Accounting for tires for cars at the enterprise. Accounting for car tires

Accounting procedure car tires depends on whether they are purchased together with the vehicle or separately from it.

VICTORIA ZHMULINA, Senior Auditor, VIT-audit LLC

The tire is one of the main elements of the chassis of the vehicle. Tires, other than those purchased with fixed assets, are included in inventories. Features of these material assets directly affect the order of their accounting and documentation. Tires are constantly subjected to increased wear and quite often fail much earlier than the end of their service life. In addition, worn tires can be either retreaded or recycled, which has different accounting implications. Tires also have certain seasonal properties that dictate the frequency of their use during the operation of the car.

In accordance with paragraph 10 Guidelines for the accounting of fixed assets, approved by the Order of the Ministry of Finance of the Russian Federation of October 13, 03 No. 91n, the fixed asset accounting unit is an inventory object. An inventory object is recognized with all fixtures and fittings, or a separate structurally separate object designed to perform certain independent functions, or a separate complex of structurally articulated objects that form a single whole, designed to perform a specific job.

Since it is not possible to use a tire purchased with the car separately from it, the initial cost of the car includes, among other things, the cost of a spare wheel with tire, inner tube and rim tape.

That is, tires, including spare ones, purchased with the car, are accounted for as a fixed asset and reflected on account 08 “Investments in non-current assets”. When the cost of the car is fully formed, the accountant makes a record

Dt01 "Fixed assets" - Kt08 "Investments in non-current assets".

Purchasing tires separately from the car

Road transport enterprises have an industry-specific Instruction for accounting for income and expenses, which was approved by Order of the Ministry of Transport of Russia dated June 24, 2003 No. 153. According to this instruction, the cost of spare parts for the repair of rolling stock and the cost of car tires are included in material costs (clause 42). The same article takes into account the costs of restoring wear and repairing car tires, but only within the limits approved by the Ministry of Transport, which is fixed in the accounting policy of the organization (paragraph 43). Excess costs for the restoration of wear and repair of tires are included in other expenses (paragraph 97).

According to the Instructions for the application of the Chart of Accounts, subaccount 10-5 “Spare Parts” takes into account the availability and movement of spare parts purchased or manufactured for the needs of the main activity, intended for repairs, replacement of worn parts of machines, equipment, vehicles, as well as car tires in stock and turnover.

According to paragraph 42 of the Guidelines for accounting for inventories, approved by Order of the Ministry of Finance of the Russian Federation dated December 28, 01 No. 119n, materials are a type of inventory. Materials include raw materials, basic and auxiliary materials, purchased semi-finished products and components, fuel, packaging, spare parts, construction and other materials.

Thus, tires purchased separately from the vehicle must be included in the material composition. At the same time, the price of tires does not affect the order of their accounting.

Documenting

To account for tires, intersectoral forms of primary documentation for accounting for inventory are used, which are approved by the Decree of the State Statistics Committee of Russia dated October 30, 1997 No. 71a. These forms include: receipt order (form No. M-4), limit-fence card (form No. M-8). An organization for accounting for the operation of tires can, in addition to unified forms primary documents independently develop and apply in economic activities their documentation that meets the requirements of Art. 9 of the Law on Accounting (clause 100 of the Methodological Guidelines for accounting for inventories). At the same time, the forms of documents developed by the organization independently must be fixed in the accounting policy. However, organizations can also use existing experience. For example, Order No. 750 of the Ministry of Agriculture of Russia dated May 16, 2003 approved specialized forms of primary accounting documentation for agribusiness enterprises, including a tire record card (form No. 424-APK), which is maintained from the moment tires are received and until they are written off (disposal) . You can also use the card for accounting for the operation of a car tire, which is an annex to the Order of the Judicial Department under the Armed Forces of the Russian Federation of June 30, 2008 No. 104 “On Approval of the Instruction on the Maintenance, Operation, Maintenance and Repair of Official Vehicles”. Appendix No. 12 to the previously valid Rules for the operation of automobile tires AE 001-04, approved by the Order of the Russian Ministry of Transport dated January 21, 2004 No. AK-9-r, also provides a form for recording tire operation.

The tire record card indicates the technical condition of the tire on the car, including defects, the nature and extent of damage. For used tires, when fitted to another vehicle, their previous mileage is recorded. After the repair of local damage, the accounting of the tire operation continues on the same card. Every month, the actual mileage is entered into each card.

When replacing a tire on road wheels with a spare tire, the driver is obliged to inform the person responsible for accounting for the operation of tires, the date of replacement, the serial number of the replaced tire, and the speedometer reading at the time of installation. These data are also recorded in the cards.

If the tire is taken out of service, the record card indicates the date of dismantling, full mileage, the reason for the removal, determined by the commission, the remaining height of the tread pattern (according to the greatest wear), the place where the tire will be repaired, restored or disposed of. When a tire is sent for restoration, deepening of the tread pattern or for scrap, the tire operation record card is signed by members of the commission who inspect the tire. In this case, the accounting card is an act of writing off the tire. New cards for recording their work are issued for tires received after restoration.

When tires are disposed of (complete wear, faulty damage), in addition to the standard issue of a tire accounting card, an act is drawn up for their write-off (disposal). This document is drawn up by a commission appointed by the head of the enterprise. The write-off (disposal) report indicates the reason for the tire write-off: unacceptable residual tread height; destruction beyond repair (rupture, longitudinal cut, etc.).

Writing off the cost of tires to the expenses of the organization

The organization has the right to write off the cost of tires as expenses when the following circumstances occur:

At the time of actual retirement due to wear or damage;

At the time of installation on the car;

Evenly as you use.

Depending on the chosen method of reflecting the cost of tires as part of the organization's costs, the reflection in the accounting of tire recycling also changes. Let's take a closer look at each accounting method.

1. Writing off the cost of tires to expenses at the time of actual disposal due to wear or damage.

According to the Instructions for the application of the Chart of Accounts: on sub-account 10-5, the presence and movement of purchased car tires in stock and turnover are taken into account. From the foregoing, the need to use sub-accounts of the second order directly follows, for example, 10-5-1 “Tires in stock, 10-5-2 “Tires in circulation”. Then, upon acceptance of tires from the warehouse for operation, an accounting entry is made: Dt10-5-1 - Kt10-5-2, and when writing off tires from the register due to unsuitability for operation: Dt20, 23, 25, 26 - Kt10-5-2.

However, when using this option, the accounting methodology is violated, and here's why. According to paragraph 6 of PBU 1/2008 "Accounting policy of the organization" (Order of the Ministry of Finance of the Russian Federation of 06.10.08 No. 106n), the accounting policy of the organization should ensure greater readiness to recognize expenses and liabilities in accounting than possible income and assets, preventing the creation of hidden reserves (requirement of prudence). When writing off tires due to their unsuitability for operation, this requirement is not observed.

In addition, this method of accounting distorts the cost of services rendered, work performed, since the cost of tires will be written off in the reporting period in which their actual operation was minimal.

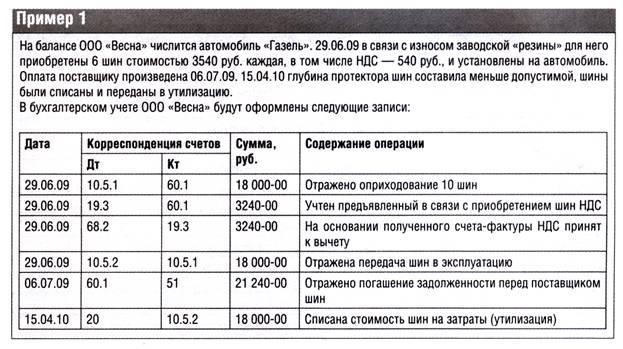

Thus, this option of accounting for tires is not recommended for use. For accountants who still apply this procedure for writing off the cost of tires, consider its reflection on an example.

2. Writing off the cost of tires to expenses at the time of their installation on the car.

According to clause 93 of the Guidelines for accounting for inventories, as materials are released from the warehouses (pantries) of the unit to sites, teams, workplaces, they are debited from the accounts of material assets and credited to the corresponding accounts of accounting for production costs (20, 23).

In accordance with paragraph 16 of PBU 10/99 "Expenses of the organization", expenses are recognized in accounting if the following conditions are met:

The expense is made in accordance with a specific contract, the requirement of legislative and regulatory acts, business customs;

The amount of the expense can be determined;

There is confidence that as a result of a particular transaction there will be a decrease in the economic benefits of the organization. This assurance exists when the entity has transferred the asset or there is no uncertainty about the transfer of the asset.

In addition, the replacement of tires purchased instead of unsuitable tires received as part of the car can be considered a car repair, therefore, on the basis of paragraph 27 of PBU 6/01, expenses are recognized in the reporting period in which the repair is completed.

Based on the above application this option accounting for tires can be considered reasonable.

However, regardless of whether car tires are on the balance sheet or not, the accountant will have to track their movement. After all, during the operation of the tire, it may be necessary to repair it, and after the tire has been exhausted, the management of the enterprise has to decide whether it is necessary to restore the used rubber or recycle it. In both cases, the tires are transferred to third parties specializing in tire retreading (recycling). for this, the organization needs accurate information about their quantitative and valuation. It is also necessary to remember that during the disposal of tires, production waste is generated, and the organization should apply the methods of their accounting, fixed in accounting and tax accounting. At the same time, the amount of waste generated at the enterprise directly affects the amount of environmental payments.

In order to control the safety of used tires written off the balance, we advise you to organize their off-balance accounting on an additionally entered account, for example, on account 012 “Tires put into operation”. This off-balance sheet account should be included in the organization's working chart of accounts.

3. Write off the cost of tires evenly as they are used.

When choosing this method of reflecting the cost of tires as part of the expenses of the organization, the principle of matching income and expenses, enshrined in paragraph 19 of PBU 10/99, is observed, there is economic feasibility when applying this accounting option (tires are written off in the period of their actual use).

The option of evenly decommissioning tires is also allowed regulations on accounting. In particular, by virtue of clause 94 of the Guidelines for accounting for inventories, the cost of materials released for production, but relating to future reporting periods, is credited to the expense account for future periods. According to paragraph 65 of the Regulation on accounting and financial reporting in the Russian Federation, approved. By order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n: the costs incurred by the organization in the reporting period, but related to the following reporting periods, are reflected in the balance sheet as a separate item as deferred expenses and are subject to write-off in the manner established by the organization during the period by which they relate.

In addition, for accountants of large transport companies, writing off the cost of tires as costs at the time of their commissioning can significantly affect the profit margin.

Thus, the use of this option for accounting for the cost of tires and their write-off is the most optimal (see example 2).

Decommissioned tires, the use of which is possible for economic purposes or which are subject to delivery in the form of waste (to be disposed of), are credited to the warehouse of the organization on the basis of a write-off certificate and an invoice for

internal movement of material assets (clause 129 of the Instructions for accounting for inventories). The waste remaining from the write-off of tires is evaluated at the value prevailing on the date of write-off based on the price of possible use and is credited at the indicated cost to the financial results of the organization. According to the Chart of Accounts, the presence and movement of used tires and scrap rubber are accounted for on account 10, subaccount 6 "Other materials", as waste.

For the purpose of calculating income tax, returnable waste means the remains of raw materials (materials), semi-finished products, heat carriers and other types of material resources formed in the process of production of goods (performance of work, provision of services), partially lost consumer qualities input resources (chemical or physical properties) and therefore used with increased costs (lower output) or not used due to intended purpose(Clause 6, Article 254 of the Tax Code of the Russian Federation).

Car tires that are not subject to further use, when taxing profits, are also returnable waste, and when sold to a third party, they are assessed at the selling price (subclause 2, clause 6, article 254 of the Tax Code of the Russian Federation).

Proceeds from the sale of used car tires are recognized as other income, for which account 91, subaccount 1 “Other income” is intended for accounting in the Chart of Accounts.

The sale of returnable waste in accordance with paragraph 1 of Art. 146 of the Tax Code of the Russian Federation is recognized as an object of value added tax. The tax base for VAT is determined as the value of such waste, calculated on the basis of prices determined in accordance with Art. 40 of the Tax Code of the Russian Federation, without including VAT in them (clause 1, article 154).

For the purpose of calculating income tax, income from the sale of recyclable waste is accounted for as income from the sale (Article 249 of the Tax Code of the Russian Federation). The income received is reduced by the cost of returnable waste, as well as other expenses associated with their sale (clause 1, article 268 of the Tax Code of the Russian Federation).

Autumn is coming soon, and you will need to purchase winter tires for your company car. Learn how to keep track of summer and winter tires in accounting and taxation. Do I need to include the cost of buying replacement tires in the price of a car? How to write off tires when they are completely worn out?

There are two situations when an organization has tires - either it buys them together with the car, or separately.

In the first case, tires are not separately accounted for - their cost (including spare tires) is taken into account in the initial cost of the car (clause 6 PBU 6/01, clause 10 of the Guidelines for accounting for fixed assets). The situation will be similar in tax accounting.

In the second case, tires should be considered as independent accounting objects. It is this case of tire accounting that will be considered in this article.

Tires are not the main tool

Although tires last more than one year, they must be accounted for as part of the inventory. Let's explain why.

Based on the norms of clause 6 PBU 6/01 "Accounting for fixed assets", an inventory item of fixed assets is an object with all fixtures and fittings or a separate structurally separate item designed to perform certain independent functions. But a car tire cannot be used separately from a car. This means that one of the main conditions for recognizing property as a fixed asset in accounting is not met.

In addition, automobile tires do not appear as independent accounting items either in the Classification of fixed assets included in depreciation groups (approved by Decree of the Government of the Russian Federation of 01.01.2002 N 1), or in the All-Russian Classifier of Fixed Assets OK 013-94 (OKOF) (approved Decree of the State Standard of Russia dated December 26, 1994 N 359).

Accounting for tires in accounting

Car tires are among the most worn components of vehicles. Tire replacement is mandatory when they are worn or damaged and is possible when the seasons change - winter and summer.

The cost of automobile tires purchased by the organization to replace worn ones is recorded on account 10 "Materials", sub-account "Spare parts". At the same time, the Instructions for the Application of the Chart of Accounts (approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n) recommend keeping records on this account of tires that are both in stock and in circulation.

During the operation of the vehicle, the organization can change seasonally winter tires to summer tires and vice versa, as well as replace completely worn-out car tires with similar new tires. Therefore, we advise you to separately take into account the tires in stock (new, seasonal, repaired).

To do this, you can open additional sub-accounts of the third order to the sub-account "Tires in stock".

Buying new tires

New tires, like any other inventories, are accepted for accounting at actual cost, which consists of the organization's actual costs for its purchase (delivery, tire cost), excluding VAT and other refundable taxes (clause 5, 6 PBU 5/01).

In accounting, the purchase of tires is reflected in the following entries:

Debit 60 Credit 51

- listed cash for tires;

Debit 10, sub-account "Spare parts", "Tires in stock", "New tires", Credit 60

- reflects the debt for purchased tires;

Debit 19 Credit 60

- reflects the VAT presented by the seller;

Debit 68 Credit 19

- accepted for VAT deduction.

Transfer of tires to operation

When tires are put into operation, they are moved only according to sub-accounts, i.e. in analytical accounting:

Debit 10, subaccount "Spare parts", "Tires in circulation", Credit 10, subaccount "Spare parts", "Tires in stock",

- tires were put into operation.

Please note: the reflection of tires in circulation on the corresponding sub-account of account 10 suggests that as long as the tires are in operation, their cost is not subject to write-off to the expenses of the organization.

Retirement of unsuitable tires

If the tires have become unusable, they are written off with the following wiring:

Debit 20, 26, 44 Credit 10, sub-account "Spare parts", "Tires in circulation",

- the cost of tires is written off as expenses.

When tires are written off for production or otherwise disposed of, one of the methods for their assessment is used, given in paragraph 16 of PBU 5/01 (FIFO method, average cost or cost of each unit). When put into operation, tires are usually valued at the cost of each unit.

Documenting

For each tire (including tires included in the initial cost of the car), the organization can either get a card for recording the operation of a car tire (Appendix 12 to the Rules for the operation of car tires, approved by Order of the Ministry of Transport of Russia dated 21.01.2004 N AK-9-r - these Rules are no longer in force, but the department has not issued other documents to replace them), or a simple material accounting card in the form N M-17 (approved by the Decree of the State Statistics Committee of Russia dated 10.30.1997 N 71a).

Information about the technical condition of the tire, mileage (its indicators must be entered monthly), and defects can be entered into the Card for recording the operation of a car tire. When removing a tire from service, it indicates: the date of dismantling, full mileage, the name of the reason for removal, determined by the commission, where the tire was sent - for repair, for restoration, for deepening the tread pattern, for scrap or for a complaint.

The issue of tires from a warehouse for installation on a car is issued by a requirement-invoice in the form N M-11 (approved by the Decree of the State Statistics Committee of Russia dated 10/30/1997 N 71a).

When a tire is sent for restoration, tread deepening or scrap, the accounting card is signed by members of the commission and closed. At the same time, it performs the functions of the act of decommissioning the tire. It also confirms the need to commission new tires.

New cards for recording their work are issued for tires received after restoration. The mileage of a tire with a deep tread pattern starts from zero in the previously entered card, while an impersonal cutting starts a new accounting card.

The aforementioned Rules did not allow removing tires from service and transferring them to scrap or for restoration, if they were suitable for operation due to their technical condition (paragraph 88 of the Rules). The list of production and operational reasons for which tires, tubes and rim tapes could be prematurely withdrawn from service was given in Appendix 9 to the Rules.

Service life

The service life of car tires is set by the head of the organization. To determine it, you can use the data given in the guidance document "Temporary norms for the operational mileage of vehicle tires (RD 3112199-1085-02)" (approved by the Ministry of Transport of Russia on 04.04.2002). The validity of these Norms has been extended until the entry into force of the new relevant technical regulations (Information letter of the Ministry of Transport of Russia dated 07.12.2006 N 0132-05/394).

In temporary norms, data are given on the average mileage of tires for passenger cars and trucks, buses and trolleybuses (tables 1 - 3). The tire mileage rate (Hi) is determined as follows:

Hi \u003d H x K1 x K2,

where H is the value of the average tire mileage for a given vehicle;

K1 - correction factor taking into account the category of operating conditions of the vehicle;

K2 is a correction factor that takes into account the operating conditions of the vehicle (the values of the correction factors are given in tables 4 and 5). At the same time, the tire operating mileage should not be lower than 25 percent of the average tire mileage.

Average tire mileage Russian production for passenger cars is approximately 40 - 45 thousand km, for tires of foreign production - 50 - 55 thousand km. The mileage of truck tires is significantly higher: for domestic tires it can reach 100,000 km, for foreign-made tires - up to 180,000 km.

Cost Accounting

When tires are put into operation, their purpose can be of two types:

- to replace worn or unusable tires;

- for seasonal change summer tires to winter tires and, vice versa, from winter tires to summer tires.

Replacing tires that are worn out or worn out for other reasons can be considered as a routine repair (replacement of worn parts) of a car. Therefore, in this case, one can general rules, regulating the procedure for writing off to production costs and circulation of costs for the repair of fixed assets.

The costs incurred during the repair of a fixed asset item are reflected on the basis of the relevant primary accounting documents for accounting for the accounting of operations for the release (expenditure) of material assets, the calculation of wages, debts to suppliers for repairs and other expenses. These costs are reflected in the accounting records in the debit of the corresponding accounts for accounting for production costs (sales expenses) in correspondence with the credit of the accounts for accounting for incurred costs (clause 67 of the Methodological Guidelines for Accounting of Fixed Assets, approved by Order of the Ministry of Finance of Russia on October 13, 2003 N 91n) . This fully applies to cases related to the purchase of car tires and their subsequent installation on a car to replace worn ones.

When replacing winter tires for the summer, the goal of the ongoing work is to adapt the vehicle to local climatic conditions. During the winter season, the replacement of summer tires with winter ones is a necessary condition for maintaining the performance of the car, since winter tires allow the car to move freely on icy and snowy roads. The use of winter tires summer season can lead to an emergency, because, as mentioned above, in comparison with summer ones, they reduce the directional stability, handling, and braking qualities of the car.

Therefore, the replacement of seasonal tires should be considered as maintenance of a fixed asset in order to maintain its performance. The cost of maintaining an item of fixed assets (technical inspection, maintenance) are included in maintenance costs production process and are reflected in the debit of the accounts for accounting for production costs (expenses for sale) in correspondence with the credit of the accounts for accounting for production costs (clauses 66 and 73 of the Guidelines for accounting for fixed assets).

The costs of maintaining fixed assets in good condition are related to expenses for ordinary activities (clause 7 of the Accounting Regulation "Organization's expenses" (PBU 10/99), approved by Order of the Ministry of Finance of Russia dated 06.05.1999 N 33n).

Consider three types of write-offs:

- write-off of tires during transfer to operation;

- writing off tires in proportion to their mileage;

- writing off tires using account 97 "Deferred expenses".

The first option is simpler, but when using it, proper analytical accounting of tires is required until they are completely retired.

The second option is more time-consuming, but when using it, used tires are written off to costs more evenly.

If you use the third option, then the write-off of expenses occurs evenly during the period to which they relate, in the manner that the organization itself establishes (evenly, in proportion to the volume of production, etc.) (clause 65 of the Regulations on Accounting, approved Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n).

Example 1. The Phoenix organization purchased a kit in September 2014 all season tires for auto. In the same month, the tires were put into operation to replace the worn ones. For four tires, 43,500 rubles were paid, including VAT - 6635.6 rubles.

In accounting, the entries will be as follows:

- 36,864.4 rubles. (43 500 - 6635.6) - tires were credited to the warehouse;

Debit 19 Credit 60

- 6635.6 rubles. - reflected VAT;

Debit 60 Credit 51

- 43 500 rubles. - transferred money for tires;

Debit 68 Credit 19

- 6635.6 rubles. - accepted for VAT deduction;

Debit 20 Credit 10, sub-account "Spare parts", "Tires in stock", "New tires",

- 36,864.4 rubles. - the cost of tires is included in the costs of ordinary activities.

Example 2. Let's supplement the data of example 1: the accounting policy of the organization provides for the write-off of the cost of tires evenly, in proportion to their monthly mileage. The average tire mileage is 43,000 km, K1 - 0.95 (tires are used on roads of the third category), K2 - 0.95 (the car is used on highways of national, republican and local significance), in September a car on new tires drove 3852 km.

The operating mileage standard for the Hi tire will be 38,807.5 km (43,000 km x 0.95 x 0.95). Since in September the mileage on new tires amounted to 3800 km, the organization can take into account 3609.73 rubles in expenses for ordinary activities. (36,864.4 rubles: 38,807.5 km x 3,800 km).

Installing tires on a car in accounting is accompanied by a record:

Debit 97 Credit 10, sub-account "Spare parts", "Tires in stock", "New tires",

- 36,864.4 rubles. - the cost of tires is included in the costs of future periods.

On the last day of September, a partial write-off of the cost of installed tires is carried out by wiring:

Debit 20 Credit 97

- 3609.73 rubles. - part of the cost of tires is included in the costs of ordinary activities.

Accounting for seasonal tires

Seasonal tires removed from the vehicle due to the end of the season are stored in the warehouse. They do not apply to:

- unused materials, as they were in operation;

- returnable waste, as they have not lost their consumer properties.

In both cases, materials are accounted for on account 10 (clause 112 of the Methodological Instructions for Accounting for Inventory Resources).

Since, at the end of the operating season, the tires are returned to the warehouse already partially worn out, the organization has the right to restore on account 10, the sub-account "Tires in stock", "Seasonal tires", the partial cost of purchasing automobile tires - reduced taking into account the degree of wear. With this method of accounting, the degree of wear of automobile tires can be determined in proportion to the mileage of the tire.

In order to calculate the cost of tires returned to the warehouse, it is necessary to determine the mileage of automobile tires during their actual operation. If the above-mentioned card for accounting for the operation of a car tire is maintained, then the data is taken from it. If such an organization does not maintain, then it remains to refer to the waybills issued for the car in the season, and select the required information from them. After that, the desired indicator is determined by the formula:

Svsh \u003d (Npr. w - Fpr) : Npr. w x w,

where Svsh is the cost of the tire returned to the warehouse;

N ex. w - tire mileage rate;

Fpr - actual mileage;

Ssh is the cost of the tire.

The corresponding account when posting seasonal tires depends on the option of writing off their cost when installed. If there was a one-time write-off during the transfer, then the cost accounts 20, 26, 44 are offset (that is, the production costs or sales costs of the current reporting period are reduced by the amount of car tires returned to the warehouse). If the write-off was carried out evenly, then account 97 is credited.

Example 3. The company "Mercury" in the spring of 2014 purchased a passenger car with a summer set of tires. The car is used for administrative purposes. In October of this year, a set of winter tires (5 pcs.) Was purchased for 53,100 rubles. (including VAT - 8100 rubles). In November, this rubber was installed on the car.

According to the accounting policy, the cost of summer and winter tires is written off evenly over the period of their operation. Tire operating mileage - 62,000 km, K1 - 0.95 (category of operating conditions - III), K2 - 1 (there are no special operating conditions for the car in the organization). From November to March inclusive, a car on winter tires drove 14,800 km, of which 3,500 km in March.

The mileage standard for these tires is 58,900 km (62,000 x 0.95 x 1).

When removing winter tires for March, the organization has the right to take into account in the costs of ordinary activities a part of the cost of winter tires - 2674.02 rubles. (45,000 rubles / 58,900 km x 3,500 km).

The cost of winter tires, according to which they are credited upon transfer to the warehouse, is 33,692.7 rubles. (45,000 rubles: 58,900 km x (58,900 km - 14,800 km)).

In accounting, the accountant will reflect the following entries:

in October 2014

Debit 10, sub-account "Spare parts", "Tires in stock", Credit 60

- 45,000 rubles. (53 100 - 8100) - a set of winter tires has been credited to the warehouse;

Debit 19 Credit 60

- 8100 rubles. - reflected VAT;

Debit 68 Credit 19

- 8100 rubles. - submitted VAT deductible.

November 2014

Debit 97 Credit 10, sub-account "Spare parts", "Tires in stock",

- 45,000 rubles. - tires were put into operation.

A set of summer tires removed from the car is transferred to the warehouse. But since the cost of these tires is taken into account in the initial cost of the vehicle, they are accounted for, regardless of the mileage, at zero cost.

IN last days November, December, January and February, the accounting department writes off part of the cost of winter tires to the expense account. The write-off values are determined in proportion to the monthly mileage of the car:

Debit 26 Credit 97

- deducted part of the cost of winter tires.

March 2015

Debit 26 Credit 97

- 2675.94 rubles. - part of the cost of winter tires is taken into account in expenses for ordinary activities;

Debit 10, sub-account "Spare parts", "Tires in stock", Credit 97

- 26,427.52 rubles. - reflects the cost of winter tires transferred to the warehouse.

The installation of summer tires is reflected only in analytical accounting, since its cost is included in the initial cost of the car.

tax accounting

In tax accounting, the vehicle acquired by the organization is accounted for as a single inventory item. Consequently, the cost of the tires installed on the car and the "spare wheel" is included in its initial cost (Article 257 of the Tax Code of the Russian Federation).

Car tires that are purchased separately from the car are not included in depreciable property. They are taken into account in the costs of maintaining and operating, repairing and maintaining fixed assets and other property, as well as maintaining them in good condition (clause 2, clause 1, article 253 of the Tax Code of the Russian Federation).

These operating costs (purchase of spare tires) are recognized for the purposes of calculating income tax (clause 1, article 260 of the Tax Code of the Russian Federation).

The replacement of seasonal tires is also included in the cost of maintaining property, plant and equipment. Consequently, the costs of acquiring a new set of tires are included in the material costs for the purchase of materials used to maintain fixed assets (clause 2, clause 1, article 254 of the Tax Code of the Russian Federation).

Companies using the accrual method should recognize these expenses on the date they are put into operation, that is, on the date tires are installed on the car (clause 2, article 272 of the Tax Code of the Russian Federation).

The reduced cost of seasonal tires removed from the car and transferred to the warehouse is not reflected in tax accounting.

Recall that the amount of material costs must be reduced by the cost:

- returnable waste (clause 6, article 254 of the Tax Code of the Russian Federation);

- balances of inventories transferred to production, but not used in production at the end of the month (clause 5, article 254 of the Tax Code of the Russian Federation).

At the same time, the balances of inventories are valued at the same cost at which they were included in expenses when writing off.

Tires removed from the vehicle are neither returned waste nor inventory residues.

As a result, with the option of a one-time write-off of the cost of tires when they are established, the amount of expenses taken into account in accounting when determining profits and the tax base for income tax at the time of posting the removed tires to the warehouse will differ. And this obliges the organization to refer to the norms of the Accounting Regulation "Accounting for settlements on corporate income tax" PBU 18/02 (approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n).

The resulting difference in expenses in accounting is recognized as taxable temporary, since it leads to the formation of deferred income tax, which should increase the amount of income tax payable to the budget in the next reporting or subsequent reporting periods.

Based on this difference, a deferred tax liability is formed (clauses 12, 15, 18 PBU 18/02).

A taxable temporary difference also arises if the accounting uses the straight-line write-off option for tires.

Continuation of example 2. In tax accounting, the cost of installed tires, 36,864.4 rubles, will be included in expenses that reduce income received when calculating income tax for 9 months of 2014.

The difference in the amounts of expenses taken into account in accounting and tax accounting is 33,254.67 rubles. (36 864.4 - 3609.73) - is a taxable temporary.

Based on this, the organization on the last day of September makes an additional entry:

Debit 68, sub-account "Income Tax", Credit 77

- 6650.93 rubles. (RUB 33,254.67 x 20%) - the amount of deferred tax liability has been accrued.

Starting from October, every month, when writing off a part of the cost of installed tires as expenses, the deferred tax liability will be partially repaid:

Debit 77 Credit 68, sub-account "Income Tax",

- reduced (redeemed) amount of deferred tax liability.