Accounting for bank transactions (cash expenditure). Write-off of fixed assets Operations on write-off of fixed assets

Document “Write-off from current account”

The program provides several ways to create a document for spending funds from a current account. This document is called “Write-off from the current account” and creates accounting entries for the credit of account 51.

1. Debiting from the current account based on the Payment Order

We considered one of the ways to create such a document when creating a “Payment Order”, when on its basis the document “Write-off from a current account” is created. We considered the option of creating a document “Write-off from a current account” directly from the Payment order form. Also, “Write-off from a current account can be created from the “Payment orders” list by placing the cursor on the line of “Payment order” that interests us and select “Write-off from a current account” on the “Create based on” command.

Based on this payment order, the document “Write-off from the current account” will be created. (Fig.1).

Rice. 1

2. Debiting from the current account from the “Bank Statements” register

Using document copy mode.

If an enterprise makes bank payments without using the creation of “Payment Orders” (which most often happens), then it is more convenient to create the “Write-off from a current account” document from the “Bank Statements” register. In this case, we will have the opportunity to create a “Write-off from a current account” document by copying a similar document. To do this, place the cursor on the document we are copying, right-click to call up the mode for selecting available commands, select the “Copy” command or use the “F9” key. (Fig.2)

Rice. 2

The document created by copying will have automatically filled in details: name of the counterparty, agreement with the counterparty, purpose of payment, item “Flow of funds”, selected VAT rate, Settlement accounts, “Type of transaction” and more. (Fig. 3)

Rice. 3

In the created document “Debit from the current account” we have to either agree with the automatically filled in details or change them. Most often, only the payment amount and payment purpose are subject to change.

We will carry out further actions with the document “Write-off from the current account” created by copying, having previously changed the payment amount in it. Let's use the "Pass" command. Let's check the transactions created by the posted document by clicking the command "Dt-Kt". (Fig. 4 and Fig. 5)

Rice. 4

Rice. 5

Let's take a closer look at the document “Document movement: Debiting from the current account...”. This document gives us the opportunity to correct accounting entries manually. To do this, use the “Manual adjustment (allows editing of document movements)” mode. We mark this mode with a “bird”. After this, we can make changes to the document details: if necessary, we change the accounting entries from Dt60.02 - Kt51 to Dt60.01 - Kt51, we can also change the “Cash Flow” item. We leave the rest of the details as they are. If we want to cancel the changes and return the original settings of the document, we need to uncheck the checkbox and post the document. (Fig.6)

Fig.6

There are not many documents in which accounting entries have been changed manually, so they are marked in a special way in the “Bank Statements” document register. (Fig. 7).

Rice. 7

Creating a document “Write-off from current account”

All types of transactions that entail the debiting of funds from a current account have been reviewed by us in the “Payment orders” section. The document “Write-off from the current account” has the same details as the program document “Payment orders”. A new document “Write-off from the current account” is created from the “Bank statements” register by using the “Write-off” command. View of the new document in Fig. 8, list of “Types of operation” in Fig. 9:

Rice. 9

Both the type of document and the list of “types of transactions” are already familiar to us from the instructions for working with “Payment orders”. Now the document “Write-off from the current account” is an independent document, it directly creates accounting entries for the credit of account 51 “Current account” and makes an entry in the document register “Bank statements”, which is the main document for accounting for banking operations. Let's repeat the accounting entries created by the document “Write-off from the current account”:

- Payment to the supplier: Dt 60.02 - Kt51 or Dt60.01 - Kt51, depending on whether the payment is for goods and materials (services) already received or an advance paid;

- Return to the buyer: Dt62.01 - Kt51 - return of funds to the buyer for an advance previously received from him;

- payment of tax: according to Debit, the corresponding account and subaccount for accounting for taxes and payments equivalent to them (accounts 68 and 69) - credit account 51;

- Repayment of the loan to the counterparty: Dt (66.03 or 67.03) - Kt51;

- Repayment of a loan to the bank: if the loan received from the bank is short-term (repayment period up to 1 year), then the accounting entry Dt66.01 - Kt51; if the loan is long-term (repayment period over 1 year), then accounting entry Dt67.01 - Kt51;

- Issuance of a loan to the counterparty: Dt58.03 - Kt51;

- Other settlements with counterparties: Dt76.05 (or Dt60.01) - Kr51;

- Cash withdrawal: Dt50 - Kr51;

- Transfer to the accountable person: Dt71.01 - Kt51;

- Transfer of wages according to the statement: Dt70 - Kt51;

- Transfer of wages to the employee: Dt70 - Kt51;

- Transfer to an employee under a contract: Dt70 - Kt51;

- Transfer of deposited wages: Dt70 - Kt51; On account 70 “Payroll calculations” you can use various subaccounts, including for accounting for deposited wages and payment of contract agreements;

- Issuing a loan to an employee: Dt73.01 - Kt51;

- Other write-off: the document provides the opportunity to independently indicate the Debit account to which the company will transfer funds: Dt... - Kr51.

At the end of our consideration of the issue of reflecting current account transactions in the 1C program, let’s take a closer look at the main document for recording transactions with banks - the “Bank Statements” register (or document journal). Rice. 10

Rice. 10

The Bank Statements register contains a lot of information. One line in it corresponds to one document “Receipt” or “Write-off”. The documents “Receipt to the current account” and “Write off from the current account” may indicate several payments on the same day with one counterparty.

Receipts of funds into the current account and their expenditure are indicated in different columns “Receipt” and “Write-off”, which is visually convenient. The date of the documents reflected in the register is indicated. The “Purpose of payment” column reflects the contents of the “Purpose of payment” field of the Receipt or Write-off documents. In the columns “Counterparty”, “Type of operation”, “Input”. number", "In. date”, “Comment”, the corresponding fields from the documents “Receipt to the current account” and “Write off from the current account” are reflected. Using the “Form Settings” command from the “More” command group, you can add the “Responsible” and “Currency” columns to the registry.

In the lower right corner information about the daily status of the current account is indicated: balances at the beginning and end of the day, receipts and expenditures of funds during the day. This information can be shown (or hidden) using the “Show/Hide Totals” command from the “More” command group.

Let's look at the commands from the command line of the "Bank Statements" registry. The “Receipt” and “Write-off” commands are intended for creating new documents “Receipt to the current account” and “Write-off from the current account”. The search command - “Find”, corresponds to its name. The “Register of Documents” team prepares a form for printing documents from the “Bank Statements” registry. The “Create based on” command suggests creating the following types of documents based on the document on which the cursor is placed: “Payment order”, “Invoice received” or “Invoice issued” (Fig. 11)

Rice. eleven

The “Download” command prompts you to select a text file to download bank statements (used for working with a large array of daily payments and subject to using the “Client-Bank” program). The “Dt Kr” command is used to check accounting entries created by the documents “Receipt to the current account” or “Write off from the current account” and reflecting the business transaction carried out by the enterprise to receive or write off funds from the current account.

In addition to the commands we listed above on the toolbar, the “Bank Statements” registry can use other commands specified in the “More” command group. Some of the commands specified in this group were described by us earlier, in addition, the following commands are used (Fig. 12):

Rice. 12

- “Copy” or “F9”;

- “Change” or “F2” - opens the specified document in order to change it;

- “Mark for deletion / Unmark” - the command carries out the operation “Mark a document for deletion” while simultaneously canceling the posting of the document (if it was previously posted). Why can’t I immediately delete a document? The 1C program does not allow the user to immediately delete unnecessary documents. The user can only mark them for deletion. Deletion of marked documents is carried out in a special mode by the responsible person of the enterprise (for example, the chief accountant). This procedure for deleting objects in the 1C program provides additional security for the enterprise database from unauthorized (accidental and thoughtless) actions of employees;

- “Refresh” or “F5” - updates data on the interface;

- “Set period” - sets the period for reflecting documents in the register;

- “Post” and “Cancel posting” - carries out or cancels the posting of the current document, that is, the document on which the cursor is placed;

- “Customize the list” - allows you to customize the “Bank statements” register using various options, for example, coloring lines with certain conditions in different colors;

- “Set default settings” - restores the original settings, canceling all changes;

- “Output List” - prepares the register of documents “Bank Statements” for display on the screen in the form of a table in an “Excel” document and for printing;

- “Linked documents” - indicates those documents that are in one way or another related to the document on which the cursor is placed;

- “Show/hide totals” - shows or hides information about the daily status of the current account;

- “Change form” - in user mode changes the form of the “Bank statements” registry. Allows you to add (subtract) columns with information used in the registry, add (subtract) commands from the command line, and more.

Columns with information about completed monetary transactions can be sorted in ascending or descending order. For example, the “Date” column can be ordered either in ascending order of the dates of payments reflected in the register, or in descending order. In Fig. Figure 10 shows the “Date” column arranged in ascending order of dates. In Fig. Column 13 “Date” is sorted in descending order of dates. Changing the ordering order is carried out by double-clicking on the “Date” field.

Rice. 13

The ability to organize data is also available for other columns of the “Bank Statements” register. You can arrange the columns “Receipt”, “Write-off”, “Input number”. For ordering, the numerical expression indicated in the column is used. So in the columns “Receipt” and “Write-off” the ordering occurs in ascending or descending order of the payment amount. The columns “Purpose of payment”, “Counterparty”, “Type of transaction” are ordered by the first letter and alphabetically. The ordering mode for the corresponding column is activated by double-clicking in the column name field.

In Fig. Figure 14 shows an example of organizing the information contained in the “Counterparties” column. The ordering occurs alphabetically (the first letter is “A”) according to the first letter of the counterparty’s name.

Rice. 14

For operations of issuing cash from a current account and crediting cash to an account, the processing of bank transactions has its own characteristics. This is due to the fact that the above transactions are simultaneously reflected both in transactions on the current account and in transactions on the cash desk of the enterprise. In order to avoid duplication of accounting entries, the 1C company decided in all its software products related to accounting to register these transactions only with cash documents: “Cash receipt order” - for the receipt of cash from the current account to the cash desk of the enterprise and “Cash expenditure order” for the issuance of cash from the cash register and crediting to the bank account of the enterprise’s cash. Thus, in order for transactions with cash to be correctly recorded in the document journal “Bank Statements”, the corresponding cash documents must be entered into the cash transactions journal.

Let's consider an example of creating a document for writing off cash from a current account to the cash desk of an enterprise (Fig. 15). And let’s check the postings created by this document. (Fig. 16).

Fig.15

Rice. 16

The program will tell us that it refuses to make accounting entries for this document and will suggest that we turn to accounting for cash transactions.

A similar operation with the program’s refusal to record accounting entries is carried out when cash is deposited from the enterprise’s cash desk to the current account: the document “Receipt to the current account” with the transaction type “Cash Deposit”.

For the eighth year now, significant changes in the use of account 97 “Deferred expenses” have been in effect in Russian accounting/RAS. Their main reason was the convergence of RAS standards with international financial reporting standards/IFRS. Despite the significant nature of the changes - the removal of future expenses from the balance sheet, the reclassification of assets on the account into accounts receivable for expenses of the current period - the use of the account continues, which means that automation of business transactions using it remains relevant.

To display RBP transactions in 1C Enterprise Accounting, edition 3.0, the following objects are provided:

- Account 97 on the chart of accounts;

- Directory “Deferred Expenses”/BPR;

- Document “Receipts (acts, invoices)”;

- Regulatory operation “Write-off of deferred expenses”;

- Report “Calculation of write-off of future expenses for the period”;

- “Subconto Card” report and other standard accounting reports.

The accounting chart of accounts is available from the “Main” section of the main interface of the system:

Active account 97 reflects information about expenses that occurred in a given reporting period, but relate to future reporting periods.

We will pay special attention to other expenses that are reflected in subaccount 97.21.

Analytical accounting on the account is carried out using the subconto “Deferred expenses” by type of expense. A directory is used as subconto elements.

The RBP directory is available from the section of the same name in the main interface of the accounting system:

It has a hierarchical structure of groups and elements. Each type of expense can be separated into a group of elements of the “RBP” directory, and each expense is its final element.

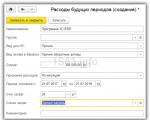

The RBP element card in 1C Accounting 8.3 contains the necessary details that allow you to display assets in the balance sheet and write them off as expenses for the current period.

After excluding a separate line for BPR from the balance sheet, this type of asset can be reflected in different lines, therefore, for the correct classification of BPR in the balance sheet lines, the attribute “Type of asset in the balance sheet” is used. Its values are fixed in the configuration; the user can select one of the predefined types:

Depending on the rule for recognizing expenses in accounting, one or another recognition method is selected:

The method affects the calculation of the amount of write-off of the RBP for the current expenses of the reporting month. Uniform write-off occurs according to the “By months” rule; a more detailed calculation by the number of days of the month is available for the “By calendar days” rule; for manual write-offs, the “In a special order” rule is applied.

To indicate the number of months or calculate the days of write-off of the RBP, the element card contains the “Period” attribute. It indicates how long it will take to write off future expenses in 1C for current expenses.

The cost account and expense item must be completed for the system to correctly write off future expenses.

RBP in 1C is displayed by the debit of account 97 at the time of its receipt. To do this, use the document “Receipts (acts, invoices)”, which is available from the “Purchases” section of the main interface of the accounting system:

The document is universal and has several types of operations. Each type of operation is applicable for a separate category of accounting objects. To register the receipt of BPO, the type of transaction “Services (act)” is used.

Filling out the document does not have any significant features. When creating, the basic rules for working with documents in 1C Accounting 8.3 are taken into account.

As a nomenclature, you can use the service element “BPO Object” and decipher it below in the content. A link to the directory object “RBP” is available after going to “Accounts”:

The created document allows you to post deferred expenses on account 97. The document generates the following movements in accounting entries:

So, the BPO is registered as an asset of the enterprise. Further operations on deferred expenses are associated with the write-off of RBP in 1C.

Write-off of RBP for expenses of the current period is issued monthly using a special regulatory operation. For convenience, all routine operations are combined in one block and placed in the “Month Closing” workplace. The workplace is accessible from the “Operations” section of the main system interface. In addition, a routine operation for writing off a BPO can be created from the list of all closing operations.

Operations on the desktop for monthly closing can be launched automatically, in order, by clicking the “Run month closing” button. If the operation is completed, it is reflected on the desktop in green font.

It is also possible to run operations individually. For each operation, after right-clicking on it, a context-sensitive menu is available. The menu contains all possible actions with the selected routine operation.

For the completed operation, you can view transactions and generate a report, which is required by BPO accounting.

The postings reflect the accounting of expenses of the current period and the closing of part of the BPR amount.

The calculation help allows you to see:

- Current expenses write-off/accounting account to which RBP are written off;

- Analysis of write-off/accounting of current expenses, to which RBP are written off;

- Start/end date of write-off of RBP;

- Remaining number of write-offs – the number of months (days) remaining from the beginning of the current month until the end date of the write-off;

- Number of months in the current period (days in the current month). Relevant only for RBPs for which the write-off procedure is established By calendar days;

- Balance at the beginning - the balance recorded under the specified BPR item at the beginning of the current month;

- Closing balance – the balance recorded under the specified BPR item at the end of the current month;

- The amount of write-off of the RBP written off as expenses of the current month when performing a routine operation.

In addition to the calculation certificate, you can generate standard accounting reports with selection by accounts or subaccounts. Reports are available from the section of the same name in the main interface of the accounting system:

We looked at all the objects in 1C Accounting 8.3, which allow you to maintain full accounting of BPO.

We talked about in what cases the disposal of fixed assets (fixed assets) occurs and how this is documented. We will talk about typical accounting entries that are made when disposing of fixed assets in this material.

General rules for accounting for disposal of fixed assets

The Chart of Accounts and the Instructions for its application stipulate that, regardless of the reason for the disposal of fixed assets, a separate sub-account can be opened to account 01 “Fixed Assets” (). In our consultation, we will use subaccount 01/B for these purposes. At the time of disposal, the initial (replacement) cost of the fixed assets, which was listed for the object in account 01, is written off to this sub-account at the time of disposal. The following accounting entry is generated:

Debit account 01/B - Credit account 01

Debit of account 02 “Depreciation of fixed assets” - Credit of account 01/B

As a result of this posting, a residual value is formed on account 01 (or subaccount 01/B, if used) for the disposed asset, which is subsequently subject to write-off. We will consider below what accounting entries will be made.

Sale of OS object

The sale of an fixed asset involves reflecting other income from its sale, as well as other expenses in the form of the residual value of the disposed fixed asset and expenses associated with the sale (clause 31 PBU 6/01, clause 7 PBU 9/99, clause 11 PBU 10 /99, Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Free transfer

When transferring an asset free of charge, the entries are similar to the entries for its sale with only one difference: income, of course, will not be reflected. VAT, in the general case, will be charged on the market value of the asset (clause 1, clause 1, article 146, clause 2, article 154 of the Tax Code of the Russian Federation).

Let's look at the free transfer of an OS object using an example.

The organization transfers a car to an individual free of charge. The initial cost of the fixed assets is 950,000 rubles, depreciation accrued at the time of transfer is 635,000 rubles. The market value of the car on the date of gratuitous transfer is 450,000 rubles (including VAT 68,644 rubles).

The accounting entries upon transfer will be as follows:

Termination of use due to moral or physical wear and tear

When an asset can no longer be used due to moral or physical wear and tear, it must be written off from accounting.

In this case, the residual value of the fixed assets item from account 01 or subaccount 01/B will be charged to other expenses of the organization:

Debit account 91, subaccount “Other expenses” - Credit account 01/B

Disposal of fixed assets as a result of an accident, other emergency or shortage

Similar to write-off as a result of moral or physical depreciation, disposal of fixed assets as a result of an accident, natural disaster or other emergency situation is reflected as part of other expenses.

At the same time, taking into account that when such circumstances arise, it is necessary to carry out an inventory, it is advisable to first take into account the lost object in account 94 “Shortages and losses from damage to valuables” (clause 27 of the Order of the Ministry of Finance dated July 29, 1998 No. 34n, Order of the Ministry of Finance dated October 31, 2000 No. 94n ):

Debit account 94 - Credit account 01/B

And only then, if there are no guilty parties, include it in other expenses:

Debit account 91, subaccount “Other expenses” - Credit account 94

Similarly, with the preliminary accounting of the fixed asset on account 94, its write-off is reflected as a result of a shortage identified as a result of the inventory.

Transfer of fixed assets as a contribution to the authorized capital

The transfer of fixed assets as contributions to the authorized capital is considered as a financial investment. Accordingly, the transfer is accounted for using account 58 “Financial investments” (Order of the Ministry of Finance dated October 31, 2000 No. 94n). Considering that the assessment of the non-monetary contribution to the authorized capital of the LLC is carried out by an independent appraiser, and the participants cannot approve the value of the fixed assets higher than that given by the appraiser, a difference is likely to arise between the residual value of the contributed fixed asset and the value at which this property is valued by an independent appraiser (clause 2 Article 66.2 of the Civil Code of the Russian Federation). This difference is taken into account in account 91.

In addition, a VAT payer organization, when transferring fixed assets as a contribution to the authorized capital, will have to restore the VAT previously accepted for deduction on this fixed asset. VAT is restored in proportion to the residual value of the fixed asset transferred as a contribution (clause 1, clause 3, article 170 of the Tax Code of the Russian Federation). The amount of recovered VAT by the transferring party is indicated in the documents that formalize the transfer of the fixed asset object, and is accepted for deduction from the receiving party. For the transferring party, the restored VAT is taken into account as part of financial investments.

Let's show this with an example.

The organization makes a contribution to the authorized capital of the LLC with an object of fixed assets with an initial cost of 560,000 rubles. Depreciation at the time of disposal of the object is 139,000 rubles. The cost (excluding VAT), which was determined by an independent appraiser for the transferred property, amounted to 480,000 rubles. This cost was approved by the decision of the LLC participants. The amount of VAT previously accepted for deduction on an asset was 100,800 rubles. Therefore, VAT in the amount of 75,780 rubles (100,800 * (560,000 - 139,000) / 560,000) is subject to restoration.

Here are the accounting records generated for the transaction of transferring an asset as a contribution to the authorized capital:

| Operation | Account debit | Account credit | Amount, rub. |

|---|---|---|---|

| 01/B | 01 | 560 000 | |

| 02 | 01/B | 139 000 | |

| The transferor's financial investments are reflected in the form of the cost of the fixed asset, determined by an independent appraiser and approved by the LLC participants | 58 “Financial investments”, sub-account “Units and shares” | 76 “Settlements with various debtors and creditors” | 480 000 |

| The residual value of the fixed assets transferred as a contribution was written off (560,000 - 139,000) | 76 | 01/B | 421 000 |

| VAT restored when transferring an asset as a contribution | 19 “VAT on purchased assets” | 68, subaccount “VAT” | 75 780 |

| Reinstated VAT is included in the cost of financial investments | 58, subaccount “Units and shares” | 19 | 75 780 |

| A positive difference is reflected between the residual value of the fixed asset and its agreed valuation (480,000 - 421,000) | 76 | 91, subaccount “Other income” | 59 000 |

If the difference in the assessment was negative, another expense would arise: Debit account 91, subaccount “Other expenses” - Credit account 76

Transfer of fixed assets under an exchange agreement

In the case when an asset is transferred in exchange for other property, it is necessary to reflect the sale of the asset, as well as the acquisition of other property. The receivables and payables arising from the transactions will need to be offset.

Let's give an example. An organization on OSNO transfers an OS object under an exchange agreement in exchange for goods. The initial cost of the OS is 325,000 rubles. Depreciation at the time of disposal is 86,000 rubles. The purchased goods are valued at 360,000 rubles, incl. VAT 54,915 rubles. The exchange was recognized as equal.

The accounting records of an organization transferring an asset in exchange for goods will be as follows:

| Operation | Account debit | Account credit | Amount, rub. |

|---|---|---|---|

| The original cost of a retiring fixed asset has been written off | 01/B | 01 | 325 000 |

| Depreciation of fixed assets was written off at the time of disposal | 02 | 01/B | 86 000 |

| Revenue from the transfer of an asset under an exchange agreement is reflected | 62 | 91, subaccount “Other income” | 360 000 |

| VAT charged upon transfer | 91, subaccount “VAT” | 68, subaccount “VAT” | 54 915 |

| The residual value of an asset transferred under an exchange agreement was written off (325,000 - 86,000) | 91, subaccount “Other expenses” | 01/B | 239 000 |

| Goods were capitalized under an exchange agreement (excluding VAT) (360,000 - 54,915) | 41 "Products" | 60 | 305 085 |

| Accepted for VAT accounting on goods received | 19 | 60 | 54 915 |

| Reflected offset of debt under the exchange agreement | 60 | 62 | 360 000 |

At the end of each month, the accountant performs so-called “routine month-closing operations.” One of these operations is to determine the amount of expenses for future periods to be included in the expenses of the current period. S.A. talks about how to perform these calculations using the 1C:Accounting 8 program and obtain the necessary accounting certificates based on the calculation results. Kharitonov, professor at the Financial Academy under the Government of the Russian Federation.

Expenses relating to future periods

In the process of carrying out commercial activities, organizations incur expenses that, for one reason or another, cannot be included in the expenses of the current period, both for accounting and for profit tax purposes.

In accounting, such expenses are called deferred expenses. Account 97 “Deferred expenses” is intended for their accounting. In Chapter 25 of the Tax Code of the Russian Federation “Organizational Income Tax” the term “deferred expenses” is not used, but, based on the recognition procedure for tax purposes, certain types of expenses are considered such in their essence.

The first question accountants often ask is: what expenses fall into the category of deferred expenses?

To answer this question, let us turn, first of all, to the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n. An approximate list of such expenses is contained in the characteristics of account 97 “Deferred expenses”, according to which expenses incurred in the current reporting period, but relating to future reporting periods, can be considered expenses related to:

- with mining and preparatory work;

- with preparatory work for production due to its seasonal nature;

- with the development of new production facilities, installations and units;

- with land reclamation and implementation of other environmental measures;

- with uneven repairs of fixed assets carried out throughout the year (when the organization does not create an appropriate reserve or fund), etc.

Let us immediately note that this list is not exhaustive (i.e. closed); it can be expanded and supplemented by the organization independently. For example, deferred expenses are the amounts of retained wages during the vacation period in that part that falls on the periods following the month of accrual; expenses for the acquisition of non-exclusive rights to computer programs for which a useful life period is established by an agreement with the copyright holder or by order of the manager, etc.

In recent years, accountants, when qualifying costs as expenses relating to future periods, are increasingly guided by the norms of Chapter 25 of the Tax Code of the Russian Federation. On the one hand, this makes it possible to reduce the risk of underestimating the tax base and, as a consequence, the amount of income tax payable to the budget. On the other hand, accounting for future expenses according to tax accounting rules allows you to avoid differences and reduce the complexity of accounting work. However, it should be taken into account that this approach is applicable only to those costs that are recognized as deferred expenses not only for profit tax purposes, but also for accounting purposes. For example, expenses for the development of natural resources can be taken into account as deferred expenses, but expenses for research, development and technological work that yield a positive result cannot, since in accounting such expenses are taken into account in the manner prescribed for intangible assets, with using account 04 (subaccount 2).

Accountants often make mistakes when they classify individual payments to counterparties as deferred expenses.

Typical ones include recognizing as deferred expenses the costs of paying for subscriptions to periodicals (including ITS disk), advertising in the media, annual subscription services for the provision of consulting services, Internet access, mobile communication services, etc. n. In fact, in all the cases listed above, there is a prepayment (advance payment) for the upcoming delivery of valuables and provision of services, which, in accordance with paragraph 3 of PBU 10/99, is not recognized as an expense.

The fact is that the main condition for qualifying these operations as leading to the recognition of an expense must be complete confidence that as a result of its commission there will be a decrease in the economic benefits of the organization (the third condition provided for in paragraph 16 of PBU 10/99). So, paying in advance does not mean that the organization will receive what it transferred the money for, since under certain conditions it can be returned to the payer. For example, according to clause 12 of the Rules for the distribution of periodicals by subscription (approved by Decree of the Government of the Russian Federation of November 1, 2001 No. 759), the subscriber may refuse to fulfill the subscription agreement before the transfer of the next copy (copies) of the periodical. In this case, the subscriber is paid the subscription price for the undelivered copies.

A similar procedure is provided for in paragraph 62 of the Rules for the provision of local, intrazonal, long-distance and international telephone services (approved by Decree of the Government of the Russian Federation dated May 18, 2005 No. 310), according to which the subscriber may at any time unilaterally refuse to fulfill the contract, subject to payment of actual expenses incurred. telecom operator costs.

Thus, payments for upcoming deliveries of valuables, performance of work, and provision of services should be taken into account as part of accounts receivable, and not deferred expenses.

Accounting for deferred expenses in "1C: Accounting 8"

To summarize information about the availability and movement of deferred expenses, account 97 “Deferred expenses” is intended. Its use in the 1C:Accounting 8 program has a number of features. They are due to the fact that the program simultaneously maintains accounting and tax accounting for income tax, but using different charts of accounts. In this regard, account 97 is in each of these charts of accounts, but there are differences in their setup.

In the chart of accounts, two subaccounts 97.01 and 97.21 are opened for account 97 (see Fig. 1).

Rice. 1

Subaccount 97.01 “Labor expenses for future periods” is intended to summarize information about labor costs accrued in the current reporting period, but relating to the following reporting periods (for example, vacation pay amounts). Analytical accounting in this subaccount is carried out in the context of expense items (the "Future Expenses" directory) and specific employees (the "Individuals" directory).

Subaccount 97.21 “Other deferred expenses” is intended to summarize information about all other deferred expenses. Analytical accounting in this sub-account is carried out according to items of expenses of future periods.

In the chart of accounts for tax accounting (for income tax), 6 subaccounts are opened for account 97 (Fig. 2).

The purpose of subaccounts 97.01 and 97.21 is similar to the subaccounts of the same name in the chart of accounts. The only difference is that in subaccount 97.01, analytical accounting is carried out additionally by types of accruals in accordance with Article 255 of the Tax Code of the Russian Federation (listing “Types of accruals for wages under Article 255 of the Tax Code”). The remaining subaccounts are specific. The peculiarity is that the information that is summarized on them is not reflected in accounting.

An exception is subaccount 97.02 “Future expenses for voluntary insurance of employees.”

The information summarized in this subaccount of the tax accounting chart of accounts is taken into account in accounting in subaccount 76.01.2 “Payments (contributions) for voluntary insurance of employees.”

Account 97.03 “Negative result from the sale of depreciable property” takes into account the amount of losses from operations of the sale of depreciable property, which the organization can include in expenses that reduce the tax base in future periods in the manner prescribed by Article 268 of the Tax Code of the Russian Federation.

Account 97.11 “Losses of previous years” takes into account the amounts of losses that the organization can take into account when determining the tax base in future periods in the manner prescribed by Article 283 of the Tax Code of the Russian Federation.

Account 97.12 “Losses of previous years of service industries and farms” takes into account the amounts of losses determined and accounted for in accordance with Article 275.1 of the Tax Code of the Russian Federation.

In the system of analytical accounting of future expenses by expense item, the “Future Expenses” reference book (Fig. 3) occupies an important place, so it is important to learn how to use it correctly.

Tax accounting for expenses of future periods is characterized by one more feature: for the purposes of PBU 18/02, expenses are accounted for in the context of accounting types “NU” (tax assessment of expenses), “VR” (temporary difference in the estimate of expenses) and “PR” (permanent difference in estimating consumption).

The directory is configured as hierarchical, that is, individual items can be combined into groups, which makes it easier to work with the directory when there is a large range of expense items or when working with the directory for different users.

Each expense item is described by a set of details necessary for automated write-off in various types of accounting. Let's consider their purpose in more detail.

The “Type of RBP” detail indicates the expense attribute for tax accounting purposes for income tax. The value of the attribute is selected from the list:

- development of natural resources;

- voluntary life insurance;

- insurance for medical expenses;

- insurance in case of employee death or disability;

- negative result from the sale of depreciable property;

- others.

The “Method of writing off expenses” indicates which algorithm is used to write off expenses: “By month”, “By day” or “In a special order”.

The “By Months” write-off method is based on counting the total number of write-off months. In this case, the amount of expenses to be written off in the current month is determined as the quotient of the amount of unwritten expenses divided by the remaining write-off period (in months) by the duration of the write-off in the current month (in months).

The “By Days” write-off method is based on counting the total number of days of write-off. In this case, the amount of expenses to be written off in the current month is determined as the quotient of the amount of unwritten expenses divided by the remaining write-off period (in days) by the duration of the write-off in the current month (in days).

We illustrate the difference in write-off algorithms with the following example.

Example 1

The expense of future periods in the amount of 1,000 rubles was taken into account. The period for writing off expenses is from February 15 to May 14, 2007. It is necessary to calculate the amount to be written off in each month of the period.

Write-off method "By month"

The total number of write-off months is: February (28 - 15 + 1) / 28 + March 1 + April 1 + May 14/31 = = 0.5 + 1 + 1 + 0.451613 = 2.951613.

Amount to be written off for a full month (for reference): RUB 1,000. / 2.951613 = 338.80 rub.

The amount of unwritten off deferred expenses is RUB 1,000;

- remaining write-off period - 2.951613 months;

- duration of write-off in the current month - 0.5 months;

- the amount of the RPB to be written off in the current month is: RUB 1,000. / 2.951613 months x 0.5 months = 169.40 rub.

The amount of unwritten off deferred expenses is 1,000 - 169.40 = 830.60 rubles;

- remaining write-off period - 2.451613 months;

- duration of write-off in the current month - 1 month;

- the amount of the RPB to be written off in the current month is: 830.60 rubles. / 2.451613 months x 1 month = 338.80 rub.

The amount of unwritten off deferred expenses is 1,000 - 169.40 - 338.80 = 491.80 rubles;

- remaining write-off period - 1.451613 months;

- duration of write-off in the current month - 1 month;

- the amount of the RPB to be written off in the current month is: 491.80 rubles. / 1.451613 months x 1 month = 338.80 rub.

Amount of unwritten off deferred expenses 1,000 - 169.40 - 338.80 - 338.80 = 153.00 rubles;

- remaining write-off period - 0.451613 months;

- duration of write-off in the current month - 0.451613 months;

- the amount of the RPB to be written off in the current month is: RUB 153.00. / 0.451613 months x 0.451613 months. = 153.00 rub.

Total amount of expenses written off: 169.40 + 338.80 + + 338.80 + 153.00 = 1,000 rubles.

Write-off method "By days"

Amount to be written off per day (for reference): RUB 1,000. / 89 = 11.235955 rub.

The amount of unwritten off deferred expenses is RUB 1,000;

- remaining write-off period - 89 days;

- the amount of the RPB to be written off in the current month is: RUB 1,000. / 89 days x 14 days = 157.30 rub.

The amount of unwritten off deferred expenses is 1,000 - 157.30 = 842.70 rubles;

- remaining write-off period - 75 days;

- duration of write-off in the current month - 31 days;

- the amount of the RPB to be written off in the current month is: RUB 842.70. / 75 days x 31 days = 348.32 rubles.

The amount of unwritten off deferred expenses is 1,000 - 157.30 - 348.32 = 494.38 rubles;

- remaining write-off period - 44 days;

- duration of write-off in the current month - 30 days;

- the amount of the RPB to be written off in the current month is: 494.38 rubles. / 44 days x 30 days = 337.08 rub.

The amount of unwritten off deferred expenses is 1,000 - 157.30 - 348.32 - 337.08 = 157.30 rubles;

- remaining write-off period - 14 days;

- duration of write-off in the current month - 14 days;

- the amount of the RPB to be written off in the current month is: 157.30 rubles. / 14 days x 14 days = 157.30 rub.

Total amount of expenses written off: 157.30 + 348.32 + 337.08 + 157.30 = 1,000 rubles.

It is easy to notice that with the same total amount of expenses and duration of write-off, the amounts written off in each month using different methods differ. According to the developers of the 1C:Accounting 8 program, the “By Months” write-off method is more universal, it provides the same calculation scheme if the total duration of the write-off is a multiple or non-multiple of an integer number of months, therefore it is offered by default as a method of writing off expenses when entering a new element into the "Future Expenses" directory. At the same time, please note that in relation to certain types of expenses, the Tax Code of the Russian Federation prescribes the use of only the “By day” write-off method. In particular, in this order it is necessary to write off the costs of compulsory and voluntary insurance, since this is directly established in paragraph 6 of Article 272 of the Tax Code of the Russian Federation.

The write-off method “In a special order” is intended only for predetermined expense items called “RBP for wages”, “RBP for unified social tax”, “RBP for insurance contributions for compulsory pension insurance of the Pension Fund of the Russian Federation” and “RBP for contributions to the Social Insurance Fund from accidents” at work and occupational diseases", as well as for such deferred expenses that the accountant wants to write off manually. Moreover, all these predefined elements are intended exclusively for use of the 1C: Accounting 8 program in conjunction with the 1C: Salary and Personnel Management 8 program.

The “Amount” attribute indicates the amount of expense for future periods, and the “Beginning of write-off” and “End of write-off” details indicate the duration of the write-off of the expense.

To automatically generate transactions in the details "Account BU" and "Account NU", "Subconto 1 (BU)", "Subconto 2 (BU)", "Subconto 3 (BU)" and "Subconto 1 (NU)", "Subconto 2 (NU)", "Subconto 3 (NU)" (in the "Analytics" group of details) indicate the account and analytical characteristics for writing off expenses of future periods, respectively, in accounting and tax accounting.

There are peculiarities in using the reference book “Future Expenses” for analytical accounting on subaccounts 97.03, 97.11 and 97.12 of the tax accounting chart of accounts. They are due to the fact that losses, information about which is summarized in these sub-accounts, are not reflected in a special way in accounting. In this regard, the fields with information about the account and write-off analytics for accounting purposes for such a directory element are not filled in.

In addition, when reflecting losses on the debit of subaccounts 97.03, 97.11 and 97.12, it is necessary to enter two entries: one for the accounting type “NU”, the second for the same amount, but with a minus sign and for the accounting type “BP”. These entries must be entered before performing income tax calculations using the document “Month Closing” in order for the program to reflect the deferred tax asset in the accounting records by posting to the debit of account 09 “Deferred tax assets” and the credit of account 68.04.2 " Calculation of income tax."

Performing calculations and preparing certificates

Monthly calculations and write-offs of deferred expenses in the 1C: Accounting 8 program are carried out automatically using the “Month Closing” document. At the same time, in order to write off expenses accounted for in subaccount 97.21 of the chart of accounts of accounting (in subaccounts 97.03 and 97.21 of the chart of accounts of tax accounting for income tax), it is necessary to select the checkboxes in the columns "BU" and "NU" for the action "Write off deferred expenses" , and to write off future expenses for voluntary insurance (from subaccount 76.01.2 of the chart of accounts for accounting and subaccount 97.02 of the chart of accounts for tax accounting) - check the boxes for the action "Calculation of insurance expenses".

All transactions subject to accounting and tax accounting must be documented. When making calculations, such documents are an accountant’s certificate, which can be drawn up, among other things, in the form of a calculation certificate. To draw up a calculation certificate for writing off deferred expenses, you must open the “Print” submenu at the bottom of the document form and select the “Write off deferred expenses” item.

The calculation certificate explains how the amount of expenses for future periods written off in the current period was calculated, and how the expenses were written off in the accounting records.

In particular, the calculation certificate presented in Figure 4 justifies the calculations for writing off deferred expenses for February 2007 in relation to example 1 discussed above.

The calculation certificate is prepared separately for accounting purposes, tax accounting for income tax, as well as for the purposes of PBU 18/02. The selection of output data is made in the form of setting up report parameters, opened by clicking the "Settings" button on the toolbar (Fig. 5).

Example 2

In February 2007, the organization carried out repairs of fixed assets using its own production for repairs. The cost of production according to accounting data is 10,000 rubles. According to tax accounting data, the cost of production is 9,000 rubles.

The difference in assessment represents a temporary difference in the amount of RUB 600. and a permanent difference in the amount of 400 rubles.

According to the manager's order, repair costs are to be included in expenses for 6 months, starting in March 2007.

Figure 6 shows the Certificate of calculation of write-off of deferred expenses for March 2007, containing data for the purposes of PBU 18/02.

Rice. 6It can be seen that in addition to tax accounting data, the certificate includes data on calculations for temporary and permanent differences in the assessment of expenses.

The program saves the completed calculations in special registers, so you can create certificates based on the calculation results not only at the time of directly working with the “Month Closing” document, but also later by selecting the appropriate item in the “Certificates-Calculations” submenu of the “Reports” menu of the main menu of the program.

Amount Debit Credit Name of transaction 80,000 91/2 01/2 The residual value of fixed assets intended for sale is written off 50,000 62 (76) 91/1 Proceeds from its sale are accrued 9000 91/2 68 VAT is accrued on the sold fixed assets If the fixed asset is transferred to another enterprise as a contribution to the authorized capital, then instead of account 62 (76) account 58 “Financial investments” is used, entry D58 K01. When donating an object, the residual value from account 01 is transferred to the debit of account 91 by posting D91/2 K01/2, and all other expenses for the gratuitous transfer of the object are collected under credit account 91.2, including VAT calculated from the market value of a similar object.

In this case there will be no income. The financial result from the gratuitous transfer is a loss that is written off by posting D99 K91/9.

Disposal of fixed assets (entries, examples)

We will consider below what accounting entries will be made. Sale of an asset The sale of an asset involves reflecting other income from its sale, as well as other expenses in the form of the residual value of the disposed asset and expenses associated with the sale (clause

31 PBU 6/01, clause 7 PBU 9/99, clause 11 PBU 10/99, Order of the Ministry of Finance dated October 31, 2000 No. 94n).

The procedure for writing off fixed assets in 2018

Finally, a corresponding note is made on the object’s inventory card. Disposal of fixed assets (write-off due to wear and tear) If an object is physically or morally worn out and is not suitable for further use, then it must be written off, that is, deregistered.

Attention

The object is written off at its residual value as other expenses of the enterprise. Postings upon disposal of a fixed asset when it is written off (physical or moral wear and tear): Debit Credit Name of transaction 01/2 01/1 The original cost of the object is written off 02 01/2 The accrued depreciation on this object is written off 91/2 01/2 The residual value of the fixed asset is written off assets Disposal of fixed assets (upon sale) The sale of an asset is registered through account 91 “Other income and expenses”, the debit account 91 collects all expenses associated with the sale, and the credit collects income in the form of revenue.

Write-off of fixed assets with residual value

- 5 Postings for disposal of fixed assets in case of emergency

- 6 Write-off of fixed assets in 1C 8.3

Transactions for the sale of fixed assets When selling property accounted for as an fixed assets object, the following operations are performed:

- Write-off of the initial price

- Reflection of proceeds received from the sale

- Accounting for VAT on the sale of an asset

Postings: How is the write-off of an asset reflected in cases of complete wear and tear?

When writing off an operating system in cases of wear and tear, the following operations are performed:

- Write-off of the initial price

- Write-off of depreciation

- Write-off from depreciated assets

Postings for write-off of fixed assets: Dt Kt Essence of the transaction Amount Primary document 01.09 01.01 Reflected initial price 450 Certificate of write-off of fixed assets 02.01 01.09 Reflected depreciation 120 91.01 01.09 Reflected amount after depreciation 330.

Disposal of fixed assets: postings

- The object is used in the activities of a business entity.

- The period of its use must exceed 12 months.

- There are no plans to resell the property.

- The object is capable of generating income.

If the initial cost of the object is equal to 40,000 or less, and the simultaneous fulfillment of the above conditions, the asset can be recognized as an inventory (clause 5 of PBU 6/01). How is the disposal of fixed assets carried out in accounting? The procedure governing the disposal of fixed assets is reflected in Part.

5 PBU 6/01. In accordance with this norm, disposal may be due to the following reasons:

- implementation;

- wear and tear: moral or physical;

- liquidation: due to an accident, natural disaster, etc.;

- other reasons given in paragraph.

Disposal of fixed assets in accounting (nuances)

Instruction 1 The main document confirming the write-off of fixed assets is the act of write-off of fixed assets (form No. OS-4). It is compiled in two copies. The first copy is transferred to the accounting department, where further accounting will take place on its basis, the second copy - to the person with whom the agreement on liability has been concluded.

Based on the write-off act, the accounting department makes a note on the inventory card about the write-off of the liquidated item. 2 When writing off incompletely depreciated fixed assets, the write-off act will be the main supporting document, since the unamortized (residual) value of the property will be reflected as the taxable profit of the organization. Income and expenses from the write-off of fixed assets are charged to the accounts of non-operating income and expenses in the period in which they were received.

How to write off a fixed asset with a residual value

Home → Accounting consultations → Fixed assets Current as of: September 5, 2017 We talked about in what cases the disposal of fixed assets (FPE) occurs and how this is documented, we talked about in our consultation.

We will talk about typical accounting entries that are made when disposing of fixed assets in this material. General rules for accounting for the disposal of fixed assets The chart of accounts and the Instructions for its application stipulate that, regardless of the reason for the disposal of fixed assets, a separate sub-account can be opened to account 01 “Fixed assets” (Order of the Ministry of Finance dated October 31, 2000 No. 94n) to account for the disposal of fixed assets. .

In our consultation, we will use subaccount 01/B for these purposes. At the time of disposal, the initial (replacement) cost of the fixed assets, which was listed for the object on account 01, is written off to this subaccount at the time of disposal.

Postings for write-off of fixed assets

PBU 6/01. Any disposal of fixed assets must be supported by the following documents:

- OS-4 (excluding cars);

- OS-4a (for cars);

- OS-4b (for the OS group, excluding motor transport).

In accordance with the order of the Ministry of Finance of the Russian Federation “On approval of the Chart of Accounts and Instructions for its application” dated October 31, 2000 No. 94n, a sub-account “Disposal of fixed assets” is opened to reflect operations on the disposal of fixed assets to account 01 “Fixed Assets”. This allows you to form the residual value of the disposed fixed asset in a separate subaccount, and then reflect it in expenses on account 91 “Other income and expenses.”

For documents that need to be used to justify the disposal of fixed assets, see the material “Documentation of write-off of fixed assets.”

How to write off fixed assets from the balance sheet? instructions, wiring

Add to favoritesSend by email Accounting for the disposal of fixed assets is maintained by all entities that have the specified type of assets on their balance sheet. We will talk about how accounting for the disposal of fixed assets is carried out, as well as about the features of tax accounting for such operations in our material.

What is the main tool? How is the disposal of fixed assets carried out in accounting? What are the features of tax accounting for the disposal of fixed assets? Summary What is a fixed asset? Fixed assets (FA) are non-current assets, the existence of which is possible if the following conditions are simultaneously met (clause.

Accounting entries for write-off transactions of fixed assets

Let's consider the main nuances of accounting for the write-off (disposal) of fixed assets, cases of write-off of fixed assets, primary documents and what transactions are made in this case. The main nuances of writing off a fixed asset In addition to the depreciation of a fixed asset, other cases of its write-off can be distinguished:

- Sales to other organizations;

- Donation, exchange;

- Theft or embezzlement;

- Contribution to the authorized capital;

- Liquidation due to emergency situations:

Important! Any operation to write off a fixed asset must have a documentary justification:

- Management order, which establishes the composition of the inventory commission.

- The act of writing off the operating system, which indicates the reasons for this action.

It is not a write-off of a fixed asset when it is moved within one enterprise (between structural divisions).

How to write off fixed assets

- If the stolen object is found, then it needs to be restored in accounting; we restore both the original value on account 01 and the accrued depreciation on account 02. Postings: Debit Credit Transaction name 01 94 The residual value of the stolen object has been restored 01 02 The accrued depreciation has been restored Next, let's move on to topic: Accounting for the lease of fixed assets.

Download sample forms for accounting for fixed assets at an enterprise: Form OS-1. Filling out the act of acceptance and transfer of fixed assetsForm OS-1a.

Filling out the building acceptance certificateForm OS-2. Invoice for internal movement of fixed assetsForm OS-3. Certificate of acceptance and delivery of OS after repairForm OS-4. We fill out the act on write-off of fixed assetsForm OS-4A.

Vehicle write-off certificate Form OS-6. Inventory cardForm OS-6B. Inventory bookForm OS-14.

Return of previously stolen fixed assets

The sequence of entries characterizing the write-off from the balance sheet of fixed assets that have become unusable due to wear and tear can be traced in the table: Disposal of fixed assets Dr Kt Characteristics of a business transaction 01 “Disposal” 01.1 The amount of the original cost of the object is written off 02 01 “Disposal” The depreciation accumulated over the entire period is written off 91.2 01 “Disposal” Expenses for the liquidation of property have been taken into account. The compiled entries fully show how to write off fixed assets from the balance sheet. If a positive liquidation value is formed, its value is credited to account 91.1.

Sale of property No one prohibits an enterprise from selling assets on legal terms. To collect information about expenses and income that resulted from the process of selling property to another individual or legal entity, account 91 is used. Amounts of costs are accumulated in the debit, and revenues are accumulated in the credit.

Any NFA object of an organization may become unusable due to material or physical wear and tear, breakdowns and other factors. It makes no sense to continue to account for unusable fixed assets on the balance sheet. Therefore, such objects must be written off. However, not all non-financial assets of a budgetary institution can be removed from accounting according to the standard procedure for writing off fixed assets. At the same time, for some types of objects you will have to obtain special permission from the owner or founder.

Types of budget property

The owner of non-financial assets of public sector institutions is the state. According to paragraph 9 of Art. 9.2 of Law No. 7-FZ of January 12, 1996, fixed assets of budgetary institutions are assigned to them with the right of operational management. The following types of budget property are distinguished:

|

Right of disposal |

|

|---|---|

|

Real estate |

|

|

Any buildings, structures, premises, etc. |

Operations on this type of OS without the official consent of the owner are unacceptable |

|

Movable |

|

|

Particularly valuable property transferred or assigned by the founder to a budgetary institution, as well as purchased with subsidies |

To carry out transactions using OCI data, the consent of the owner is required |

|

Particularly valuable property acquired by a budgetary institution at the expense of its own income from business and other activities |

The BU has the right to independently dispose of this OCI Exceptions in which the consent of the founder is required:

|

|

Other movable |

An exhaustive list of OCI, as well as the procedure for defining an OS as an OCI, is determined by the owner - founder of the budgetary institution. OCI are objects without which the implementation of the main activities of a state institution becomes impossible or difficult.

How to write off fixed assets from the balance sheet

Situations in which write-off from accounting is required:

- complete or partial loss of useful properties of an object, in which the OS cannot function properly;

- physical loss or damage to an object, these include: breakage, destruction, damage, loss;

- moral or technical obsolescence of the OS, in which the modernization of property is economically unjustified.

The end of the useful life of an asset is not a basis for writing it off from accounting.

The organization must create a permanent commission that is authorized to make decisions on similar issues.

The composition of the special commission should be fixed by a separate order of the head of the government agency or defined in the accounting policy.

When writing off fixed assets, the documentation looks like this:

- The minutes of the meeting of the standing committee are approved, which determines the key points of the disposal of fixed assets from the register.

- Based on the protocol, the manager creates a separate order - an order for operations with fixed assets.

- An act of writing off fixed assets from accounting is drawn up. OKUD act form 0504104 for OS, except transport, and 0504105 - for deregistration of transport. An organization can develop and approve its own forms of acts.

When writing off particularly valuable or real estate property, it is required to obtain the consent of the founder. In order for the owner to make a decision, in addition to the commission’s conclusion, it is necessary to collect a complete package of documents that confirms the material or physical wear and tear (loss) of the object. An exhaustive list of supporting documentation is established by the founder.

Postings for write-off of fixed assets for public sector employees

|

Operation |

||

|---|---|---|

|

Accumulated depreciation on a retired asset is written off |

||

|

The residual value of the fixed asset was written off for the following reasons: |

||

|

In case of shortage or destruction |

||

|

During natural disasters |

||

|

Other reasons |

||

|

Materials generated after dismantling (disassembly) of the PF were capitalized |

||

|

The costs incurred to write off the object are reflected |

The need to write off balance sheet items sooner or later arises for any institution. It may be associated, for example, with physical wear and tear of objects, loss of consumer qualities, damage or theft, or the consequences of natural disasters. The write-off of fixed assets in budgetary institutions is regulated by the state and is under special control. The procedure begins with the decision of the permanent commission on the receipt and disposal of assets in accordance with the requirements of clause 34 of the Instruction of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n.

Commission for write-off of fixed assets

The decision to write off fixed assets is documented in a protocol signed by the chairman, secretary and members of the commission participating in the meeting. The approved protocol serves as the basis for drawing up a Write-off Act in the prescribed form (depending on the type of property being written off) in accordance with Appendix No. 1 to Order No. 52n of the Ministry of Finance of the Russian Federation dated March 30, 2015. Then they create a package of documents according to the list, which is approved by the federal executive body.

The meeting will be legal only if there is a quorum, which is at least two-thirds of the members (clause 7 of the regulation of the Government of the Russian Federation of October 14, 2010

The decision to write off federal property is made by a majority of votes present at the meeting by signing an act (clause 9 of the post of the Government of the Russian Federation of October 14, 2010 No. 834).

Organizations are responsible for failure to provide or improper provision of information about federal property or provision of unreliable and (or) incomplete information about it to the Federal Agency for State Property Management and (or) territorial bodies (clause 51 of the Decree of the Government of the Russian Federation of July 16, 2007 No. 447) .

Minutes of the meeting of the commission on write-off of fixed assets

The form is not unified and is approved by the head of the institution as an annex to the order, which establishes the procedure by which federal (regional, municipal) property is written off.

The protocol may contain the following details:

- name of the institution;

- Title of the document;

- Document Number;

- Date of preparation;

- place of compilation (address of the commission's location);

- composition of participants indicating which of them was present;

- meeting agenda (list of property that needs to be written off);

- who was listened to and what was considered (which objects need to be written off, inventory numbers, year of manufacture, state of inspection, period of use, technical condition, economic feasibility of repairs, conclusion of a technical examination);

- what they decided;

- voting results;

- signatures of participants.

Sample protocol for write-off of fixed assets

An example of filling out the protocol of the commission for writing off fixed assets

As a visual illustration, let’s fill out the protocol step by step.

Step 1. Fill in the details of the institution. It is advisable to indicate not only the full name without abbreviations, but also INN, KPP, OKPO.

Step 2. Fill in the name and number of the document, for example, “Minutes No. 1 of the meeting of the commission on writing off fixed assets,” and also indicate the date of preparation.

Step 3. Fill in the place of origin (address of the commission’s location).

Step 4. Fill in the list of participants in the “Attending the meeting” section. It is required to indicate your full name and position in the organization, as well as your role in the commission.

Step 5. We indicate the agenda of the meeting, for example, “Consideration of the issue of writing off fixed assets of the institution.”

Step 6. Fill out the “Listen” section. It is required to indicate the details of the speakers (name and position) and the topics of the reports with a list of objects for disposal.

Step 7. Fill out the “Resolved” section. It is necessary to provide a description of the objects that have been decided to be written off, including the inventory number and book value. For example, “CDK device” manufactured in 2000, inv. No. 0001, manager No. D 000/1, book value RUB 117,000.00.”

Step 8. We fill out the section with information about the voting results and the section with the signatures of the participants (each person signs in the space provided for this).

The completed document will look like this.

Detailed information about write-offs

Write-off of fixed assets (fixed assets) is a process during which an item of fixed assets is written off from the organization’s balance sheet. Write-offs must be carried out in a strictly established manner. A special commission must be created to conduct a technical examination and draw up an act of writing off a fixed asset. Technical expertise determines the current condition of the device and provides an opinion on the possibility or advisability of its restoration or further use.

If it is determined that further use of the device is impossible due to its complete moral or physical wear and tear, impracticality or impossibility of repair, obsolescence, etc., a defect inspection report, on the basis of which it is possible to make further write-off of fixed assets. The main reasons for write-off are the failure of a fixed asset that is not suitable for further use.

Based on the act of decommissioning of equipment, a corresponding note about its disposal is entered into the inventory card.

Inventory cards for fixed assets disposed of in accordance with write-off acts are stored for a period established by the management of the organization, but not less than five years from the date of write-off of fixed assets.

Why write off the operating system from the balance sheet of the enterprise

Fixed assets on the balance sheet of your organization, such as office equipment, furniture and other equipment, are subject to property tax. If fixed assets are obsolete and no longer generate income for the organization, if they are damaged, and repairs are impractical or impossible for some reason, then it is necessary to write them off the balance sheet in order to stop paying taxes.

It is not necessary to wait until the end of the depreciation period to carry out this procedure, as indicated by the accounting provision “Accounting for fixed assets” PBU 6/01:

V. Disposal of fixed assets

29. The cost of an item of fixed assets that is being retired or is not capable of bringing economic benefits (income) to the organization in the future is subject to write-off from accounting.

In order to write off, you will need to compile a list of defects. A commission of the organization itself can draw it up, but if such a commission or specialists with the necessary qualifications are not at your disposal, then you need to involve a specialized third-party organization.

It is the list of defects that serves as the basis for writing off the organization’s fixed assets from accounting.

Who needs an act on write-off of fixed assets

Due to the fact that during operation any product suffers wear and tear and obsolescence, write-off of fixed assets may be required by any company that keeps records of fixed assets.

The reasons for write-off can also include the sale of fixed assets to a third party (write-off with residual value), transfer on a gratuitous basis, leasing and others.

Write-offs in budgetary organizations are carried out in agreement with its owner, who may be represented by property relations bodies (Rosimushchestvo). The procedure for writing off municipal property is also established by these bodies.

Based on this procedure, managers of fixed assets of budgetary organizations determine the procedure for maintaining document flow for the write-off of federal property.

The write-off of the property of a budgetary institution, as well as documentation for this process, is agreed upon with the main manager of budget funds, with the property relations authorities in the event that an item of fixed assets is transferred or sold to third parties.

Write-off procedure

The disposal of fixed assets (write-off) is determined by the accounting regulations “Accounting for fixed assets” 6/01 (clause 29):

The cost of an item of fixed assets that is being retired or is not capable of bringing economic benefits (income) to the organization in the future is subject to write-off from accounting.

According to the same paragraph, write-off of fixed assets occurs in the following cases:

sales

termination of use due to moral or physical wear and tear

liquidation in case of an accident, natural disaster and other emergency situation

transfers in the form of a contribution to the authorized (share) capital of another organization, mutual fund

transfers under an agreement of exchange, gift

making contributions under a joint venture agreement

identifying shortages or damage to assets during their inventory

partial liquidation during reconstruction work

in other cases

Write-off in organizations

In cases where an organization performs a write-off on its own, it needs to create a commission, which should include: the chairman of the commission, the chief accountant, the person financially responsible for the safety of fixed assets

If necessary, an order must be drawn up to create such a commission.

The commission inspects fixed assets, indicates the reasons for their liquidation, determines whether there is a possibility of additional use or whether such a possibility is no longer available.

If the organization does not have specialists with the required qualifications, it is necessary to involve a third-party organization that issues a write-off certificate (defect detection certificate). If the unsuitability of a fixed asset item is confirmed by the commission, the head of the organization issues an order to write off the fixed assets. A write-off act is issued.

The reason for write-off can be not only physical, but also moral wear and tear, this should also be taken into account. When an enterprise registers an asset, its depreciation is calculated annually. And then, when writing off, the final amount of accumulated depreciation for this object is taken into account.

Physical wear and tear of property

- depreciation of property associated with a decrease in its performance as a result of both natural physical aging and the influence of external unfavorable factors.

Obsolescence— partial loss of use value by fixed assets due to the reduction in the cost of their reproduction or due to lower productivity compared to new ones

The write-off act is drawn up in form No. OS-4 and drawn up in 2 copies. It is signed by the members of the commission and approved by the head of the organization or an authorized person. The first copy is drawn up for the accountant, and the second for the person financially responsible for the safety of fixed assets.

The document must indicate the reason for the write-off, the condition of the object (i.e. date of manufacture, period of use, original cost of acquisition, amount of accrued depreciation).

Next, an order can be generated for write-off (this is an internal document and is not mandatory). There is no established form for such an order; it can be issued in any form. After this, write-off information (date of write-off and number of the asset write-off act) is entered into the object’s inventory card.

If the use or resale of a written-off fixed asset is still possible, it is accounted for using invoice No. M-11 (for parts remaining from the fixed asset) or act No. M-35 (for materials).

In government institutions, documents for making a final decision on write-off are sent to Rosimushchestvo (Federal Agency for State Property Management), which exercises the powers of the owner in relation to fixed assets in federal ownership.

If the cost of an asset is less than 3,000 rubles, there is no need to coordinate the write-off with the Federal Property Management Agency.

If the cost is from 3,000 rubles to 200,000 rubles, write-off approval is required.

In this case, it is necessary to send to the Federal Property Management Agency: a letter attaching a list of fixed assets, write-off acts, copies of inventory cards, a copy of the report on the technical condition, a copy of the order to create a commission, a letter from the federal executive body that has jurisdiction over the federal budgetary institution

If the cost is over 200,000 rubles, then an extract from the federal property register (about entering the property into the register) must be added to the documents.

Home — Articles

Disposal of fixed assets - document flow

Cessation of use of a fixed asset due to moral or physical wear and tear, liquidation during an accident, partial liquidation during reconstruction are special cases of disposal of fixed assets.