Invoices and other VAT documents. How to cancel an invoice

Both the seller and the buyer have to deal with the issue of canceling an invoice if it is necessary to edit a previously issued document. Resolution 1137 of December 26, 2011 prescribes the procedure for carrying out this procedure for both parties. In this article we will look at how to cancel an invoice and what actions the seller and buyer should take.

Actions of the seller when canceling an invoice

When corrected, the invoice retains its number and date in line 1; line 1a indicates the number of the correction and the date it was made. A corrected s/f (ISF) is compiled when the errors are not significant, are random or arithmetic in nature - a typo, values multiplied incorrectly, an incorrectly specified rate. The ISF replaces the original document, canceling it (see →).

Sellers are required to maintain a Sales Book, which records all sales transactions. Entries are made based on the invoice in the period when the calculation of the added tax became obligatory. The chronological order of document registration is maintained. Each invoice, during the execution of which the seller has an obligation to calculate VAT, must be shown in the Book.

Correcting invoice indicators entails the need to change the Sales Book data. The seller must reflect in it the correct data regarding the tax base and the final amount of VAT.

Thus, the seller needs not only to correct the s/f, but also to cancel it in the Sales Book. The data in this register is used to prepare a declaration for the quarter and determine the final tax burden, and therefore the information in it must be correct and true.

The seller carries out the procedure for canceling the record of an erroneous s/f and registering the correct sample. The procedure for carrying out this procedure depends on when exactly the correction is carried out - in the same quarter when the original document was drawn up, or in another.

| Quarter in which the correction is made | Cancellation procedure in the Sales Book |

| In which the original s/f was issued, that is, the dates of the original and amended forms refer to the same quarter (in the ISF, the dates in fields 1 and 1a fall on the same period). | The incorrect option is re-entered into the Book with a minus, negative values are shown in fields 13a-19. The correct corrected version is recorded in the Book in the usual manner in the same quarter. The number and date of correction from field 1a is transferred to field 4 of the Book. |

| In another, different from the quarter when the original form was issued (in the ISF, the dates in fields 1 and 1a fall on different periods) | In the Book, during the period of registration of an erroneous s/f, an additional sheet is drawn up for re-entering the original s/f with negative indicators in fields 13a-19. The correct copy of the s/f is registered already in the quarter of its extract. The number and date of correction from field 1a is transferred to field 4 of the Book. |

Negative entries invalidate the original document and the new entry records the correct invoice information.

If the erroneous invoice was not registered in the Sales Book, then the seller does not have the obligation to pay tax from it, it does not appear in the declaration and does not participate in the calculation of the tax burden. When issuing a new correct s/f, there is no need to make a canceling negative entry in the Book. The new document is registered in the usual way in the statement quarter.

When making a canceling entry, column 3 shows the number and date of the erroneous invoice, column 13b shows the total amount for this invoice, taking into account the additional tax, and a minus sign is placed in front of the amount. In the column for indicating the cost excluding tax (14-16 depending on the rate), the value is also indicated with a minus sign. In the column for indicating the tax amount (17-18 depending on the rate) the indicator is also negative.

The ISF is registered in the standard way, in column 3 the number and date are similar to the original form. In column 4 - the number and date from field 1a of the invoice. The recording then continues as usual.

Filling example

Actions of the buyer when canceling an invoice

The buyer receives one copy of the invoice from the seller to use for VAT refund purposes. If the seller changes the s/f and cancels the old incorrect form, then the buyer must also make a cancellation entry in his accounting register - the Purchase Book.

This book is required for all buyers paying added tax. It collects data on all s/f received from sellers with VAT, for which a refund is possible.

After receiving the corrected version from the seller, you need to cancel the registered s/f using a negative entry and enter information about the new corrected version in the standard manner.

As a rule, the seller, along with the corrected document, also sends the buyer a notification paper, which specifies the quarter when the erroneous s/f was generated, and also provides its details.

Based on the documentation received from the seller, the buyer carries out the procedure for canceling the incorrect document, and the procedure for its implementation also depends on the moment of receipt of the ISF and its comparison with the moment of registration of the original s/f and the fact of transfer of the VAT return.

| Period in which the corrected copy was received | Cancellation procedure in the Purchase Book |

| Before submitting a declaration for the period in which an incorrect account is registered in the Purchase Book | The original s/f is re-registered with minus values in fields 15 and 16. The new corrected copy is registered in the usual way in the current period of its receipt. The number and date of the ISF from field 1a is transferred to field 4 of the Book. |

| After submitting a declaration for the period of registration of an erroneous s/f | An additional sheet is formed in the Book for the quarter in which the incorrect s/f was reflected. Data on s/f with errors with minus values in fields 15 and 16 are re-entered into this sheet. The new s/f received is entered into the Book for the current period when it was received from the seller. The number and date of the ISF from field 1a is transferred to field 4 of the Book. |

Thus, the procedure for canceling an invoice with shortcomings depends on whether the buyer managed to report to the tax office on the tax from this s/f or not. After each quarter, the buyer submits an added tax declaration, which shows the VAT to be refunded and paid, with the output of the total amount for transfer. The deadline for filing this declaration is the 25th of the following month.

If the declaration is submitted by the buyer before the deadline, then upon receipt of the ISF from the seller before the 25th, it will be necessary to prepare an additional sheet for the past quarter, and the sheet can be made not only with a negative cancellation entry, but also to register the received ISF.

Filling out an additional sheet of the Purchase Book when canceling a personal account

In column 3 of the additional sheet the number and date of the canceled s/f are indicated. The total cost is shown in gr. 15 with a minus sign. The VAT amount is in column 16, also with a minus sign.

Filling example

Filling out an additional sheet of the Purchase Book when canceling a personal account

Reflection of invoice cancellation in the VAT return

If the buyer or seller has already reported to the tax office for the period in which the error was identified, then they will have to not only draw up a corrected copy of the invoice, cancel the incorrect entry in the Purchase (or Sales) Book, register the corrected form, but also prepare an updated declaration.

Making changes to the s/f may lead to an increase or decrease in the tax base and, as a consequence, the VAT itself. In order for the tax office to have correct data for the past period, you should draw up an updated declaration for this period, in which information is already entered based on the correctly entered tax return.

For the seller

If, after filing an updated return, the tax amount has increased, then the difference between the initial tax amount and the updated amount must be paid.

The procedure for reflecting in the declaration the cancellation of the original invoice by the seller depends on the fact of transfer of the declaration to the tax office:

For the buyer

The buyer must also submit an updated tax return that corrects previously submitted information. The procedure for reflecting in the updated declaration the fact of cancellation of an incorrect s/f also depends on whether the buyer has reported to the Federal Tax Service or not.

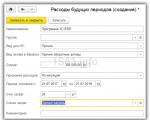

The concept of “adjustment” itself implies a change in some data. We will look at changing data in VAT accounting in 1C 8.3 using the “Enterprise Accounting” configuration as an example.

There are two options here: using an “Adjustment Invoice” (CAI) or correcting erroneously entered data. In many ways, the user actions in these cases are similar, but we will look in detail at working in 1C with KSF, as well as how to reflect the direct correction of VAT errors.

CSFs are issued by the seller to the buyer in the event of a change in the price and (or) quantity of goods (works, services). An important condition is that such changes must be agreed upon between the parties to the transaction. Then there is no need to submit updated VAT returns, and CSF (for example, adjustment documents for shipment) are reflected in accounting for the period when they were compiled (from the seller) and received (from the buyer).

There are two types of adjustments – increasing or decreasing the cost of sales. An accountant more often has to deal with a situation of decreasing value, for example, when applying retro discounts.

The accounting treatment is as follows:

From the buyer:

- Decrease in value - in the sales book;

- The increase in value is in the purchase book.

From the seller:

- Reducing the cost - in the purchase book;

- The increase in value is in the sales book.

Before the advent of Russian Government Decree No. 952 dated October 24, 2013, the Seller, when the cost of shipment increased, had to submit an updated declaration for the shipment period. Many sources on the Internet still advise this procedure, but it is no longer relevant. “Clarifications” on VAT are submitted if errors are discovered, and the agreed price change is now not an error.

Let's consider the process of reflecting CSF in the 1C accounting program, first from the buyer, then from the seller.

Adjustment invoice in 1C from the buyer

Example 1. The Buyer received SF from the Seller in the first quarter in the amount of 118,000 rubles, incl. VAT 18,000 rub. In the second quarter, the parties agreed to change the price downward by 10%. In the second quarter, the seller offered CSF in the amount of 106,200 rubles. incl. VAT 16,200 rub.

In the adjustment document, we use tinctures to indicate the order in which the changes are reflected. Here it should be indicated that the adjustment is carried out by agreement (the type of operation can also be error correction, more on that later).

On the “Main” tab, leave the “Restore VAT in the sales book” setting. In addition, depending on the situation, we can change the options where to reflect the adjustment - in all sections of accounting or only for VAT. We chose the first option, then accounting entries are generated.

Let's change the condition: now we need to increase the cost of admission. The algorithm of actions is largely similar, only the data is reflected in the purchase book. Accordingly, uncheck the box to reflect the adjustment in the sales book.

Fill out the tabular part of the “Products” tab. We increase the price, the remaining amounts will be recalculated automatically.

To reflect the data in the purchase book, fill out the document “Creating purchase book entries.” It is generated automatically by clicking the “Fill out document” button. The document has several tabs; our adjustment is reflected in the “Acquired Values” tab.

The document contains transactions and records for VAT registers, on the basis of which we can create a purchase book.

Let's take the same one Example 1 We will only show its reflection from the seller.

We have a primary document and a SF for implementation.

We will reduce the selling price, the remaining amounts are recalculated automatically.

Next, to reflect the adjustment in the regulated reporting, purchase ledger entries should be generated. The “Fill out the document” button automatically generates them; the data from the example is displayed on the tab dedicated to reducing the cost of sales.

Now you can see the data in the purchase book.

The next adjustment option is for the seller to increase the price. The algorithm is largely similar; the CSF is reflected in the sales book.

Correction of an invoice in 1C

Additionally, we will consider the question of what to do if the data needs to be changed in case of an error. Then the CSF is not applied, but corrections are made, which should be reflected in additional lists of the purchase or sales book, depending on the situation, and then updated declarations are generated and submitted.

If you do not need to cancel the SF, but you need to make some corrections, then in the document for data correction you should select the “Correction of primary documents” option. Let's show an example of correcting implementation data.

We register the SF and look at the sales book. When creating the sales book, we see that there is no data for the second quarter.

And for the first one, an additional list appeared, where the incorrect SF was canceled and the correct one was reflected.

We have considered correcting the error when the seller’s price increases; in other erroneous options, when accounting for the seller and the buyer, you should be guided by the logic of the actions described above in the CSF.

We hope that this guide will help you quickly figure out how to correctly adjust VAT in 1C.

For the 1st quarter of 15, sales of services were made, an invoice was issued accordingly, but this sale was not accepted by the Customer, so it must be canceled, but simply deleting these documents from the accounting program is impossible, because the sequential numbering of invoices, acts will be disrupted.... How to do this correctly?

The invoice should be cancelled. To do this, fill out an additional sheet to the sales book for the period in which the error was made, and reflect in it the amount of shipment and tax for the erroneously issued invoice with a minus sign.

The tax base for VAT should be adjusted. Since the issued invoice was included in the total sales amount for the tax period, tax was excessively charged on this amount. This means that the organization has overpaid. Therefore, it is necessary to adjust the tax base and recalculate the tax. And, despite the fact that such an error led to an overpayment of VAT, in this situation it is necessary to submit an updated declaration to the tax office.

The rationale for this position is given below in the materials of the Glavbukh System

Situation:What should a selling organization do if it erroneously issued two invoices for the same transaction? This was discovered after filing a VAT return.

You will have to adjust the VAT tax base, recalculate the tax, and also notify the buyer of the error.

Due to the fact that the invoice was issued repeatedly for the same transaction, both the seller’s VAT tax base and the buyer’s tax deduction will be overestimated. Therefore, if you find such an error, you need to perform the following steps.

1. Cancel the reissued invoice in the sales ledger.

After all, it is on the basis of the sales book that the amount of VAT payable is determined (Section II of Appendix 5k). To do this, fill out an additional sheet to the sales book for the period in which the error was made, and reflect in it the amount of shipment and tax on the erroneously issued invoice with a minus sign (clause 11 of Section II of Appendix 5 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

2. Adjust the VAT tax base for the period in which the error was made.

Since the re-issued invoice was included in the total sales amount for the tax period, tax was excessively charged on this amount. This means that the organization has overpaid. Therefore, it is necessary to adjust the tax base and recalculate the tax. And despite the fact that such an error led to an overpayment of VAT, in this situation it is necessary to submit an updated declaration to the tax office. It is not possible to adjust the tax base in the current period. This is explained by the fact that the general rules provided for correcting errors in accordance with Article 81 and paragraph 1 of Article 54 of the Tax Code of the Russian Federation do not apply to VAT.*

Create an updated declaration based on the corrected sales book, taking into account the completed additional sheet (clause 5 of section IV of appendix 5 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). The resulting tax overpayment can be offset or refunded.

3. Notify the buyer of the discovered error.

It is clear that the buyer registered the erroneously issued invoice in the purchase book. And based on the data in such a book, he forms the amount of tax accepted for deduction (Section II of Appendix 4 to Resolution of the Government of the Russian Federation of December 26, 2011 No. 1137). By reflecting an extra invoice there, the buyer simply overestimated the amount of the deduction.

As a result, arrears arise, which is why organizations may be charged penalties and fines.

Therefore, as soon as you discover that you have issued an invoice again by mistake, be sure to inform the buyer about this - send him a corresponding notification. Based on such a document, he will be able to make changes to the purchase book and also submit an updated declaration.

Olga Tsibizova,

Deputy Director of the Department

tax and customs tariff policy of the Ministry of Finance of Russia

- Download forms

We are starting a series of lessons on working with VAT in 1C: Accounting 8.3 (edition 3.0).

Today we will look at the topic: “Corrected invoice.”

Most of the material will be designed for beginner accountants, but experienced ones will also find something for themselves.

Let me remind you that this is a lesson, so you can safely repeat my steps in your database (preferably a copy or a training one).

So let's get started.

A little theory

Unlike a corrective invoice, a corrected invoice is used to correct errors made when filling out the original invoice.Corrections are made only in cases where filling errors are detected, for example:

- typos,

- incorrect details,

- tax rates are mixed up.

The number and date of the corrected invoice completely coincide with the primary document, but it additionally indicates the number and date of the correction.

Corrections are numbered within the primary invoice from 1 to infinity.

Let's look at possible situations using examples.

Seller side fix

On January 1, 2016, we (VAT LLC) shipped 2 air conditioners to Buyer LLC at a price of 15,000 rubles each (including VAT).At the same time, we issued the buyer a primary invoice No. 1 dated 01/01/2016, in which we made a typo, indicating 3 air conditioners instead of two.

We issue the initial invoice

Go to the “Sales” section, “Sales (acts, invoices)” item:Create and fill out a new document “Sales (goods)”:

We carry it out, and then issue an invoice (button at the bottom of the document):

The error was discovered in the same tax period (by the seller)

We discovered our error on January 10, having issued the buyer a corrected invoice No. 1 (correction 1) dated 01/01/2016 (correction 01/10/2016).We issue a corrected invoice in the same tax period (from the seller)

Again go to the “Sales” section, select “Sales (acts, invoices)”:

Select the previously created implementation with the left mouse button, and then select the “Create based on” item (can be hidden in the “More” item) and then the “Adjust implementation” item:

Fill in the implementation adjustment:

Please note a few points:

- Type of operation "Correction in primary documents".

- Correction No. 1 dated January 10, 2016.

- Quantity 2.

We look at the sales book in the same tax period (from the seller)

We create a sales book for the 1st quarter:

And we see that the primary invoice has been canceled (by the reversal method):

The corrected invoice was included in the sales book:

At the same time, the number and date of the correction are also indicated:

The error was discovered in another tax period (at the seller)

We discovered our error on April 1, having issued the buyer a corrected invoice No. 1 (correction 1) dated 01/01/2016 (correction 04/01/2016).We issue a corrected invoice according to the same scheme (as above), only with the date 04/01/2016:

In this case (issuing a corrected invoice in a different tax period), the correction is made through an additional sheet of the 1st quarter sales book.

Opening the sales book for the 1st quarter:

Click on “Show settings”:

Check the box "Generate additional sheets" for the current period:

We create a sales book and, instead of the main section, indicate “Additional sheet for the 1st quarter of 2016”:

Here is the cancellation of the original invoice:

And here is the corrected invoice indicating the number and date of correction:

Buyer side fix

On January 1, 2016, we (VAT LLC) received 2 air conditioners from Supplier LLC at a price of 15,000 rubles each (including VAT).At the same time, we received the primary invoice No. 1 dated 01/01/2016, in which there was a typo (3 air conditioners are indicated instead of 2).

Entering the initial invoice

Go to the “Purchases” section, “Receipts (acts, invoices)”:

Create and fill out a new document “Receipt (goods)”:

We register the primary invoice at the bottom of the document:

The error was discovered in the same tax period (by the buyer)

The seller discovered his mistake on January 10, having issued us (the buyer) a corrected invoice No. 1 (correction 1) dated 01/01/2016 (correction 01/10/2016).We enter the corrected invoice in the same tax period (from the buyer)

Again go to the “Purchases” section, “Receipts (acts, invoices)”:

Select the previously created receipt with the left mouse button, and then select the “Create based on” item (can be hidden in the “More” item) and then the “Receipt Adjustment” item:

We fill out the receipt adjustment as follows:

On the "Products" tab, indicate the correct quantity:

We post the document and register the corrected invoice:

We make an entry in the purchase book in the same tax period (from the buyer)

Go to the "Operations" section and select "VAT Accounting Assistant":

We indicate the period “1st quarter” and then open the formation of purchase ledger entries.

Often, when maintaining accounting records, checking entries in the purchase book for previous periods, the accountant discovers errors in filling out the purchase book. One of the common mistakes is recording the same invoice twice in the purchase ledger.

Example: The organization TH “Romashka”, which applies the general taxation system, on October 15, 2015, after submitting the VAT return for the third quarter. 2015, I discovered errors in accounting: documents Act, invoice, reflecting the transaction for the purchase of advertising services from the counterparty TV SHOP, accordingly, an invoice entered incorrectly twice in the purchase book for the third quarter of 2015. In this article we will look at , how to make corrections for VAT accounting purposes (Fig. 1).

In accordance with Art. 54 of the Tax Code of the Russian Federation, if it is necessary to make changes to the purchase book (after the end of the current tax period), the cancellation of the entry on the invoice, adjustment invoice is made in an additional sheet of the purchase book for the tax period in which the invoice, adjustment invoice was registered before corrections are made.

Additional sheets of the purchase book are its integral part and are compiled in accordance with sections III and IV of this document.

According to paragraph 1 of Art. 81 of the Tax Code of the Russian Federation, a taxpayer who discovers non-reflection or incompleteness of information, as well as errors, in the declaration submitted to the tax authority, is obliged to make the necessary changes to the tax return and submit an updated tax return to the tax authority, if errors (distortions) led to an understatement of the tax amount, payable.

Conclusion: When making corrections to the purchase book, you must provide an additional sheet of the purchase book and a tax return for the period being adjusted.

To do this we need only two documents:

- “Reversal” document to correct an error in accounting;

- document Reflection of VAT for deduction.

To reverse movements and postings of a re-entered document, we will use the Transaction document entered manually. When creating this document, we will select the Storno type. In the created document, you must select the document to be reversed. The tabular part will be automatically filled in with the transactions of the document being reversed, only with negative amounts. The VAT accumulation register movements presented must be deleted.

To cancel an erroneous entry in the purchase book, we will use the document Reflection of VAT for deduction. To do this, go to the Operations menu - Reflection of VAT for deduction. Let's create a document. In the document details, we need to select the Counterparty, the counterparty agreement, the Receipt document (act). You must check all the boxes in the document settings.

In the Goods and Services tab, you need to fill out the tabular part of the document using the Fill in settlement document button. Also in the details the amount must be set with a minus sign. The document settings and movements are shown in Fig. 3 and 4.

Result: When posting, the document in accounting will be reversed upon acceptance of VAT for deduction and will create an entry in the purchase VAT accumulation register (purchase book).

To get the final result, let's go to the purchase book and create an additional sheet for the adjusted period (Fig. 5).

In this article we do not consider a number of operations, but before generating an updated VAT return, you need to do the following:

- additional income tax assessment;

- payment of arrears and penalties on taxes;

- generation of an updated VAT return for the third quarter.

Liked? Share with your friends

Consultations on working with the 1C program

The service is open specifically for clients working with the 1C program of various configurations or who are under information and technical support (ITS). Ask your question and we will be happy to answer it! A prerequisite for obtaining consultation is the presence of a valid ITS Prof. agreement. The exception is the Basic versions of PP 1C (version 8). For them, a contract is not necessary.