to keep its property

- Payment rent depending on the type of production, the duration of the contract and the possibility of concluding a sublease agreement, it can act as a variable cost

- Salary management personnel in the conditions of the normal functioning of the enterprise is independent of the volume of production, however, with the accompanying restructuring of the enterprise layoffs ineffective managers can also be reduced.

Variable (conditionally variable) costs(English) variable costs) are expenses that change in direct proportion in accordance with an increase or decrease in the total turnover (sales proceeds). These costs are associated with the operations of the enterprise for the purchase and delivery of products to consumers. This includes: the cost of purchased goods, raw materials, components, some processing costs (for example, electricity), transportation costs, piecework wages, interest on loans and borrowings, etc. They are called conditional variables because the direct proportional dependence on sales volume actually exists only in a certain period. The share of these expenses may change in some period (suppliers will raise prices, the rate of inflation of selling prices may not coincide with the rate of inflation of these costs, etc.).

The main sign by which you can determine whether costs are variable is their disappearance when production is stopped.

Examples of Variable Costs

In accordance with IFRS standards, there are two groups of variable costs: production variable direct costs and production variable indirect costs.

Production variable direct costs- these are expenses that can be attributed directly to the cost of specific products on the basis of primary accounting data.

Production variable indirect costs- these are expenses that are directly dependent or almost directly dependent on changes in the volume of activities, however, due to the technological features of production, they cannot or are not economically feasible to be directly attributed to manufactured products.

Examples direct variables costs are:

- The cost of raw materials and basic materials;

- Energy and fuel costs;

- The wages of workers engaged in the production of products, with accruals on it.

Examples indirect variables costs are the costs of raw materials in complex production. For example, when processing raw materials - coal - coke, gas, benzene, coal tar, ammonia are produced. When milk is separated, skimmed milk and cream are obtained. In these examples, it is possible to divide the costs of raw materials by types of products only indirectly.

Break even (BEP — break even point) - the minimum volume of production and sales of products at which costs will be offset by income, and in the production and sale of each subsequent unit of production, the enterprise begins to make a profit. The break-even point can be determined in units of production, in monetary terms, or taking into account the expected profit margin.

Break-even point in monetary terms- such a minimum amount of income at which all costs are fully paid off (the profit is equal to zero).

BEP=* Sales proceeds

Or what is the same BEP= = *P (see below for a breakdown of the values)

Revenue and expenses must refer to the same time period (month, quarter, six months, year). The break-even point will characterize the minimum allowable sales volume for the same period.

Let's look at the example of a company. Cost analysis will help you visualize the BEP:

Break-even sales volume - 800 / (2600-1560) * 2600 \u003d 2000 rubles. per month. The actual sales volume is 2600 rubles/month. exceeds the break-even point, this is a good result for this company.

The break-even point is almost the only indicator about which you can say: “The lower the better. The less you need to sell to start making a profit, the less likely you are to go bankrupt.

Break-even point in units of production- such a minimum quantity of products at which the income from the sale of this product completely covers all the costs of its production.

Those. it is important to know not only the minimum allowable revenue from sales in general, but also the necessary contribution that each product should bring to the total profit box - that is, the minimum required number of sales of each type of product. To do this, the break-even point is calculated in physical terms:

VER = or VER =

=

or VER =

=

The formula works flawlessly if the company produces only one type of product. In reality, such enterprises are rare.

Variable costs in the enterprise

For companies with a large range of production, the problem arises of allocating the total amount of fixed costs to individual types of products.

Fig.1. Classic CVP Analysis of Cost, Profit and Sales Behavior

Additionally:

BEP (break even point) - break even,

TFC (total fixed costs) - the value of fixed costs,

VC(unit variable cost) - the value of variable costs per unit of output,

P (unit sale price) - the cost of a unit of production (realization),

C(unit contribution margin) - profit per unit of production without taking into account the share of fixed costs (the difference between the cost of production (P) and variable costs per unit of production (VC)).

CVP-analysis (from the English costs, volume, profit - expenses, volume, profit) - analysis according to the "costs-volume-profit" scheme, an element of managing the financial result through the break-even point.

overhead costs- the costs of doing business that cannot be directly related to the production of a particular product and therefore are distributed in a certain way among the costs of all manufactured goods

Indirect costs- costs that, unlike direct ones, cannot be directly attributed to the manufacture of products. These include, for example, administrative and management costs, the costs of staff development, costs in the production infrastructure, costs in the social sphere; they are distributed among various products in proportion to a reasonable base: the wages of production workers, the cost of materials used, the volume of work performed.

Depreciation deductions- an objective economic process of transferring the value of fixed assets as they wear out to a product or service produced with their help.

©2015-2018 poisk-ru.ru

All rights belong to their authors. This site does not claim authorship, but provides free use.

Copyright Violation and Personal Data Violation

8.1. uHEOPUFSH Y LMBUUYZHYLBGYS YODETZEL

h LLPOPNYUEULPK MYFETBFKHTE Y OPTNBFYCHOSCHI DPLKHNEOFBI YUBUFP RTYNEOSAFUS FBLIE FETNYOSCH, LBL "UBFTBFSHCH", "TBUIPPDSHCH", "YODETTSLY". oERTBCHYMSHOPE PRTEDEMEOYE LFYI RPOSFIK NPTSEF YULBYIFSH YI LPOPNYUEULYK UNSCHUM.

bFTBFSh- LFP DEOETSOBS PGEOLB UFPYNPUFY NBFETYBMSHOSCHI, FTHDPCHSCHI, ZHJOBUPCHSCHI, RTYTPDOSCHI, YOZHPTNBGYPOOSCHI Y DTHZYI CHYDPH TEUKHTUPCH ABOUT RTPY'CHPDUFCHP Y TEBMYYBGYA RTPD HLGYY BY PRTEDEMEOOOSCHK RETYPD READING.

LBL CHYDOP Y PRTEDEMEOYS IBFTBFSCH IBTBLFETYHAFUS:

- DEOETSOPK PGEOLPK TEUKHTUPCH, PVEUREYUYCHBS RTYOGYR YЪNETEOIS TBMYUOSCHI CHYDPH TEUKHTUPCH;

- GEMECHPK HUFBOCHLPK (UCHSBOSCH U RTPY'CHPDUFCHPN Y TEBMYYBGEK RTPDHLGYY CH GEMPN YMY U LBLPK-FP YU UVBDYK LFPZP RTPGEUUB);

- PRTEDEMEOOCHN RETYPDPN READER, F. E. DPMTSOSCH VSHCHFSH PFOUEOSCH ABOUT RTPDHLGYA b DBOOSCHK RETYPD READER.

pFNEFYN EEE PDOP CHBTSOPE UCHPKUFCHP IBFTBF: EUMY IBFTBFSCH OE CHPCHMEYUEOSCH CH RTPY'CHPDUFCHP YOE URYUBOSCH (OE RPMOPUFSHHA URYUBOSCH) ABOUT DBOOHA RTPDHLGYA, FP 'BFTBFSCH RTECHTB EBAFUUS CH ЪBRBUSCH USCHTShS, NBFETYIBMPCH Y F.D. R. y LFPZP UMEDHEF, UFP IBFTBFSCH PVMBDBAF UCHPKUFCHPN BRBUPENLPUFY Y CH DBOOPN UMHYUBE POY PFOPUSFUS L BLFICHBN RTEDRTYSFYS.

tBUIPPSCH- LFP ЪBFTBFSCH PRTEDEMEOOOPZP RETYPDB READING, DPLKHNEOFBMSHOP RPDFCHETSDEOOOSCHE, LPOPNYUEULY PRTBCHDBOOSCHE (PVPUOPCHBOOSCHE), RPMOPUFSHHA RETEOYYE UCHPA UFPYNPUFSH ABOUT TEBMYЪPCHBOOKHA ЪB FFPF RETYPD RTPDHLGYA.

h PFMYYUYE PF ЪBFTBF TBUIPDSCHOE NPZHF VSHCHFSH CH UPUFPSOY ЪBRBUPENLPUFY, OE NPZHF PFOPUYFSHUS L BLFICHBN RTEDRTYSFYS. sing PFTBTSBAFUS RTY TBUYUEFE RTYVSHMY RTEDRTYSFYS CH PFUEFE P RTYVSHMSI Y HVSCHFLBI. RPOSFYE "UBFTBFSCH" YITE RPOSFYS "TBUIPDSCH", PDOBLP RTY PTEDEMEOOOSCHI HUMPCHYSI POY NPZHF UPCHRBDBFSH.

yodetzly- UFP UCHPLKHROPUFSH TBMYUOSCHI CHYDCH IBFTBF ABOUT RTPY'CHPDUFCHP Y RTPDBTSH RTPDHLGYY H GEMPN YMY HER PFDEMSHOSHCHI YUBUFEK. OBRTYNET, YJDETSLY RTPY'CHPDUFCHB - LFP 'BFTBFSCH NBFETYIBMSHOSHCHI, FTHDPCHSCHI, ZHJOBUPCHSCHI Y DTHZYI CHYDPH TEUKHTUPCH ABOUT RTPY'CHPDUFCHP Y RTPDBTSH RTPDHLGYY. LTPNE FPZP, "YODETTSLY" CHLMAYUBAF UREGYZHYUYUEULYE CHYDSCH IBFTBF: EDYOSCHK UPGYBMSHOSHCHK OBMPZ, RPFETY PF VTBLB, ZBTBOFYKOSHCHK TENPOF Y DT. rPOSFYS "ЪBFTBFSCH ABOUT RTPYЪCHPDUFCHP" Y "YODETTSLY RTPYЪCHPDUFCHB" NPZKhF UPCHRBDBFSH Y TBUUNBFTYCHBFSHUS LBL YDEOFYUOSCHE FPMSHLP CH PRTEDEMEOOSHCHI HUMPCHYSI.

pGEOLB YЪDETZEL (ЪBFTBF), B ЪBFEN RPYUL RHFEK YI WOYTSEOIS - PVSBFEMSHOPE HUMPCHYE RTEKHURECHOIS MAVPZP ЖЖЖЕЛФЫЧОПЗП ВЪЪОУБ. UOYTSEOYE HTPCHOS YIDETTSEL, PVEUREYUYCHBEF, RTY RTYYYI TBCHOSHI HUMPCHYSI, TPUF RTYVSHMY, RPMHYUBENPK PTZBOYEBGEK, F.Ye. LLPOPNYUEULHA YZHZHELFYCHOPUFSH HER JHOLGYPOITCHBOYS.

YUUMEDHS RTYTPDH SBFTBF, OEPVIPDYNP PFNEFYFSH, UFP CH VYOEUE UHEEUFCHHAF TBMYUOSCHE YI CHYDSCH (FBVM. 8.1).

fBVMYGB 8.1.

lMBUUYZHYLBGYS IBFTBF

|

rtyobl LMBUUYZHYLBGYY |

zTHRRYTPCHLB IBFTBF |

|

RP OBBYUYNPUFY DMS LPOLTEFOP RTYOYNBENPZP TEYOYS |

TEMECHBOFOSHCH Y OETEMECHOFOSHCHE IBFTBFSCH |

|

rp |

PUOPCHOSCHE Y OBLMBDOSCHE ЪBFTBFSCH |

|

rp URPUPVH PFOEUEOIS ABOUT UEVEUFPYNPUFSH RTPDHLGYY |

rTSNSHCH Y LPUCHEOOOSCHE ЪBFTBFSCH |

|

RP PFOPIEOYA L PVYAENKh RTPY'CHPDUFCHB RTPDHLGYY |

RETENEOOSCH Y RPUFPSOOSCHE ЪBFTBFSCH |

|

rp |

ZTHRRRYTPCHLB ЪBFTBF RP LPOPNYUEULYN LMENEOFBN |

|

RP NEUFKH ChPOYOLOPCHEOYS IBFTBF |

zTHRRYTPCHLB ЪBFTBF RP UVBFShSN LBMSHLHMSGYY |

u FPYULY ЪTEOYS HRTBCHMEOYUEULPZP TEYOYS, CHUE ЪBFTBFSCH (CHRTPYUEN, LBL Y RPUFHRMEOYS) PTZBOYBGYY NPZHF VSHFSH LMBUUYZHYGYTPCHBOSHCH CH UPPFCHEFUFCHY U FEN, OBULPMSHLP POY KOBUYNSCH DMS LPOLTEFOPZP RTYOYNBENPZP TEYOYS. RP LFPNKh LTYFETYA IBFTBFSCH PTZBOYBGYY OEPVIPDYNP RPDTBBDEMSFSH ABOUT TEMECHBOFOSHCH Y OETEMECHBOFOSHCH IBFTBFSCH. FE ЪBFTBFSCH, LPFPTSCHE YЪNEOSAFUS CH TEEKHMSHFBFE RTJOYNBENPZP TEYOYS, OBSCCHCHBAFUUS TEMECHBOFOSHCHNY.ъBFTBFSCH LPNRBOYY, ABOUT LPFPTSHCH RTYOYNBENSCHE TEYOYS CHMYSOIS OE PLBJSCHCHBAF, SCHMSAFUS OEM, F.E.

rTETSDE YUEN THLPCHPDUFCHP PTZBOYBGYY UNPTCEF RTYOSFSH CHCHEYOOOPE TEYOYE RP LPOLTEFOPK RTPVMENE, ENH OEVPVIPDYNP CHLMAYUYFSH CHUE TEMECHBOFOSHCHE VBFTBFSCH, PFOPUSEYEUS L TBUUNBFTYCHBENPNH TEYOYA, CH BMZPTYFN (RTPGEUU) RTYOSFIS TEYOYS. CHLMAYOE OETEMECBOFOSHHI IBFTBF YMYY YZOPTYTPCHBOYE MAVSHI TEMECHBOFOSHCHI YDETTZEL RTYCHEDEF L FPNKh, UFP TEOYOYE NEOEDCETCH YMY THLPPCHPDUFCHB PTZBOYBGYY VHDEF PUOPCHBOP OB OECHETO SHCHI DBOOSHI Y, CH LPOEYUOPN UYUEFE, RTYOSFSHCHE TEYOYS PLBTSHFUS OECHETOSHCHNY.

rTPPDPMTSYN TBUUNPFTEOYE LMBUUYZHYLBGYY BLFTBF ABOUT TEMECHBOFOSHCH Y OETEMECBOFOSHCHE, RTPBOBMYYTPCHBCH DBOOSCHE, RTEDUFBCHMEOOSHCH RTYNETE 1.

rTYNET 1. rTEDRPMPTSYN, UFP PTZBOYBGYS OEULPMSHLP MEF OBBD LHRYMB USCHTSHE BYB 50,000 THV, Y H OBUFPSEEE CHTENS X OEE OEF ChPNPTSOPUFY RTPDBFSH LFY NBFETYBMSCH YMY YUR PMSHBPCHBFSH YI CH VHDHEEK RTPDHLGYY ЪB YULMAYUEOYEN CHBTYBOFB CHSHCHRPMOEOIS BLBLB PF RTPUMPZP UCHPEZP BLBYUYLB, LPFPTSCHK ZPFPH LHRIFSH CHUA RBTFYA FPCHBTB, D MS YJZPPFCHMEOYS LPFPTPZP RPFTEVHAFUS CHUYE HLBBOOSCHE NBFETYBMSCH, OP OE OBNETEO RMBFYFSH OB OEZP VPMSHIE 125,000 THV. dPRPMOYFEMSHOSHE YIDETSLY, UCHSBOOSHCHE AT RETETBVPFLPK NBFETYBMPCH CH FTEVKHENSCHK FPCBT, UPUFBCHMSAF 100,000 THV. UMEDHEF MY LPNRBOY RTYOSFSH L YURPMOEOYA TBUUNBFTYCHBENSCHK BLB? oEUPNOOOOP. IDETTSLY ABOUT NBFETYBM SCHMSAFUS DMS RTYOYNBENPZP TEEYOYS VETBMYUOSCHNY, OETEMECHOFOSHCHNY, FBL LBL POY PUFBOHFUS FENY CE UBNSCHNY OYEBCHYUINP PF FPZP, VKhDEF DBOOSCHK YB LB RTYOSF YMY PFCHETZOHF. TEMECBOFOSHCHNY TSE YJDETTSLBNY SCHMSAFUS 100 000 THV. ABOUT CHSHCHRPMOOEOYE BLBLB. eUMMY UPRPUFBCHYFSH 125,000 THV RPUFHRMEOYK U TEMECHBOFOSHCHNY BBFTBFBNY CH 100,000 THV, FP UPFBOCHYFUS RPOSFOSHCHN, RPYUENKH BLB GEMEUPPVTBOP RTYOSFSH. eUMY LPNRBOYS RTYNEF RTEMPTSEOOSCHK BLB, POB HMHYUYF UCHPE ZHOBOUPCHPE RPMPTSEOIE ABOUT 25,000 THV.

rP LLPOPNYUEULPK TPMY CH RTPGEUUE RTPY'CHPDUFCHB BLFTBFSCH NPTsOP TBDEMYFSH ABOUT PUOPCHOSCHE Y OBLMBDOSHCHE.

l PUOPHOSHCHN PFOPUSFUS ЪBFTBFSCH, UCHSBOOSHCHE OERPUTEDUFCHEOOP U FEIOPMPZYUEULYN RTPGEUUPN, B FBLTS U UPDETTSBOYEN Y LURMHBFBGYEK PTHDYK FTHDB.

about BLMBDOSH- TBUIPPSCH ABOUT PVUMHTSYCHBOYE Y HRTBCHMEOYE RTPY'CHPDUFCHEOOOSCHN RTPGEUUPN, TEBMYBGYA ZPFCHPK RTPDHLGYY.

rP NEFPDKh PFOEUEOIS IBFTBF ABOUT RTPYЪCHPDUFCHP LPOLTEFOPZP RTPDHLFB CHSHDEMSAF RTSNSHCH Y LPUCHEOOOSCHE IBFTBFSCH.

pTSNS- LFP ЪBFTBFSCH, UCHSBOOSHCHE U YЪZPFPCHMEOYEN FPMSHLP DBOOPZP CHYDB RTPDHLGYY Y PFOPUYNSCHE OERPUTEDUFCHEOOP ABOUT UEVEUFPYNPUFSH DBOOPZP CHYDB RTPDHLGYY.

lPUCHEOOOSCHE VBFTBFSCH RTY OBMYYUY OEULPMSHLYI CHIDPCH RTPDHLGYY OE NPZHF VSHCHFSH PFOUEOSCH OERPUTEDUFCHEOOP OY ABOUT PDYO OYI Y RPDMETSBF TBURTEDEMEOYA LPUCHEOOOSCHN RHFEN.

DMS PVPUOPCHBOYS LPNNETYUEULPK UFTBFEZYY PTZBOYBGYY CHBTSOPE OBBYEOOYE YNEEF LMBUUYZHYLBGYS VBFTBF RP UFEREOY BTCHYUYNPUFY YI PF PVYAENPCH RTPYCHPDUFCHB OB RPUFPSOO SHCH Y RETENEOOSCHE YЪDETZLY.

rpd RPUFPSOOOCHNY RPOINBAFUS FBLYE Y'DETTSLY, PVYAEN LPFPTSCHI H DBOOSCHK NPNEOF OE BCHYUIF OERPUTEDUFCHEOOP PF CHEMYUYOYOSCH Y UFTHLFHTSCH RTPY'CHPDUFCHB, rTYNETSCH RPUFPSOOSCHI Y'DETZEL - RMB FB RB RPNEEEOYS, TBUIPPSCH ABOUT UPDETSBOYE JDBOIK, SBFTBFSCH ABOUT RPDZPFPCHLH Y RETERPDZPPFPCHLH LBDTPCH, PFUYUMEOYS CH TENPOPOSCHK ZHPOD, BNPTFYBGYS PUOPCHOSHI ZHPODPCH. fBLYE TBUIPPSCH NPZKhF CHPTBUFY U FEYEOOYEN READER, OP POY PUFBAFUS OEYNEOOOSCHNY H PTEDEMEOOOSCHK RTPNETSHFPL READER (OBRTYNET, BTEODOBS RMBFB CH FEYEOOYE ZPDB). FETNYO "RPUFPSOOSCHE" HLBSHCHCHBEF, FBLYN PVTBPN, ABOUT FP, UFP LFY IBFTBFSCH OE YNEOSAFUS BCHFPNBFYUEULY U YNEOEOYEN PVYAENB RTPYCHPDUFCHB. rPUFPSOOSCHE ЪBFTBFSCH NPZKhF YЪNEOYFSHUS RP DTHZPK RTYYUOYOE, OBRTYNET, LBL UMEDUFCHYE LBLPZP-MYVP HRTBCHMEOYUEULPZP TEYOYOS.

DYOBNYLKH UHNNBTOSHCHI Y HDEMSHOSHCHI RPUFPSOOSCHI RBFTBF YMMAUFTYTHAFUS ABOUT TYU. 8.1. J 8.2.

uhhhhhhhhhhhhhh PUFBAFUS OEYNEOOOSCHNY RTY TBMYUOSCHI PVYAENBI DEFEMSHOPUFY, B HDEMSHOSHCHE RPUFPSOOSCHE YEDETSLY HNEOSHYBAFUUS U KHCHEMYYUEOYEN PVYAENB DESFEMSHOPUFY, F.E.

2.5.3. Calculation of conditionally fixed and variable costs of the cost of coal

OBVMADBEFUSS PVTBFOBS ЪBCHYUYNPUFSH.

|

|

|

|

tyu. 8.1. DYOBNYLB UHNNBTOSCHI RPUFPSOOSHI IBFTBF |

tyu. 8.2. DYOBNYLB HDEMSHOSCHI RPUFPSOOSHI IBFTBF |

rpd RETENEOUSCHNYЪDETSLBNY RPOYNBAFUS ЪBFTBFSCH, PVEYK PVYAEN LPFPTSCHI ABOUT DBOOSHK NPNEOF READING OBIPDYFUS CH OERPUTEDUFCHEOOOPK ЪBCHYUYNPUFY PF PVYAENPCH RTPYЪCHPDUFCHB Y TEBMYЪBGYY RTPDHLGYY LPNRBOYY. RETENEOOCHNY YJDETCLBNY SCHMSAFUS, OBRTYNET, UBFTBFSCH ABOUT RTYPVTEFEOYE USCHTSHS, PRMBFH FTHDB, IOETZYY, FPRMYCHB DMS RTPYCHPDUFCHEOOSHCHI GEMEK, TBUIPPSCH ABOUT FBTH, HRBL PCHLH DMS RTPDHLGYY Y DT.

dms PRYUBOYS RPCHEDEOYS RETENEOOSCHI RBFTBF YURPMSHHEFUS UREGIBMSHOSHCHK RPLBBFEMSH - LPZHZHYGYEOF LMBUFYUOPUFY (TEBZYTPCHBOYS) IBFTBF. BY IBTBLFETYJHEF UPPFOPYOYE NETSDH FENRBNY YNEOEOYS IBFTBF Y PVYENB DEFEMSHOPUFI:

l \u003d fb / fP,

HERE - LPZHZHYGYEOF LMBUFYUOPUFY (TEBZYTPCHBOYS) ЪBFTBF;

fb - FENR YЪNEOEOYS ЪBFTBF, %;

FP - FENR YЪNEOEOYS PVYAENB DESFEMSHOPUFY, %.

FELHEIE BBFTBSCH UYUYFBAFUS RPUFPSOOSCHNY, EUMY SING OE TEBZYTHAF ABOUT YNEOEOYE PVYAENB DEFEMSHOPUFY (LPZHZHYGYEOF LMBUFYUOPUFY YDETZEL TBCHEO OHMA). obyuyobs U OHMS RP NETE TPUFB PVYAENB DESFEMSHOPUFY POY KHCHEMYYUYCHBAFUS CH PFOPUYFEMSHOP VPMSHYEK RTPRPTGYY, RPFPPNKh RPMKHYUYMY OBCHBOYE RTPZTEUUYCHOSHI RETENEOOSHCHI RBFTBF(LPZHZHYGYEOF LMBUFYUOPUFY VPMSHIE EDYOYGSCHCH). DYOBNYLB UHNNBTOSHCHI Y HDEMSHOSHCHI RTPZTEUUYCHOSHI RETENEOOSCHI YDETZEL RTEDUFBCHMEOB ABOUT TYU. 8.3. BLFEN RP NETE HCHEMYYUEOYS PVYAENB DEFEMSHOPUFY RETENEOOSCHE YODETTSL YЪNEOSAFUS CH PJOBLPCHSCHI U OIN RTPRPTHYSI, Y YI OBSCCHCHBAF RTPRPTGYPOMSHOSHCHNY RETENEOOSCHNYY BFTBFBNY(LPZHZHYGYEOF LMBUFYUOPUFY TBCHEO EDYOYGE). YI RPCHEDEOYE YMMAUFTYTHEFUS ABOUT TYU. 8.4.

|

|

|

|

tyu. 8.3. DYOBNYLB RTPZTEUYCHOSCHI RETENEOOSHCHIIBFTBF: B) UHNNBTOSCHI; B) HDEMSHOSHCHI |

|

|

|

|

|

tyu. 8.4. DYOBNYLB RTPRPTGYPOBMSHOSHCHI RETENEOOSCHI RBFTBF: B) UHNNBTOSCHI; B) HDEMSHOSHCHI |

|

u DEKUFCHYEN ZHBLFPTB LLPOPNYY ABOUT NBUYFBVE RTPYCHPDUFCHB TPUF RETENEOOSCHI YODETTSEL UVBOPCHYFUS VPME NEDMEOOCHN, YUEN TPUF PVYAENB DEFEMSHOPUFY. LFY IBFTBFSCH RPMKHYUYMY OBCHBOYE DEZTEUYCHOSCHI RETENEOOSCHI YDETZEL(LPZHZHYGYEOF LMBUFYUOPUFY NEOSHIE EDYOYGSCHCH). zTBZHYLY RPCHEDEOYS DEZTEUUYCHOSCHI RBFTBF - UCHPLKHROSCHI Y H TBUYUEFE ABOUT EDYOYGH RTPDHLGYY - RTYCHEDEOSCH ABOUT TYU. 8.5.

|

|

|

|

tyu. 8.5. DYOBNYLB DEZTEUUYCHOSHI RETENEOOSCHI RBFTBF: B) UHNNBTOSCHI; B) HDEMSHOSHCHI |

|

RTYCHEDEOOOSCHE TYUKHOLY RPLBJSCHCHBAF, UFP NETsDH DYOBNYLPK BVUPMAFOSCHI Y PFOPUYFEMSHOSHCHI CHEMYUYO IBFTBF UHEEUFCHHEF OBBYUYFEMSHOBS TBOYGB. obrtynet, HDEMSHOSHE RPUFPSOOSCHE RBFTBFSCH RTECHTBEBAFUS CH TBOPCHYDOPUFSH DEZTEUUYCHOSCHI RETENEOOSHCHI BFTTBF, B HDEMSHOSHCHE RTPRPTGIPOBMSHOSHCH RETENEOOSCHE RBFTBFSCH - CH CHBTYBOF RPUFP COMMUNICATIONS BFTTBF. NECDH FEN LPMYUEUFCHP YUYUFP RETENEOOSCHI YMY YUYUFP RPUFPSOOSCHI IBFTBF OE FBL HTS CHEMYLP. UMEDPCHBFEMSHOP, DTKHZYN CHBTSOSCHN BURELFPN FEPTYY LMBUUYZHYLBGYY BLFTBF ABOUT RPUFPSOOSCHE Y RETENEOOOSCHE SCHMSEFUS RTPVMENB HUMPCHOPUFY YI RPDTBDEMEOYS.

The analysis of the performance of the company is an extremely important event. This makes it possible to identify negative trends hindering development and eliminate them. The formation of the cost is an important process on which the company's net profit depends. In this case, it is important to know what variable costs are, how they affect the performance of the enterprise. Their analysis uses certain formulas and approaches. How to find out the amount of variable costs, how to interpret the result of the study, you should learn more.

general characteristics

Variable Costs (VC) are the costs of the organization that change their amount according to the volume of production. If the company ceases to function, then this indicator will be equal to zero.

Variable costs include such types of costs as raw materials, fuel, energy resources for production. This also includes the salary of key employees (the part that depends on the implementation of the plan) and sales managers (percentage for implementation).

This also includes tax levies, which are based on the amount of sales. These are VAT, shares, tax on the simplified tax system, UST, etc.

Calculating the variable costs of the enterprise, it is possible to increase the profitability of the company, provided that all the factors influencing them are properly optimized.

Impact of sales volume

There are different types of variable costs. They differ in defining features and form certain groups. One of these classification principles is the breakdown of variable costs by sensitivity to the impact on them of sales volume. They are of the following types:

- proportional costs. Their coefficient of response to changes in the volume of production (elasticity) is equal to 1. That is, they grow in the same way as sales.

- progressive costs. Their elasticity index is greater than 1. They increase faster than the volume of production. This is a high sensitivity to changes in conditions.

- Degressive costs respond to changes in sales more slowly. Their sensitivity to such changes is less than 1.

It is necessary to take into account the degree of response of changes in costs to an increase or decrease in production output when conducting an adequate analysis.

Other varieties

There are several more signs of classification of this type of costs. On a statistical basis, the organization's variable costs are general and average. The former include all variable costs for the full range of products, while the latter are determined per unit of production or a specific group of products.

On the basis of reference to the cost price, variable costs can be direct or indirect. In the first case, the costs are directly related to the price of sales products. The second type of costs is difficult to assess for attributing them to the cost price. For example, in the production of skimmed milk and cream, it is quite problematic to find the amount of costs for each of these items.

Variable costs can be manufacturing or non-manufacturing. The former include the costs of raw materials, fuel, materials, wages and energy resources. Non-production variable costs should include administrative, commercial expenses.

Calculation

A number of formulas are used to calculate variable costs. Their detailed study will make it possible to understand the essence of the category under consideration. There are several approaches to the analysis of the indicator. Variable costs, the formula of which is most often used in production, look like this:

PZ = Materials + Raw materials + Fuel + Electricity + Salary bonus + Percentage for sales to sales representatives.

There is another approach to assessing the presented indicator. It looks like this:

ПЗ = Gross (marginal) profit - fixed costs.

This formula emerges from the statement that the total costs of an enterprise are found by summing fixed and variable costs. Using one of two approaches, you can assess the state of the indicator in the enterprise. However, if you want to evaluate the factors that affect the variable part of the costs, it is better to use the first type of calculation.

Break even

Variable costs, the formula of which was presented above, play an important role in determining the break-even point of an organization.

At a certain equilibrium point, the enterprise produces such a volume of products at which the value of profits and costs coincide. In this case, the company's net profit is 0. Marginal profit at this level corresponds to the sum of fixed costs. This is the breakeven point.

It shows the minimum allowable income level at which the company's activities will be profitable. Based on such a study, the analytical service should determine a safe zone in which the minimum allowable level of sales will be performed. The higher the indicators from the break-even point, the higher the stability indicator of the organization and its investment rating.

How to apply calculations

When calculating variable costs, you should take into account the definition of the break-even point. This is due to a certain pattern. As variable costs increase, the break-even point shifts. At the same time, the profit zone moves even higher on the chart. As production costs increase, the company must produce more output. And the cost of this product will also be higher.

Ideal calculations use linear relationships. But when conducting a study in real production conditions, a nonlinear relationship can be observed.

For the model to work accurately, it must be applied in short-term planning and for stable categories of goods that do not depend on demand.

Ways to reduce costs

To reduce variable costs, you can consider several ways to influence the situation. It is possible to take advantage of the effect of increasing production. With a significant increase in production volume, the change in variable costs becomes non-linear. At a certain point, their growth slows down. This is the breaking point.

This happens for several reasons. Initially, the cost of remuneration of managers is reduced. With such events, it is possible to conduct scientific research and introduce technological innovations into the production process. The scrap size is reduced and the product quality is improved. Fuller utilization of production capacities also has a positive effect on the indicator.

Having become familiar with such a concept as variable costs, you can correctly use the methodology for calculating them in determining the development paths of an enterprise.

variable costs These are costs, the value of which depends on the volume of output. Variable costs are opposed to fixed costs, which add up to total costs. The main sign by which it is possible to determine whether costs are variable is their disappearance during a stop in production.

Note that variable costs are the most important indicator of an enterprise in management accounting, and are used to create plans to find ways to reduce their weight in total costs.

What is variable cost

Variable costs have the main distinguishing feature - they vary depending on the actual production volumes.

Variable costs include costs that are constant per unit of output, but their total amount is proportional to the volume of output.

Variable costs include:

raw material costs;

Consumables;

energy resources involved in the main production;

salary of the main production personnel (together with accruals);

the cost of transport services.

These variable costs are directly charged to the product.

In value terms, variable costs change when the price of goods or services changes.

How to find variable costs per unit of output

In order to calculate the variable costs per piece (or other unit of measure) of the company's products, you should divide the total amount of variable costs incurred by the total amount of finished products, expressed in physical terms.

Classification of variable costs

In practice, variable costs can be classified according to the following principles:

According to the nature of the dependence on the volume of output:

proportional. That is, variable costs increase in direct proportion to the increase in output. For example, the volume of production increased by 30% and the amount of costs also increased by 30%;

degressive. As production increases, the company's variable costs decrease. So, for example, the volume of production increased by 30%, while the size of variable costs increased by only 15%;

progressive. That is, variable costs increase relatively more with output. For example, the volume of production increased by 30%, and the amount of costs by 50%.

Statistically:

are common. That is, variable costs include the totality of all variable costs of the enterprise across the entire product range;

average - average variable costs per unit of production or group of goods.

According to the method of attribution to the cost of production:

variable direct costs - costs that can be attributed to the cost of production;

variable indirect costs - costs that depend on the volume of production and it is difficult to assess their contribution to the cost of production.

In relation to the production process:

production;

non-production.

Direct and indirect variable costs

Variable costs are either direct or indirect.

Production variable direct costs are costs that can be attributed directly to the cost of specific products based on primary accounting data.

Production variable indirect costs are costs that are directly dependent or almost directly dependent on the change in the volume of activity, however, due to the technological features of production, they cannot or are not economically feasible to be directly attributed to manufactured products.

The concept of direct and indirect costs is disclosed in paragraph 1 of Article 318 of the Tax Code of the Russian Federation. Thus, according to tax legislation, direct expenses, in particular, include:

expenses for the purchase of raw materials, materials, components, semi-finished products;

wages of production personnel;

depreciation on fixed assets.

Note that enterprises can include in direct costs and other types of costs directly related to the production of products.

At the same time, direct expenses are taken into account when determining the tax base for income tax as products, works, services are sold, and written off to the tax cost as they are implemented.

Note that the concept of direct and indirect costs is conditional.

For example, if the main business is transportation services, then drivers and car depreciation will be direct costs, while for other types of business, maintaining vehicles and remunerating drivers will be indirect costs.

If the cost object is a warehouse, then the storekeeper's wages will be included in direct costs, and if the cost object is the cost of manufactured and sold products, then these costs (storekeeper's wages) will be indirect costs due to the impossibility of unambiguously and in the only way to attribute it to the object costs - cost.

Examples of Direct Variable Costs and Indirect Variable Costs

Examples of direct variable costs are costs:

for the remuneration of workers involved in the production process, including accruals on their wages;

basic materials, raw materials and components;

electricity and fuel used in the operation of production mechanisms.

Examples of indirect variable costs:

raw materials used in complex production;

expenses for research and development, transportation, travel expenses, etc.

conclusions

Due to the fact that variable costs change in direct proportion to the production volume, and the same costs per unit of finished product usually remain unchanged, when analyzing this type of cost, the value per unit of production is initially taken into account. In connection with this property, variable costs are the basis for solving many production problems related to planning.

Still have questions about accounting and taxes? Ask them on the accounting forum.

Variable Costs: Accountant Details

- Operational leverage in the main and paid activities of the BU

They are useful. Management of fixed and variable costs, as well as their associated operational ... in the structure of the cost of fixed and variable costs. The effect of operating leverage arises... variable and conditionally constant. Conditionally variable costs change in proportion to the change in the volume of provided ... constant. Conditionally fixed costs Conditionally variable costs Maintaining and maintaining buildings and ... the price of the service falls below the variable costs, it remains only to curtail production, ...

- Financing the state task: examples of calculations

- Does it make sense to divide costs into variable and fixed costs?

It is the difference between revenue and variable costs, shows the level of reimbursement of fixed ... costs; PermZ - variable costs for the entire volume of production (sales); permS - variable costs per unit...increased. Accumulation and distribution of variable costs When choosing a simple direct costing ... semi-finished products of own production are taken into account at variable costs. Moreover, complex raw materials, with ... The total cost on the basis of the distribution of variable costs (for output) will be ...

- Dynamic (temporary) profitability threshold model

For the first time he mentioned the concepts of "fixed costs", "variable costs", "progressive costs", "degressive costs". ... The intensity of variable costs or variable costs per working day (day) is equal to the product of the value of variable costs per unit ... total variable costs - the value of variable costs per unit of time, calculated as the product of variable costs by ... respectively, total costs, fixed costs, variable costs and sales. The above integration technology...

- Director's questions to which the chief accountant should know the answers

Equality: revenue = fixed costs + variable costs + operating profit. We are looking for... products = fixed cost / (price - variable cost/unit) = fixed cost: marginal... fixed cost + target profit) : (price - variable cost/unit) = (fixed cost + target profit ... equation: price = ((fixed costs + variable costs + target profit) / target sales ... , in which only variable costs are taken into account. Marginal profit - revenue ...

Example 2. In the reporting period, variable costs for the release of finished products, reflected .... The cost of production includes variable costs in the amount of 5 million rubles... Debit Credit Amount, rub. Reflected variable costs 20 10, 69, 70, ... Part of general factory costs added to the variable costs that form the cost 20 25 1 ... Debit Credit Amount, rub. Variable costs are reflected 20 10, 69, 70, ... Part of general factory costs is added to the variable costs that form the cost price 20 25 1 ...