Exchange accounting 3.0 zup 2.5. Publications

) based on 1C 8.3, data exchange with Accounting 3.0 is very different from version 2.5. In version 2.5, the exchange took place according to the rules of exchange through an XML file at the initiative of the user. In version ZUP 3.0, we are no longer talking about exchange, but about data synchronization.

Now you don’t need to upload and download every time, you only need to set up synchronization between databases once. Moreover, it became possible to configure a synchronization schedule, without excluding forced data exchange.

So, let's look at the instructions on how to set up data synchronization between 1C ZUP 3.0 and Enterprise Accounting 3.0.

Uploading data from 1C ZUP 3.0

Let's launch the ZIK 3.0 configuration , go to the “Administration” menu and select “Data synchronization settings”.

And here many stumble upon the first “pitfall” - the flag Data synchronization not available! And the reason is simple: there are not enough rights to configure synchronization. To access the settings, it is not even enough Full rights. Only a user with the role can configure synchronization System administrator. In this case, you should contact a 1C specialist or your system administrator, or assign this role to yourself. Let's look at how to do this (those who have the checkbox available can skip the next part of the article).

To enable a role System administrator let's take advantage Configurator. IN Configurator you need to go to the menu Administration, then submenu Users and select the user who will configure the synchronization. Then in the window that opens, go to the tab Others and check the box next to the role System administrator.

Click OK and exit the configurator. Restart the ZIK 3.0 configuration and make sure that the checkbox Data synchronization now available. Let's install it.

Now you can proceed to setting up synchronization settings. To open the start setup window, click on the link Data synchronization. In the window that opens, set a prefix for numbering documents and directories (for example, “ ZK"), transferred to the Accounting Department. On the list Set up synchronization select data Enterprise Accounting, edition 3.0.

The Settings Assistant window will open. Here the program will prompt you to make a backup copy of the database before starting the settings. I advise you not to neglect this procedure. We will make the settings manually, and not from a file created in another program, which we will indicate with the appropriate selection.

Get 267 video lessons on 1C for free:

Click Further. In the next window, we indicate that we intend to connect directly to the Accounting 3.0 database and where it is located. If the database is located on the same computer or on a computer on the local network, you need to specify the path to it.

If the path is not known, you can find it as follows. We launch 1C 8.3 and select in the launch window the Information base from which the exchange will take place. At the bottom of the window the path to the database will be indicated; you need to copy it without quotes and paste it into the field Information base catalog in the synchronization settings window.

If the Infobase is located on the 1C Enterprise Server, the necessary data for the connection can also be found in the launch window.

When connecting to a database on the server, two parameters are required:

- Server cluster

- Infobase name

In the launch window, place the cursor on the name of the Infobase, and connection parameters will appear at the bottom of the window.

After you have set all the necessary parameters, press the button Check connection. If everything is correct, you should see the following picture:

Click Further. The program will check the connection again and prompt you to select Organizations, for which data should be uploaded to Accounting (link Change data upload rules), in one window and Organizations, which will be used to upload from Accounting to ZUP 3.0 (next window).

And then I came across the second pitfall. When the button is pressed Further I got this error message:

It turned out that in the configuration Enterprise accounting, with which we are going to synchronize, you also need to check the box Data synchronization. We go to the Accounting information database (again, be sure to use a user with System Administrator rights), then the Administration menu, select Data synchronization settings. Check the box Data synchronization. Accounting can be closed and returned to ZUP.

Uploading to 1C Accounting 8.3

After clicking the Next button, a window will appear asking you to perform synchronization. You can immediately press the button Ready and synchronize immediately, but I first unchecked this checkbox to find out what else the program would offer me, namely the promised exchange schedule.

Click Ready and we get to a window where you can view and change all previously made settings, as well as set up a schedule.

Setting up the schedule did not cause any particular complaints. After pressing the button Tune The settings window appears. Check the box Automatically according to schedule and follow the link to the window Schedule. After setting, click OK. The schedule can be configured for each Information base its own for both uploading and loading data.

It remains to mention one more important point. The first time you synchronize, you need to do a data mapping. This is necessary to avoid duplication of elements of reference books or documents. This is mainly true for reference books.

Setting up the exchange of 1C ZUP and BP. Uploading and loading data from 1C Salary and HR Management 2.5 to Enterprise Accounting 3.0

Setting up data exchange in the 1C program between the “Salaries and HR Management” and “Enterprise Accounting” configurations does not take much time, especially if you are a 1C specialist. Let's look at data exchange using the example of the Salary and Personnel Management version 2.5 and Enterprise Accounting version 3.0 configurations.

In the Salary and Personnel Management 2.5 program, open the program settings through the Service / Program Settings menu and go to the Accounting Program tab and select Enterprise Accounting edition 3.0 (Figure 1).

Figure 1. – Setting up uploading in 1C

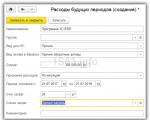

To upload data from “salary” to “accounting”, let’s go to Service / Data exchange / Uploading data to accounting program. In the window that opens, select an organization, indicate the period for uploading data and the path to the file where the data from the infobase will be written. Then click “Run” (Figure 2).

Figure 2. – Uploading data from 1C

After the data from the “salary” has been downloaded, we will load it into the “accounting” department. In the 1C Accounting 3.0 program, on the Directories and accounting settings tab, open the Accounting Parameters Settings window. There, in the Employees and Salary section, we indicate that payroll and personnel records are kept in an external program (Figure 3).

Figure 3. – Setting up accounting parameters in Accounting 3.0

Now let's go to the Employees and salary tab and in the Data exchange with ZUP section, click Loading salary data in ZUP format, ed. 2.5 (Figure 4).

Figure 4. – Data exchange with ZUP

In the window that opens, select the data file that we saved from the 1C Salary and Personnel Management program and click “Download data” (Figure 5).

I. What needs to be done in 1C: Accounting 8,” ed. 3

We will describe the sequence of actions for the Taxi interface.

1. Menu item “Main” - “Accounting parameters”. Open the “Salaries and Personnel” tab and indicate that salary calculation and personnel records are maintained in an external program.

We indicate how we want to perform the unloading - for each employee or collectively.

2. Menu item “Salaries and personnel” - “Salary accounting settings”. Check the “Use ZUP ed. exchange format” checkbox. 2.5".

3. Unload from “1C: Accounting 8”, ed. 3. in “1C: Salary and Human Resources Management”, edition 2.5 chart of accounts and necessary analytics.

To do this, go to the menu item “Salaries and Personnel” - “Upload to “Salaries and Personnel Management”, ed. 2.5

If accounting in “1C: Salary and HR Management” is not yet maintained, then enable the item “Information for uploading to a new information base.” In this case, information about the organization, accounting policies, individuals, etc. will be downloaded.

It is recommended to do the initial unloading only once. If accounting in “1C: Salary and Human Resources Management” is already maintained, then before uploading we check the identity of the organization name, INN and KPP in the programs “1C: Salary and Human Resources Management”, ed. 2.5 and “1C: Accounting 8”, ed. 3.

During further work with programs, if the analytics (or chart of accounts) in “1C: Accounting 8”, ed. 3, then we will have to make an additional upload of this analytics into “1C: Salary and HR Management”. In this case, we only select the checkboxes for the “Accounting Objects” section (or, accordingly, upload only the modified chart of accounts and subaccount types).

In the example, the upload is carried out to the file we specified.

II. What needs to be done in “1C: Salary and HR Management”, ed. 2.5

Setting up the exchange in “1C: Salary and HR Management”, ed. 2.5

1. Menu item “Service” - “Program Settings”. Opens the “Accounting Program” tab and indicate that the accounting program used is “Enterprise Accounting”, edition 3.0.

2. We set the mode we need for uploading transactions - with detail by employee or summary.

3. Load the previously downloaded data from “1C: Accounting 8”, ed. 3. To do this, go to the menu item “Service” - “Data exchange” - “Universal data exchange”. Go to the “Data Loading” tab, indicate the file into which the data was downloaded from “1C: Accounting 8”, ed. 3 and click “Load data”.

4. Now we have all the information to set up postings in “1C: Salary and Personnel Management”, ed. 2.5. Open “Payroll calculation by organizations” - “Salary accounting” - “Methods of reflecting salaries in regulated accounting”. We indicate the correspondence of invoices with analytics.

If the entire salary of employees is allocated to one account, then the posting can be linked to the organization; if the salary of different departments is allocated to different accounts, then we link different postings to the departments, etc. The point is that all accruals and deductions that are applied in the organization must be reflected in the postings. After calculating wages and taxes, we create and post the document “Reflection of wages in regulated accounting.” It creates wires. We make a report “Salary summary” and a report “Reflection of salaries in regulated accounting”. We check whether all accruals and deductions are reflected in the postings. If everything is fine, then we proceed to uploading the transactions into “1C: Accounting 8”, edition 3.

5. To do this, go to the menu item “Service” - “Data exchange” - “Uploading data into an accounting program”:

We upload the transactions to the file we specified.

III. The final stage is loading transactions into 1C: Accounting 8, ed. 3

6. Go to the menu item “Salaries and Personnel” - “Loading data in ZUP format, ed. 2.5”, indicate the path to the file for uploading transactions from “1C: Salaries and Personnel Management”, ed. 2.5 and click the “Load data” button.

After loading, documents will be generated in the “Salaries and Personnel” menu item

- “Salary (ZUP 2.5, ZIK 7.7)

- “Salary payment slip.”

To reflect the fact of payment of wages, it is necessary to generate a document “Cash expenditure order” with the type of operation “Payment of wages according to statements” or “Payment of wages to an employee” with reference to the transferred statements for payment of wages.

The 1C: Accounting 8 application supports a mode in which a local program, for example, 1C: Salaries and HR Management, is used to calculate payroll and personnel records. At the same time, data exchange is carried out through a file, similar to how the exchange is organized with the client-bank system.

Enabling payroll accounting mode in an external program

To start using this operating mode, follow these steps:

After installing the described settings, in the section Employees and salaries, commands for calling processing for unloading and loading data, as well as documents into which data will be loaded, will become available.

Uploading data into the local program "1C: Salary and HR Management"

To upload data to the payroll accounting program, follow these steps:

As a result, the exchange file will be saved to the local computer, and it can be loaded into the 1C: Salary and Personnel Management program.

In the future, when the two programs work together, it may be necessary to update data on analytical accounting objects contained in the salary accounting information base. In this case, when exchanging, it is recommended to check the boxes for sections of the item Accounting objects.

Sections Chart of accounts And Types of subconto It is recommended to include it in the transfer during the initial exchange and if changes were made to the chart of accounts of the 1C: Accounting 8 application.

Loading salary data into the 1C: Accounting 8 application

To download salary data, follow these steps:

After the file is uploaded to the service, salary data will appear in the 1C: Accounting 8 application (see the next section).

additional information

Salary data is loaded into the following documents of the 1C: Accounting 8 application:

- Reflection of salaries in accounting (for exchange in ZUP format, rev. 2.5)- information about accrued wages and withheld taxes (contributions) from the payroll is loaded into the document. When posting a document, entries are generated to record wages in accounting, and wages and taxes (contributions) from the payroll are reflected in tax accounting;

- Salary payment slip (for exchange in ZUP format, rev. 2.5)- information about salary payments is loaded into the document. To reflect the fact of salary payment in accounting and tax accounting, you should enter a document in the program Account cash warrant with the type of operation Payment of wages according to statements or Payment of wages to an employee, indicate the document Statement... and the payment amount.If the payment is made by transfer to a bank, then you must enter the document Debiting from current account with the type of operation Transfer of salaries, indicating Statement... and the payment amount.

Important! If in the accounting parameters settings on the tab Employees and salaries option selected Summary for all employees, then in the documents for salary payment ( Account cash warrant And Debiting from current account) indicate Statement... not required. In this case, when downloading data from the local program "1C: Salary and Personnel Management", you should also indicate that the download is carried out collectively by employee.

When selecting a statement in documents Account cash warrant And Debiting from current account the amount to be paid is determined automatically and cannot exceed the amount indicated in the statement (or for a group of statements, if several are specified). The amount to be paid is determined by the value of the details Payout document Statement...- i.e. Only those amounts for which the value is indicated are considered paid Paid.

In the document Account cash warrant should choose Statement... Through the cash register.

In the document Debiting from current account should choose Statement..., in which the payment method is indicated in the header Via bank.

Uploading data from the local program "1C: Salary and HR Management"

To carry out an exchange with the "1C: Accounting 8" application, in the program settings, you must first indicate with which accounting application you intend to exchange. For this, in the form Setting up the program(menu Service / Program settings), on the tab Accounting program you should indicate the accounting application used (in our case, this is Accounting 8 ed. 3.0), and also select the mode of uploading transactions - with detail by employee or summary.

If you select the upload mode in the settings Summary, then in the list of objects the item Salary payable will be missing. In this case, in the 1C: Accounting 8 application, data on payment statements is not required to reflect the fact of salary payment in accounting.

Processing is intended for downloading data Uploading data into an accounting program(menu command Service / Data exchange / Uploading data to an accounting program). In the processing, you should indicate the organization for which the upload is carried out, the period of the uploaded data and the file for uploading the data.

We wish you success and pleasant work!

In this article, we will tell you how to set up the transfer of data from the 1C: Salaries and Personnel Management 8 program to 1C: Accounting 8 when using these software products together for the first time. The setup is performed once, and subsequent transfers are carried out automatically. The accounting capabilities in 1C:Enterprise 8 have many options, so all selected options must be reflected in the data transfer settings.

The connection between the programs “1C: Accounting 8” and “1C: Salaries and Personnel Management 8” is carried out at the posting level.

For this purpose, the program provides special processing , which can operate in two modes: transfer of transactions and transfer of cash transactions.

Posting transfer mode

In the mode of transferring transactions to “1C: Accounting 8”, a document is transferred , formed in the program “1C: Salaries and Personnel Management 8”.

Treatment Uploading data into an accounting program(in “1C: Salary and Personnel Management 8”) is launched from the menu Service - Data exchange.

Before starting processing, you must specify the period - month for which transactions are uploaded, select the path and name of the upload file, and select the checkbox Reflection of wages in regulatory accounting(we’ll talk about uploading cash documents later).

Postings are uploaded once a month after salaries are calculated, contributions and taxes are calculated, and postings are generated. Or rather, you can upload and download as many times as you like, but each subsequent download replaces the previous one.

Next in the program menu “1C: Accounting 8” Service - Data exchange with Salary and Personnel Management 8 - Loading data from the “Salary and Personnel Management 8” configuration you should specify the file into which the upload was performed and click the button Execute.

But in order to prepare transactions for downloading from “1C: Salaries and Personnel Management 8”, you need to generate them, and this requires certain settings. Setting up the formation of postings in “1C: Salary and Personnel Management 8” must begin with setting up the accounting dimensions used in “1C: Accounting 8”.

To begin with, you should indicate in “1C: Accounting 8” in Setting up accounting parameters on the bookmark Settlements with personnel that payroll and personnel records are maintained In an external program. It is necessary to define the account 70 analytics: For each employee or Summary for all employees.

In the case when accounting in “1C: Accounting 8” started earlier than using “1C: Salaries and Personnel Management 8”, it makes sense to upload Information for uploading to a new information base. In the “1C: Accounting 8” menu, select Service -> Data exchange with Salary and personnel management 8 -> Uploading data into the “Salary and personnel management” configuration rev 2.5(Fig. 1).

Rice. 1

You must specify a file to upload data.

Please note that in order to be able to upload transactions and payments into 1C:Accounting 8 in the future, you need to take care of data synchronization.

Information about the organization and divisions of organizations must be absolutely identical in both programs, and if analytical accounting of settlements with personnel is carried out for each employee, then the elements of the directories must also coincide Individuals And Organization employees.

So - the initial data from “1C: Accounting 8” has been downloaded. Now they should be loaded into “1C: Salaries and Personnel Management 8”.

In the menu "1C: Salaries and personnel management 8" Service -> data exchange -> universal exchange on the tab you need to select the file specified during upload and click on the button at the top of the window Download data.

Next, you need to perform the initial settings in the menu in “1C: Salary and Personnel Management 8” Service -> Program settings on the bookmark Accounting program. It is necessary to specify the accounting program used and the upload mode. If during the operation of the system the edition of “1C: Accounting 8” was replaced (for example, from 2.0 to 3.0), you should change this setting accordingly and reformat the transactions before uploading them.

Checkbox Allow downloading of data on personal income tax and insurance premiums should be installed if you plan to generate regulated reporting (personalized by the Pension Fund and Personal Income Tax) in 1C: Accounting 8.

Moreover, in the form of processing Uploading data into an accounting program checkboxes become available Accounting data for personal income tax and insurance contributions (UST) And Social insurance benefits accounting data(Fig. 2).

Rice. 2

When checked Accounting data for personal income tax and insurance contributions (UST) In addition to postings, the following information will be additionally uploaded:

- documentation Adjustment of accounting for personal income tax, insurance premiums and unified social tax with relevant accounting data, the date of which falls within the specified period;

- data from independent information registers: Income from a previous place of employment (NDFL), Application of deductions (NDFL) and Standard deductions for individuals for personal income tax, Standard deductions for individuals for children;

- data from accumulation registers: Personal income tax information on income, personal income tax settlements with the budget, personal income tax property deductions, calculated insurance premiums, income accounting for the calculation of insurance premiums, unified social tax calculated, unified social tax information on income entered for the specified period;

- data from accumulation registers will be transferred to the document Adjustment of personal income tax accounting, insurance premiums and unified social tax. Additionally, according to movements in the personal income tax register, property deductions with the type of movement Coming a document will be created Confirmation of the right to property deduction.

Check box Social insurance benefits accounting data entails the transfer of additional documents Adjustment of accounting for personal income tax, insurance premiums and unified social tax with the corresponding accounting data, the date of which falls within the specified period and data from the registers: Earnings of recipients of child care benefits up to one and a half years old, Child care benefits up to one and a half years old And Social Security Benefits entered for the specified period.

We recommend generating regulated salary reporting in “1C: Salary and Personnel Management 8” and not loading “1C: Accounting 8” with unnecessary information (i.e., do not check the Allow downloading of data on personal income tax and insurance premiums in the program settings).

Now you need to configure the wiring. Methods of reflection in accounting can be specified for the organization as a whole, for the division, for the employee and for the type of calculation.

In this case, the data is used in the following sequence of the reflection method indicated:

- in accounting for a specific planned accrual for a specific employee;

- in accounting for a specific accrual;

- in the document Entering the distribution of the basic earnings of the organization's employees;

- in accounting for the earnings of a specific employee;

- in accounting for earnings;

- in accounting for the organization's earnings;

- in a way Reflection of accruals by default.

The method of reflecting planned accruals for specific employees is registered in the document Entering information about regulated accounting of planned accruals.

The method of reflecting the salaries of specific employees is registered in a document Accounting for the basic earnings of an organization’s employee in regulated accounting.

These two documents should be used in “exceptional” cases, that is, when you need to indicate an exception to a general rule.

Thus, the general rule for the type of calculation is indicated in the details Reflection of basic and additional accruals in accounting(Fig. 3).

Rice. 3

When choosing a method for reflecting costs in the calculation type settings, you can select either a specific transaction from the directory Ways to reflect wages in regulated accounting, or options - according to basic accruals or as of the date of the event.

Option according to basic accruals means that the accrual is reflected in accounting on the same accounts as the base accruals previously reflected in accounting, in proportion to their value.

Option as of the date of the event means that the accrual is reflected in accounting in the same way as basic earnings were reflected in accounting at the start date of the event.

The general rule for an employee is taken from the cost reflection method specified on the tab Accounting in the form of a directory element Organizational divisions, in which the employee is listed, or, if the method of reflecting costs is not indicated there, then on the tab Salary accounting in the form of a directory element Organizations.

Document Entering the distribution of the basic earnings of employees of organizations(Fig. 4) allows you to temporarily register the distribution of basic earnings across different accounts for one month. This is convenient to use to allocate a share of earnings under UTII.

Rice. 4

When filling out the method of reflecting costs in all of the above forms, use the reference book Ways to reflect wages in regulated accounting(menu Salary calculation by organization -> Salary accounting -> Methods of reflecting wages in accounting).

The directory contains predefined entries (see Fig. 5):

Rice. 5

- Reflection of accruals by default, it is used automatically by the program when, when generating accounting entries for accruals, the reflection method is not specified;

- Distribute in proportion to base accruals it makes sense to indicate only for specific accruals calculated based on the results of other accruals;

- Do not reflect in accounting It makes sense to indicate for accruals and deductions, which are recorded directly in the accounting program. The accounting does not reflect both the accruals themselves, for which this method of reflection is specified, and the taxes and contributions calculated from this accrual;

- Reflection of the share of sick leave at the expense of the employer has not been used since 2011, from the moment in the program this accrual became a separate type of accrual, where you can specify the posting.

You can fill out this reference book first when making settings, or you can add all the cost accounting options used as needed.

It is not always necessary to fill out all the details in the postings. On the contrary, more often they should be left blank.

If you do not specify a debit account or a credit account, then the account will be entered automatically if the accrual to which such posting is assigned has a calculation base, and its reflection in accounting is determined.

If you do not specify the subconto value Division on expense accounts, then they will be substituted automatically according to the department in which the employee is registered.

Subconto meaning Workers on account 70 and does not need to be specified at all - it is automatically selected based on employees whose accruals are reflected in accounting, if specified The mode of uploading transactions to the accounting program- with details on employees.

When reflecting deductions on subconto writs of execution Counterparties are selected from the props Recipient of the document.

By default, insurance contributions to extra-budgetary funds and benefits at the expense of the employer are reflected in cost accounts under the same cost item as the accruals from which the calculation was made.

To reflect insurance premiums and benefits at the expense of the employer in accounting for cost items other than accrual cost items, you need to configure the correspondence of cost items in the directory Correspondence of cost items for reflecting wages in accounting (menu Salary calculation by organization -> Salary accounting -> Correspondence of cost items for reflecting wages in regulatory accounting, see fig. 6).

Rice. 6

Compliance is described by the type of cost item, the accrual cost item and the cost item on which it is necessary to reflect insurance premiums and the share of benefits at the expense of the employer. You can set compliance for the following types of cost items:

- Insurance premiums(used to describe the procedure for recording insurance contributions for the insurance and funded parts of the pension, Social Insurance Fund, TFOMS and FFOMS);

- FSS NS(used to specify the correspondence of cost items for contributions to the Social Insurance Fund, insurance against industrial accidents and occupational diseases);

- Benefits at the expense of the employer(used previously when there was no separate type of calculation for paying benefits at the expense of the employer).

You can add other cost items. The list of cost item types is automatically supplemented with directory elements Estimated liabilities and provisions.

The procedure for setting up compliance (list of rules) is as follows: specify the type of cost item, then specify the accrual cost item that needs to be replaced and the cost item that needs to be replaced. If you do not specify an accrual cost item, then all insurance premiums related to a given type of cost item will be reflected according to the cost item specified in the column Cost item.

In conclusion, let us recall the sequence of actions when generating transactions:

Perform settings in the programs “1C: Salaries and HR Management 8” and “1C: Accounting 8”;

Make sure that the objects used during unloading in both programs match exactly;

Verify that when generating transactions, all accrued amounts are taken into account using the Analysis of accruals to employees of organizations report and comparing the data in the report Summary of accrued salaries of organizations with the indicator for account 70 from the report Reflection of salaries in regulated accounting;

Generate an upload file in “1C: Salary and Personnel Management 8”;

Upload the generated file to 1C:Accounting 8.

Cash transaction transfer mode

In mode Transferring cash transactions treatment Uploading data into an accounting program(see Fig. 2 above) allows you to transfer cash and bank documents.

If transactions, as mentioned earlier, make sense to transfer only at the end of the month, then cash transactions need to be transferred regularly as they occur.

To transfer cash transactions, check the box Cash documents and specify the upload option All documents or Escrow only.

List of uploaded documents for the option All documents depends on the accounting settings Salary payment.

If not selected Simplified accounting of mutual settlements, the following documents will be uploaded:

- Receipt cash order;

- Account cash warrant;

- Outgoing payment order;

- Deposit of organizations;

For option Escrow only The following documents will be uploaded:

- Salary payable to the organization;

- Deposit of organizations;

- Write-off of depositors to the income of organizations.

Simplified accounting of mutual settlements implies that payment documents are not created Expenditure cash order, Payment order, which means they will not be unloaded.

If documents are entered for the specified upload period Account cash warrant with the type of operation Payment of wages to an employee, then in this case it is not possible to download summary data, and it is recommended to either download detailed data or cancel posting of documents Account cash warrant with the specified type of operation.

When unloading cash documents, it is necessary to monitor the unloading period and approve the document numbering regulations for ease of interaction with 1C: Accounting 8. So, for example, you can agree that the number of the next cash document is always assigned in the 1C: Accounting 8 program.

Further options are possible depending on the accountant’s ability to access the 1C: Accounting 8 information database. Either he sets the number in “1C: Accounting 8” independently, or this is done by the responsible accountant, who sends electronic messages about the next cash document. The number is then duplicated in the 1C: Salaries and Personnel Management 8 program.