Inv 11 in 1s 8.2 where to find. We take into account future expenses correctly

Deferred expenses in 1C Accounting 8.3 mean those expenses that we incurred in the past or reporting periods, but they will be included in the cost of goods or services we produce in the future. Simply put, we bought it now, and we will have income in the future.

For example, we bought the 1C:ERP program. This program will allow us to reduce the labor costs of employees (dispatchers, technologists, storekeepers). Thus, we will not have to subsequently increase our staff. We will also be able to optimize production costs and workload of production workshops. The program will also allow us to make plans correctly, which will undoubtedly affect the company’s revenue in a positive direction.

Expenses for the purchase of software can be classified as deferred expenses in accordance with the second paragraph of paragraph 39 of PBU 14/2007.

Deferred expenses can be written off daily, monthly, lump sum and in any other way at your discretion.

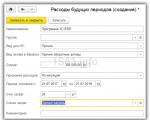

The first step is to add our purchase of the program to 1C 8.3. To do this, open the “Future Expenses” directory. It is located in the "Directories" section.

We will indicate “1C:ERP Program” as the name. In the fields “Type for NU” and “Type of asset in the balance sheet” we will leave the default values. In the “Amount” field we indicate the cost of the program we purchased – 360,000 rubles.

We will recognize expenses month by month throughout the year, starting from the current date. As a cost item in this example, it is most correct to indicate account 26 - “General business expenses”. The cost item will be “Other expenses”.

There is nothing difficult in filling out this directory. Click on the “Save and Close” button.

Receipt of deferred expenses

We will process the purchase of the 1C:ERP program through the document “Receipt (invoice acts”). It is located in the "Purchases" menu.

In the document list form that opens, click on the “Receipt” button and select the “Services (act)” item.

We will not describe in detail how to fill out the header of the document. You can read about this in. The counterparty will be 1C-RARUS SMB MOSCOW LLC.

Let's take a closer look at the tabular part. Add a line to it and select the appropriate service from the directory. If you haven't created it yet, then create it. Next, in the tabular section, indicate the quantity and price. To keep the example simple, we will not pay VAT.

The most important thing for proper accounting of the purchase of a 1C program is to correctly set up accounting accounts. Follow the hyperlink in the corresponding column of the table.

In the settings window that opens, specify 97.21 as accounting and tax accounts. In the “Future expenses” fields, select the directory element of the same name that we created earlier. The cost division is optional, but we will fill it out anyway. Additional analytics won't hurt us.

Next, click on the “OK” button and post the document. The image below shows the movements of the generated receipt document. As you can see, not only the accounts we need were substituted in the postings, but also subaccounts.

Write-off of deferred expenses

Write-off of RBP in 1C 8.3 Accounting is carried out at the close of the month. In this example, the program purchase amount classified as deferred expenses should be written off monthly during the year.

For the purposes of our task, we will not consider all the operations performed by month end processing. We will only be interested in the item “Write off deferred expenses”.

This transaction will be displayed in the month closing assistant only when there are such expenses intended for write-off in the current month. When creating the directory element “Future expenses” at the very beginning, we indicated the beginning of the write-off period – 07/21/2017. Consequently, the transaction to write off deferred expenses will appear only at the close of July 2017.

The generated movements are reflected in the figure below. In the first month - July, a smaller amount was written off due to the fact that we made the purchase only on the 21st. All expenses will be written off within a year.

So we’ll enter: “Domain in the “ru” zone.”

- For tax accounting purposes, we will indicate “Other”.

- Type of asset in the balance sheet: “Other current inventories.”

- Field "Amount": is indicated for informational purposes only. The write-off amount is calculated according to the algorithm indicated below and based on the remaining amount to be written off according to accounting data. We will indicate here the domain purchase amount – 2600 rubles. in a year.

- In the write-off parameters, we will indicate the frequency. For example, “By month”.

- Let the cost account be 26.

- Cost item – “Other expenses”.

- All that remains is to indicate the period for which the expenses should be completely written off. Let's say we plan to launch and make our website popular in 4 months.

Reflection of future expenses in 1C accounting 8.3 (3.0)

To launch the assistant, click the Perform month closing button, after which the 1C Accounting 3.0 (8.3) program sequentially performs all the necessary operations to close the month: If any errors are detected in accounting, the 1C 8.3 program will issue an information message about the content of the error and the document in which it is done: also a way to quickly open a document and correct it: Typical errors in 1C 8.3 Accounting 3.0, how to find and correct them during the month-end closing procedure are discussed in our article. After correcting errors in accounting, you must once again close the month in 1C 8.3.

Inventory of deferred expenses inv-11 for bp 3.0

Login / Registration Evgeny Belozerskikh Qualification: Programmer-Consultant Author of the development Evgeny Belozerskikh

- Age: 32 years

- 1C experience: 8 years

Contacts Show Configuration: Enterprise Accounting 3.0 Platform version: 8.3 Cost, rub: Free Processing file: Download Report “Unified Form INV-11 for inventory of deferred expenses”, configuration “Enterprise Accounting ed.

Inventory of deferred expenses inv-11

It is more convenient to make it short and informative, so that it is easier to use the quick search in the program. And the full name is the name of the item from the receipt document.

Both of these names may coincide (then select the name from the receipt document): It is very important for the integrity of accounting in 1C 8.3 Accounting 3.0 to create one card for one type of item. That is why, when creating a new type of product/service, it is more correct to use standard/established names, or those accepted at the enterprise.

Also, special attention should be paid to such a parameter as Item Type, since it is this that is used to set up automated accounting entries in 1C 8.3 and to correctly reflect purchased/sold goods, works or services in accounting: After filling out the item card, save the data and transfer it to document, click the Save and close button.

Deferred expenses in 1s 8.3 accounting

- 1 On what account are deferred expenses accounted for in 1C 8.3

- 2 Where are deferred expenses reflected in 1C 8.3

- 3 How to reflect deferred expenses in 1C 8.3 - step by step

- 3.1 Step 1

- 3.2 Step 2

- 3.3 Step 3

- 3.4 Step 4

- 3.5 Step 5

- 3.6 Step 6

- 3.7 Step 7

- 3.8 Step 8

- 4 Write-off of deferred expenses in 1C 8.3

- 4.1 Help-calculation of write-off of deferred expenses in 1C 8.3

- 5 Regulatory framework

In which account are deferred expenses accounted for in 1C 8.3? All deferred expenses are accounted for in account 97 in accordance with the instructions for using the chart of accounts.

8.x inventory of rbp

Courses 1C 8.3 and 8.2 » Training 1C Accounting 3.0 (8.3) » Closing the month » Deferred expenses in 1C 8.3 Deferred expenses (hereinafter referred to as FPR) are expenses that were incurred in the current period and relate to future reporting periods. Let's study step by step, using an example, how to post deferred expenses in 1C 8.3 Accounting 3.0.

What are deferred expenses? For example, the acquisition of software in which the exclusive rights of the organization are not transferred (1C programs, Consultant Plus, Garant, etc.).

Developments for 1c

This can be done in several ways:

- Drag each RBP card into the group by holding down the left mouse cursor:

- By selecting several cards with the left mouse button while holding down the Ctrl button and dragging them to the required group:

- Selecting several cards with the left mouse button with the Ctrl button pressed, calling up the context menu, select Move to group and select the required group:

We select a group of future expenses: Step 3 After this operation, it is better to change the viewing mode of the directory to the Tree view so that you can see the BPO in the group Software and other BPO cards: The composition of the group Software is reflected: Or other BPO cards: Step 4 Next, create a new one card of future expenses in 1C 8.3: Enter the data in the Name and Group field: After this, we begin to fill out the BPO card.

Future expenses in 1s 8.3

We can see the same information in the 1C 8.3 program: Go to Account Description: In 1C 8.3 the account description is displayed: Where deferred expenses are reflected in 1C 8.3 In the 1C 8.3 Accounting 3.0 program, a special reference book has been created to reflect certain BPOs: In this reference book cards of already created BPOs are stored, and there is also the opportunity to:

- Create a new type of RBP;

- Group existing cards into “folders” (groups);

- Or find the required RBP:

How to reflect deferred expenses in 1C 8.3 - step by step Step 1 For example, let’s create a card of this type of BBP as “1C Basic Enterprise Accounting Program” and place it and other software products in the Software group. To do this, we will create the Software group: Step 2 After this, we will transfer the BPOs already in the list to this group.

Future expenses in 1s 8.3, inventory, write-off, accounting

To do this, in the receipt document, click the Add button and fill out the item card that opens: The name of the item in the 1C 8.3 program is used to search for goods/services. It is more convenient to make it short and informative, so that it is easier to use the quick search in the program.

And the full name is the name of the item from the receipt document. Both of these names may coincide (then select the name from the receipt document): It is very important for the integrity of accounting in 1C 8.3 Accounting 3.0 to create one card for one type of item.

That is why, when creating a new type of product/service, it is more correct to use standard/established names, or those accepted at the enterprise.

Inventory of deferred expenses inv-11 for bp 3.0

In the “Future expenses” fields, select the directory element of the same name that we created earlier. The cost division is optional, but we will fill it out anyway.

Additional analytics won't hurt us. Next, click on the “OK” button and post the document. The image below shows the movements of the generated receipt document.

Important

As you can see, not only the accounts we need were substituted in the postings, but also subaccounts. Write-off of deferred expenses Write-off of RBP in 1C 8.3 Accounting is carried out at the close of the month.

In this example, the program purchase amount classified as deferred expenses should be written off monthly during the year.

Reflection of future expenses in 1C accounting 8.3 (3.0)

Deferred expenses in 1C Accounting 8.3 mean those expenses that we incurred in the past or reporting periods, but they will be included in the cost of goods or services we produce in the future. Simply put, we bought it now, and we will have income in the future. For example, we bought the 1C:ERP program. This program will allow us to reduce the labor costs of employees (dispatchers, technologists, storekeepers). Thus, we will not have to subsequently increase our staff.

We will also be able to optimize production costs and workload of production workshops. The program will also allow us to make plans correctly, which will undoubtedly affect the company’s revenue in a positive direction.

Expenses for the purchase of software can be classified as deferred expenses in accordance with the second paragraph of paragraph 39 of PBU 14/2007.

Inventory of deferred expenses inv-11

Brief instructions for connecting a report To connect a report, you need to use the command “Print forms, reports and processing” - “Additional reports and processing” in the “Administration” section on the navigation panel. Next, in the form of a list of additional reports and processing, use the “Create” button.

Attention

A recording form will open with a dialog for selecting an external report file. Select a file. Then you need to specify the sections in which the report will be available.

In the “Quick access” column, indicate the users who need this report. Finally, click the “Save and Close” button. After recording, the report can be launched by selecting the command<Выбранный — «Отчеты» — «Дополнительные отчеты».

Deferred expenses in 1s 8.3 accounting

We will indicate the start date of write-off and the end date accordingly. Get 267 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

Now you can click the “Record and close” button and proceed to registering the accounting of deferred expenses: Registration of deferred expenses in 1C 8.3 We do the registration using the document “Receipt of goods and services” on the “Services” tab. Go to the “Purchases” menu, then click the “Receipt of goods and services” link.

Click the “Receipt” button and select “Receipt of services”. We fill out the header of the document as usual upon admission (described more than once).

There shouldn't be any questions here. Let's move on to filling out the tabular part. Let's add a new line, select an item, indicate the quantity and amount.

8.x inventory of rbp

Deferred expenses can be written off daily, monthly, lump sum and in any other way at your discretion. Content

- 1 Directory “Deferred Expenses”

- 2 Receipt of deferred expenses

- 3 Write-off of deferred expenses

Directory “Future Expenses” The first step is to add our purchase of the program to 1C 8.3.

To do this, open the “Future Expenses” directory. It is located in the "Directories" section. We will indicate “1C:ERP Program” as the name. In the fields “Type for NU” and “Type of asset in the balance sheet” we will leave the default values. In the “Amount” field we indicate the cost of the program we purchased – 360,000 rubles. We will recognize expenses month by month throughout the year, starting from the current date. As a cost item in this example, it is most correct to indicate account 26 - “General business expenses”.

Future expenses in 1s 8.3

See the service in 1C 8.2 (8.3) in our video lesson: Step 7 In the document Receipt of services: Act, we see the purchased RBP, indicate its quantity. And in order to correctly reflect the price, you should pay attention to the upper right corner of the document: Depending on what receipt document is on hand (the price is “with VAT”, or “Without VAT, or “Including VAT”) and depends on the choice:

- If the price of the purchased GWS in the document is already indicated with VAT, then you must select VAT in the amount in the Document Prices parameters so that the 1C 8.3 program does not re-charge VAT on the cost of the GWS.

- If in the receipt document the prices are indicated without VAT, but the supplier and your organization are VAT payers, then you must select VAT on top so that the 1C 8.3 program will automatically charge VAT on the cost of the goods and materials.

- If we purchase goods without VAT, then there is no need to go to the Document Prices.

Write-off of deferred expenses is carried out in three ways:

- monthly, within a certain date range;

- daily (meaning calendar days), within a certain date range;

- in an arbitrary (special) way. As a rule, this means a one-time write-off.

These settings are specified in the reference book of the same name “Future Expenses”. Let’s start our acquaintance with taking into account future expenses with this reference book and filling it out. Entering a new object and setting up the write-off of future expenses Let's go to the directory. Let's go to the "Directories" menu, then to the "Deferred expenses" submenu. In the list of directory elements, click the “Create” button. The setup form will open. Let's fill in the following details of Form 1C:

- Name. Let's say we purchased a domain in the “ru” zone.

So we’ll enter: “Domain in the “ru” zone.”

- For tax accounting purposes, we will indicate “Other”.

- Type of asset in the balance sheet: “Other current inventories.”

- Field "Amount": is indicated for informational purposes only. The write-off amount is calculated according to the algorithm indicated below and based on the remaining amount to be written off according to accounting data.

We will indicate here the domain purchase amount – 2600 rubles. in a year.

- In the write-off parameters, we will indicate the frequency. For example, “By month”.

- Let the cost account be 26.

- Cost item – “Other expenses”.

- All that remains is to indicate the period for which the expenses should be completely written off. Let's say we plan to launch and make our website popular in 4 months.

How to correctly fill out the INV-11 form for each column? Gr. 4 = initial amount of RBP;Gr. 7 = gr. 4 / gr. 6 = gr. 11;Gr. 8 = written off by RBP before January 1 of the current year, i.e. amount of written-off RBP for 2015; Gr. 9 = gr. 4 - gr. 8;Gr. 10 = gr. 8 / gr. 7;Gr. 12 = gr. 11 x gr. 10 (number of months: full or incomplete); Gr. 13 = gr. 4 - gr. 8 = gr. 9

There are no detailed instructions for filling out the INV-11 form.

Column 4= RBP;

In column 5 - if the expenses are one-time, the date of actual expenses is indicated;

Gr. 7 = gr.4/gr.6 x gr.10;

Gr. 8 = Gr.7 = if the inventory for 2015 is written off by the RBP before January 1 of the current year, i.e. the amount of written-off RBPs for 2015.

Gr. 9 = gr. 4 - gr. 8;

Gr. 10 is the number of months from the date the expenses were incurred (Wrong -8 / gr. 7;)

For example, the date of RBP according to gr. 5 -01.0 8 .2015 , inventory for 2015 (i.e., the date of the inventory was 2016), then gr. 10 = 12- 7 =5,

If the date of the RDP according to gr. 5 -01.0 4 .2014 , inv. for 201 5 g., then gr. 10 = 24 -3 =21;

Gr.11 = gr. 4/gr.6;

Gr.12= if inventory is for the year, then true = gr. 1 x gr. 10 (full)

For example, the BPR date is 08/16/2015, inv. for 2015, then Gr. 12 = gr. 11 x gr. 10 = 5 x gr.10

Gr. 13 =gr.4 –gr.9.

You can see a sample of filling out INV-11 in the Forms section and below. Using the sample, you can check the calculation of the graph.

How many copies

Two copies. One copy is transferred to the accounting department, the second remains with the commission

Who fills it out

Inventory commission.

Who signs

Chairman and members of the inventory commission.

When is it issued?

When inventorying deferred expenses. During such an inventory, the following is established:

– reliability of the amounts reflected in account 97 “Deferred expenses” as of the date of the inventory;

– the correctness of writing off amounts for expenses during the period established by the order of the manager.

The act is filled out on the inventory date.

Based on what documents

Order to conduct an inventory.

Why do you need accounting?

If, during the inventory, underwritten or overwritten expenses are identified, act No. INV-11 indicates the amounts that need to be written off or expenses that need to be restored. Then, based on this act, appropriate adjustments are made to the accounting.

Since 2011, there have been changes in accounting legislation, which also affected the procedure for accounting for future expenses. A.V. talks about what exactly has changed in the legislation and how these changes are reflected in the 1C: Accounting 8 program. Yarvelyan (SiData LLC, St. Petersburg).

Since 2011, there have been changes in accounting legislation that affected, in particular, the procedure for recording expenses that occurred in one billing period, but related to several. Such expenses in accounting are usually referred to as “deferred expenses” (hereinafter referred to as FPR).

An innovation associated with the legislative changes described above is the asset type attribute. Its meaning is to determine which line of the balance sheet this expense should be included in. This attribute can take the following values:

|

Meaning |

Balance line in which the BPR will be reflected |

Balance section |

|

Fixed assets |

1150 “Fixed assets” |

Section I “Non-current assets” |

|

Fixed assets |

1190 “Other non-current assets” |

Section I “Non-current assets” |

|

1210 "Stocks" |

Section II "Current assets" |

|

|

Accounts receivable |

1230 “Accounts receivable” |

Section II "Current assets" |

|

Current assets |

1260 “Other current assets” |

Section II "Current assets" |

The type of asset must be filled in at the time of balance sheet formation for all BPOs that have a debit balance on accounts 97 at the end of the reporting period.

If the type of asset is not filled in for a certain RBP, it will be included in line 1260 “Other current assets” of the balance sheet.

For accounting and write-off of RBP, this detail is not important. Changes in legislation did not affect the procedure for recognizing and writing off RBP, which remained the same in the program.

This, in particular, means that if, before generating reports, there is a need to somehow redefine the types of assets for recognized BPR, the values of the corresponding details can be changed without reposting either the receipt documents or the write-off transactions of the BPR.

Since since 2011, organizations have the right to independently decipher the necessary balance sheet lines, the report form Balance sheet by default contains only main lines. String decryption can be configured using a special form Setting up decoding of individual balance sheet indicators. In this way, you can configure the display of the assets and amounts of the RBP - see fig. 2.

Rice. 2

You can also decipher the amount for each line of the balance using the button Decipher on the top command bar of the report.

When generating and automatically filling out the balance sheet (regulated report Accounting statements since 2011), the program makes it possible to decipher the values of balance indicators (see Fig. 3).

Rice. 3

In order to check the correctness of filling out the type of asset in the BPR directory and analyze how these expenses will be displayed on the balance sheet, you can use a standard accounting report Subconto analysis, having previously configured it as follows:

1. Specify as the type of subconto Future expenses;

2. Specify as the first grouping Future expenses. Type of asset;

3. Specify as the second grouping Future expenses.

Other report parameters can be configured as needed. As a result, we obtain a picture that fully reflects the distribution of RBP between balance sheet assets, with a breakdown for each RBP (see Fig. 4).

Rice. 4

In a similar way, you can set up the balance sheet for account 97.

From the editor

About the procedure for reflecting future expenses in “1C: Accounting 8” in the case when expenses are taken into account at the time of payment and at the time of their occurrence, read in the reference book “Organizational Income Tax” in the “Taxes and Contributions” section on ITS: