Unique accrual identifier 20 25 characters. UIN in payment orders: sample

Where to indicate the UIN in a payment order in 2019? Where can I get the UIN? What happens if you do not indicate the UIN code on the payment? You will find answers to these and other questions in this article.

Where to indicate the UIN

UIN is a Unique Accrual Identifier. This identifier is represented as a code that consists of 20 or 25 digits.

The UIN must be indicated in payment orders for the transfer of taxes and contributions. To reflect the UIN code, field “22” of the payment order is intended, which is called “Code” (clause 1.21.1 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P).

In what cases should you indicate the UIN?

In 2019, the UIN must be indicated only in payment orders for payment of arrears, penalties or fines at the request of the Federal Tax Service, Pension Fund or Social Insurance Fund.

That is, to indicate the UIN, organization or individual entrepreneur in the payment:

- first they must receive from the Federal Tax Service, Pension Fund or Social Insurance Fund an official request for payment of arrears, penalties or fines;

- find the UIN code in this requirement;

- transfer it to your payment card in field 22 “Code”.

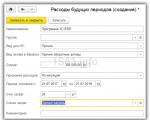

The UIN field can be found at the bottom of the payment order:

Accordingly, to the question “where can I get the UIN?” there is only one answer - in the request for payment received from the regulatory authorities. There is no single UIN for taxes or contributions. In each specific case the code is unique.

What to indicate in field 22

Fill in field 22 of the payment order as follows:

- if the request contains a UIN – the value of the UIN;

- if the request does not contain UIN – “0”.

If you indicate the UIN number in field 22, then the recipients of the funds (for example, tax authorities), upon receiving the payment, will immediately identify that it is an arrear, penalty or fine upon request. And they will take it into account correctly.

Read also Early payment of personal income tax is possible

If you make a mistake in the UIN

Using the UIN number, taxes, insurance contributions and other payments to the budget are automatically recorded. Information about payments to the budget is transmitted to the GIS GMP. This is the State Information System about State and Municipal Payments. If you specify the wrong code, the system will not identify the payment. And the obligation to pay will be considered unfulfilled. And as a consequence of this:

- the company will incur debt to the budget and funds;

- continue to accrue penalties;

- you will need to clarify the payment and find out its “fate”;

- the money will arrive to the budget or funds with a delay.

UIN and current payments

When paying current taxes, fees, and insurance premiums calculated by payers independently, the UIN is not established. Accordingly, there is no need to indicate it in field 22. Received current payments are identified by tax authorities or funds by TIN, KPP, KBK, OKTMO (OKATO) and other payment details. A UIN is not needed for this.

Also, the UIN does not need to be indicated on the payment slip when paying arrears (penalties, fines), which you calculated yourself and did not receive any requirements from the Federal Tax Service, Pension Fund or Social Insurance Fund.

When paying all current payments, in field 22 “Code” it is enough to indicate the value “0” (FSS Letter No. 17-03-11/14-2337 dated 02/21/2014). There is no need to use quotation marks. Just enter - 0.

If, when transferring current payments in field 22, you indicate “0”, then banks are obliged to execute such orders and do not have the right to require filling out the “Code” field if the payer’s TIN is indicated (letter of the Federal Tax Service of Russia dated 04/08/2016 No. ZN-4-1/6133 ). At the same time, do not leave field 22 completely empty. The bank will not accept such a payment.

Since 2014, a new code has appeared in payment documents that entrepreneurs draw up to transfer payments to the budget, which is called UIN.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

This number is used only for payments to government agencies. Its main role is to determine payments in the budget, and will not allow the system to get stuck on unknown revenues.

Important aspects

The UIN must be specified in orders for sending tax payments and contributions. It is similar to KBK, but they are different codes. They are entered in different fields.

This code is assigned to a payment that is made by an established body to the recipient and is intended for the convenience of transferring payments to the state budget.

It is written down in the receipt or request that is sent to the taxpayer. Transfers with the prescription of UIN coding made it possible to reduce errors when crediting payments to the state budget.

It is much easier for government agencies to control payments using this code, INN/KPP or BCC of the company. After all, the state system will immediately determine the payment.

A unique number is written in line 22 when sending fines, arrears, penalties to the tax inspectorates, the Pension Fund of the Russian Federation or the Federal Social Insurance Fund of the Russian Federation.

When paying current tax payments, you should enter 0 in line 22. You cannot leave this area blank, otherwise the correspondent service bank will refuse to execute your payment orders.

What is its purpose

UIN is a unique personal enrollment number, which makes it easier for the inspection body to identify the payer who paid the contribution to the tax enrollment registration system.

When writing a UIN, the order for tax payments should go quickly through the payment system and end up where it is needed.After all, if the UIN is registered, other checks are not carried out by the system for faster crediting of funds.

The description of this code in the payment document allows you to fulfill the corresponding obligation on time.

This is due to the fact that banks notify the necessary information to the state register of data on payments sent to government agencies, which speeds up the procedure for sending them.

The UIN is included in receipts not only for tax payments, but also for other payments, for example, penalties for UIN.

This also includes payments for services from government bodies at various levels. According to statistics, the use of UIN has greatly reduced the number of lost payments.

Sometimes banking companies simply oblige taxpayers to fill in field 22 UIN when sending orders for payment to the state budget.

In addition to the UIN, you can also select the UIP code - a unique payment identifier. It also fits into box 22 of the payment slip.

But this code is used for non-budget payments that are made within the framework of an agreement signed between the parties.

Where is it on the payment order?

The UIN will appear in the payment order when paying taxes if the company plans to make a contribution in accordance with the request received from the tax service.

The UIN is written down in this important document; all that remains is to write it on the payment slip. Field 22 of the payment document is intended to display the UIN code.

In this receipt it is easy to find; next to this field there is a “Code”. The use of a UIN code means that this identifier has already been defined.

Therefore, the UIN is prescribed in papers that are formed on the basis of documents received from government agencies. They can be requests, receipts, etc.

When a company or individual entrepreneur creates payment documents for tax payments, the UIN is not determined for them.

These entities send taxes by period to the established details, registering their own TIN.

These rules determine that in line 22 in this situation it is necessary to display 0 instead of a twenty-digit code.When making a payment for treatment, the UIN code, unless provided for in the agreement, does not need to be specified. In this situation, 0 is also written.

In addition, for budget companies it is necessary to register the UIN in the application for cash payment, on the basis of which a payment order is created.

Decoding the code

UIN is a unique accrual identifier. This cipher is presented in the form of a code that is divided into 20 or 25 numbers.

This designation is divided into four blocks:

Sample filling

For regular shipments to the state budget by period or early payment, the UIN code does not need to be entered.

You must carefully transfer this code into the document, otherwise the funds will fall into the category of unexplained payments.

Your debt will not be paid, and the penalty will continue to increase. Field 22 cannot be left blank, even if the UIN code has not been assigned.

In such a situation, the value 0 without quotes is written. The taxpayer will be identified by TIN.

A generated payment that does not have anything written in field 22 will not be processed by the bank. It will return it without execution, and will describe the reason as “Field 22 is not filled in.”

Where can I get it (individual entrepreneur, legal entity)

The source of UIN data is requests for payment of tax payments and penalties. Therefore, if you are not a debtor for payments to the state budget, then you will not have a UIN - as a detail included in the payment document, it simply will not be created by the recipient of the payment due to the lack of a request from the fiscal service.

For individual entrepreneurs who make advance payments for personal income tax, tax employees can also send ready-made receipts.

At the top of the receipt in the line “Document Index” the UIN code is written. To pay an advance to an individual entrepreneur, the payer must enter this code in line 22.

If the order is created on the Federal Tax Service portal, then the UIN code is assigned automatically. The UIN is used when transferring mandatory payments to the state budget by ordinary citizens.

Taxes are calculated for them by the Federal Tax Service. These include transport, property taxes, etc.

Every year, at a certain period, all payers who have a taxable object receive notifications that show in detail how the tax was calculated, what form needs to be sent to the state budget, etc.

These letters arrive to individuals. persons at their registration address. For them, the UIN is considered an index of the payment transfer notice. Citizens only need to enter it on the payment form.

Usually, the tax service, along with the notice, also sends a receipt for sending payments. Therefore, physical a person should remember that if he takes a ready-made receipt for payment, then the UIN code is already written in it.

If the payer has not received a notice from the inspection authorities, the UIN can be viewed in the taxpayer’s personal account.

In addition, on the tax service portal, individuals. the person may ask for a receipt or draw up one for payment.

Then the portal will set the UIN for the shipment. There is also a rule according to which, if the payer does not know the UIN, he must register his TIN in the payment slip.

Business entities usually calculate their tax payments independently. These are called current payments. To determine them, you only need to register the KBK, INN of the subject and checkpoint, if any.

The transfer data does not require any other verification of details. In this situation, the taxpayer enters “0” in line 22.

It’s another matter if companies are assigned obligations as a result of inspections. Then, based on the decision made, a payment request is generated.The government agency that issued it also states in this document the UIN, which the taxpayer must register in order to make the payment.

In what cases is it not needed?

UIN is required when transferring money to fiscal authorities: fees, tax payments, etc. It is also used when making payments to federal and city authorities.

There are cases when a twenty-digit code is not required:

Even if according to the rules it is not necessary to register the number, this field should not be empty. Instead of this code they put the number zero.

Video: what to pay attention to

Unique accrual identifier (UIN) is a new payment document detail introduced by the Ministry of Finance of the Russian Federation in 2014 for the payment of tax payments and other fees to the budget system of the Russian Federation.

What is a UIN and why is it needed?

UIN is a unique accrual identifier used to simplify and identify cash transfers to the budget. This detail allows you to reduce the number of uncleared payments received by the budget of the Russian Federation. When registering a payment document, a unique accrual identifier must be indicated in field No. 22 “Code”.

This accrual identifier must be specified:

- when paying for services to local governments and state authorities;

- when making payments to the budget of the Russian Federation.

The unique identifier is intended to enable banks to provide information about the received payment to the GIS GMP (state information system on state and municipal payments). This system collects information about all payments received by budgets of all levels, such as registration of real estate with justice authorities, provision of extracts from the Unified State Register of Legal Entities, issuance of certificates, payment of administrative fines, payment of fines to the traffic police, etc.

Where to find out the unique accrual identifier (UIN)

A novice accountant may wonder where to find out the UIN. There are no special documents or reference books providing this information. The UIN code is unique and cannot be repeated. A unique identifier is assigned when a payment is calculated by the revenue administrator of the budget system of the Russian Federation. In case of independent calculation of tax or insurance premium, such payment will not have a UIN code.

The UIN always consists of 4 parts and 20 characters.

- Characters 1 to 3 are intended for the payee, budget revenue administrator or executive authority code.

2. Character 4 is an identifier not currently used, so it has a value of 0.

3. Characters 5 to 19 - the unique number of the payment being made or the document index in the tax system of the Russian Federation.

4. Sign 20 is a control block calculated using a specially developed algorithm.

In this form, the UIN is transferred to the GIS GMP (state information system on state and municipal payments).

What is the meaning of unique accrual identifier (UIN)?

When receiving a request to pay taxes (contributions) from a tax or other fund, you must pay attention to whether this document contains a 20-digit unique identifier code (UIN). If it is available, then when generating a payment document, the UIN must be entered in the “Code” field. For example, UIN 98765432109876543210. If the UIN code is not specified, then, just like with a voluntary payment, you must enter zero in this field.

In the absence of notification from the tax authority, individuals have the opportunity to independently generate a payment document. There is an Internet service on the website of the Federal Tax Service of Russia that allows the taxpayer to generate receipts for payment, and the document index (UIN) is assigned automatically.

Organizations that independently calculate and make tax payments on time can do without a UIN when generating payment orders. For them, the code for calculating taxes and contributions is KBK, and the identifier of the payer himself is the TIN and KPP numbers for legal entities and TIN for individual entrepreneurs.

From March 28 of this year, 2016, if an enterprise transfers a contribution or tax within the established time frame, then it is allowed not to indicate the UIN in the payment order. In this material we will consider in detail other adjustments regarding the filling out of payment orders, which, in accordance with the order of the Ministry of Finance number 148n dated September 23, 2015, will be in effect, as noted above, from March 28, 2016. The above changes concern the payment of fines, taxes, fees, duties and other various types of payments that will be sent to the budget.

It is important to note that the form of payment is given in the second appendix to the Regulations of the Central Bank of Russia under number 383-P dated June 19, 2012. All rules regarding the completion of this document were approved by the Ministry of Finance in the order dated November 12, 2013 under number 107n. However, from March 28th they will change.

2016: UIN in a payment order

A unique accrual identifier is indicated in the payment order if a tax or fine must be paid at the request of the fund or tax authorities. Then the UIN field marks 22 payment orders. The identifier is formed from 20 or 25 characters, which cannot simultaneously equal zeros.

If an enterprise transfers a payment that it calculated independently, then it does not have a UIN. For example, this could be an advance on income tax within a certain specified period. Then in this case the payment must be identified by KBK, and. But banking institutions still required that field 22 be filled out. If there was no UIN, it was necessary to enter zero. The Federal Tax Service speaks about such clarifications in the clarifications dated March 24, 2014.

From March 28, the UIN in the payment order can be left blank. This is stated in the instruction of the Central Bank of Russia under number 3844-U dated November 6, 2015, registered with the Ministry of Justice under number 40831 dated January 27, 2016.

Checkpoint codes and TIN

The checkpoint and TIN of enterprises are taken from the registration certificate. This information will then need to be transferred to the payment order. Now the length of this information is strictly regulated: for the TIN of an enterprise, ten characters (digits) are allotted, for the TIN of individuals - 12. Individuals, if they do not have a UIN, must indicate the TIN in the payment order. This is emphasized by the Federal Tax Service under the number in letter No. ZN-4-1 / 21600 @ dated December 9, 2015.

The checkpoint for everyone is formed from nine characters. In this case, the first 2 characters of the codes can be zeros at the same time. After all, the latter indicate the code of the region in which the taxpayer is registered, and the code “00” simply does not exist.

KBK and OKTMO

The budget classification code (BCC) is formed from twenty characters. All KBK signs cannot simultaneously be zeros. It is important to say that only 1 BCC can be entered in 1 payment. If there is an error in the number, the tax will not be credited to you. Therefore, funds will have to be transferred to the budget again. This is noted in the letter of the Federal Tax Service under the number DT-4-1 / 3362 @ dated September 4, 2015.

OKTMO is formed from eight or eleven characters (digits), but all of them cannot be zeros.